Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

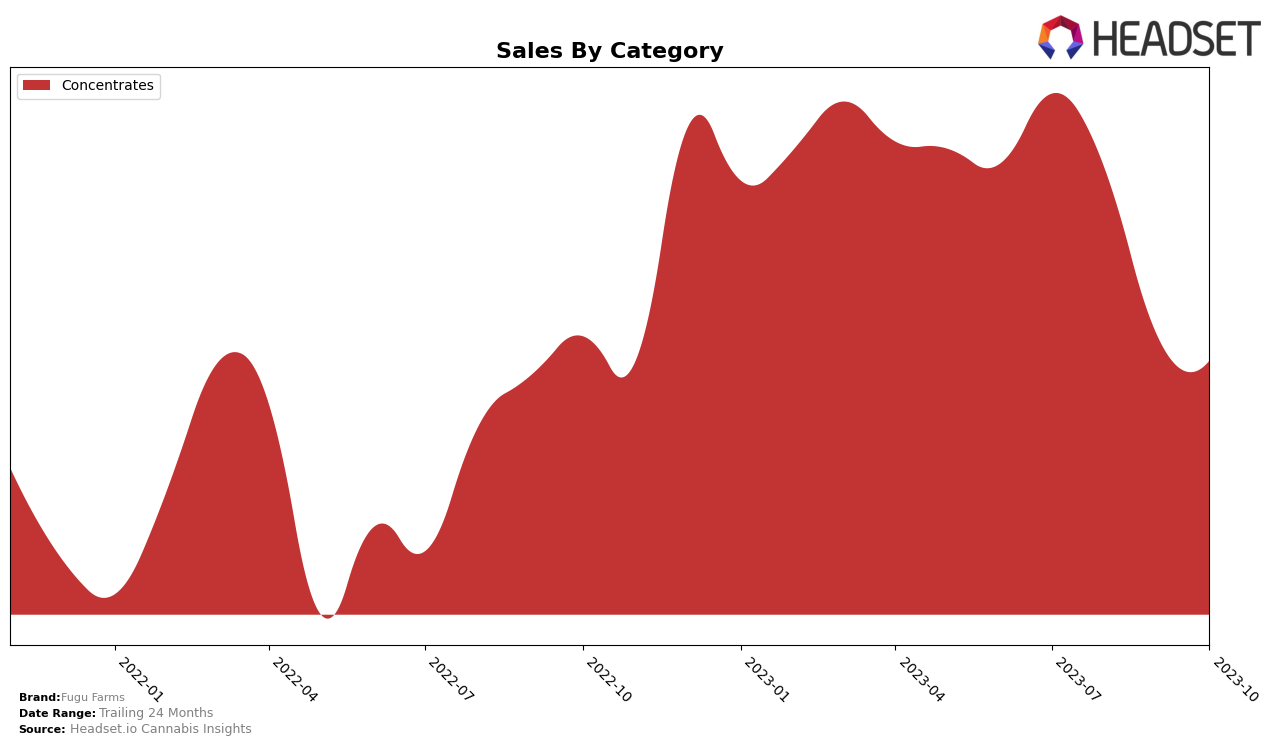

In the Concentrates category, Fugu Farms has been experiencing a steady decline in its ranking within the Washington market. As of July 2023, Fugu Farms held a respectable 11th position among the top 20 brands. However, over the following three months, the brand dropped nine spots, ending in 20th place by October 2023. This downward trend is somewhat mirrored in their sales figures, with a noticeable decrease from July to September. It's worth noting that while their ranking continued to fall in October, their sales did see a slight uptick. This could suggest a potential stabilization or even a possible future rebound for the brand in this category.

It's also important to consider the competitive landscape in the Washington Concentrates market. Fugu Farms' decrease in ranking doesn't necessarily indicate a failing strategy, but could be a result of increased competition or shifting consumer preferences. Despite the downward trend, Fugu Farms has managed to stay within the top 20 brands in the state, which is a testament to the brand's resilience and continued relevance in the market. However, keeping an eye on the performance in the coming months will be crucial to fully understand the brand's trajectory.

Competitive Landscape

In the Concentrates category within Washington state, Fugu Farms has been experiencing a downward trend in its ranking, moving from 11th place in July 2023 to 20th place by October 2023. This is indicative of a decrease in sales, as it is outperformed by competitors such as Agro Couture, From the Soil, Hitz Cannabis, and Dank Czar. Notably, Agro Couture and Hitz Cannabis have shown an upward trend, improving their rankings over the same period. From the Soil, while showing a general improvement, had a slight dip in October 2023. Dank Czar, despite a strong start in July, has seen a drop in its ranking, similar to Fugu Farms. This competitive landscape suggests Fugu Farms needs to strategize to regain its earlier position in the market.

Notable Products

In October 2023, Fugu Farms' top-performing product was 'Dulce De Uva Hash Rosin (1g)', maintaining its first-place ranking from the previous month with sales of 496 units. The 'Rainbow Belts #11 Solventless Hash Rosin (1g)' product moved up to second place from third, with a significant increase in sales. The 'GuavaZ x Papaya Hash Rosin (1g)' and 'Mani Hash Rosin (1g)' products were new entrants to the top rankings, securing third and fourth place respectively. 'Lemon Peel Hash Rosin (1g)', despite a dip in sales, managed to hold onto the fifth position. This shows a dynamic shift in product performance compared to the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.