Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

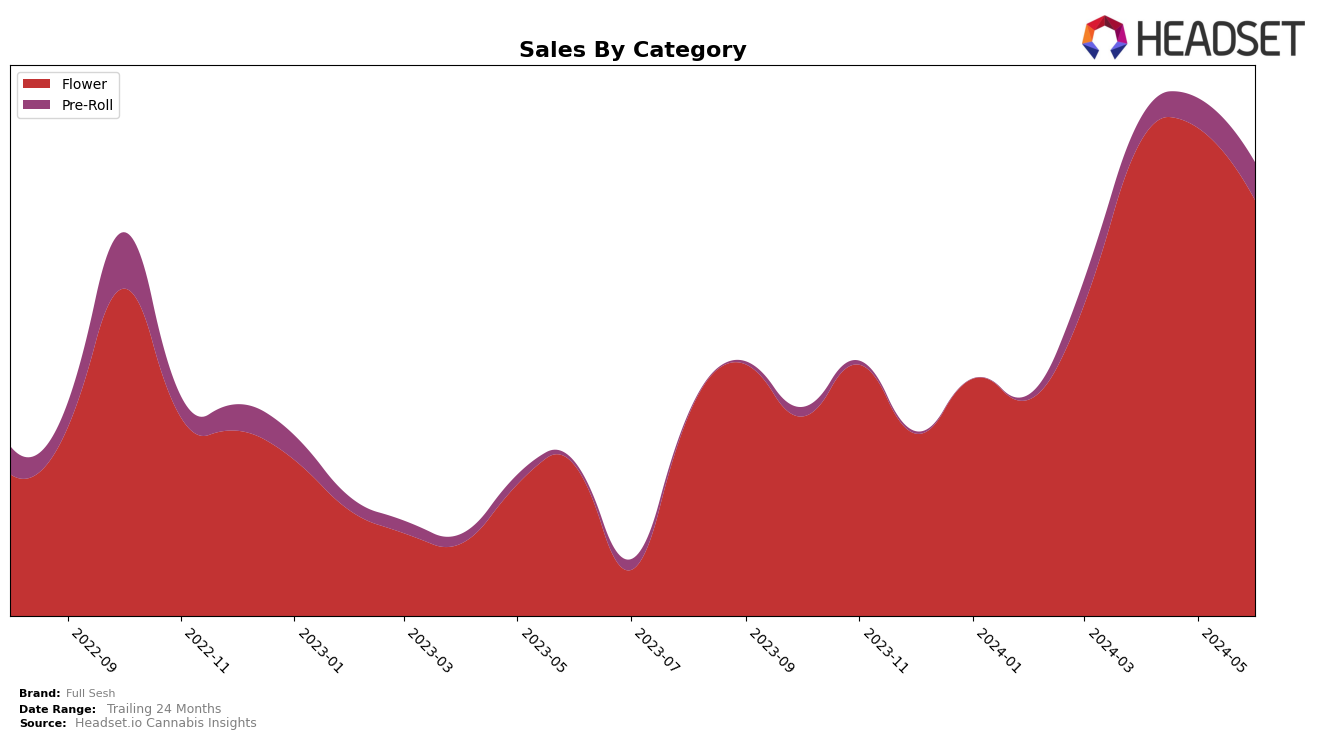

Full Sesh has shown notable performance across various categories and states, with some significant movements in rankings. In British Columbia, Full Sesh's ranking in the Flower category fluctuated over the months, reaching its highest point at 26th place in April 2024 before dropping to 34th place by June 2024. This indicates a potential challenge in maintaining a consistent market position in a competitive landscape, despite having a peak sales month in April. The brand's sales in British Columbia also saw a notable increase in April, but subsequent months reflected a decline, suggesting a need for strategic adjustments to sustain growth.

In Saskatchewan, Full Sesh experienced a more dynamic shift. Their Flower category ranking surged from not being in the top 30 in March and April to achieving 22nd place in May 2024, before slightly dropping to 28th in June. This upward trend in Saskatchewan highlights a significant improvement in market penetration and brand recognition. In the Pre-Roll category, Full Sesh entered the top 30 in May 2024 at 59th place and improved to 49th place by June, indicating a positive reception in this product segment. These movements suggest a strategic opportunity for Full Sesh to capitalize on its growing presence in Saskatchewan.

Competitive Landscape

In the highly competitive Flower category in British Columbia, Full Sesh has shown notable fluctuations in its ranking and sales over the past few months. Starting at rank 36 in March 2024, Full Sesh improved significantly to rank 26 in April, before experiencing a slight decline to rank 29 in May and further down to rank 34 in June. Despite these changes, Full Sesh's sales have generally trended upward, peaking at 218,094 CAD in April. Competing brands like Color Cannabis and 18twelve have shown more volatile rankings, often falling out of the top 30, which indicates a less stable market presence. Meanwhile, Soar and Holy Mountain have maintained more consistent rankings, generally staying within the top 30. This competitive landscape suggests that while Full Sesh has room for improvement in maintaining a stable rank, its upward sales trajectory is a positive indicator of growing consumer preference.

Notable Products

In June 2024, Bamboo Honey Pre-Roll 3-Pack (1.5g) emerged as the top-performing product for Full Sesh, with notable sales of 787 units. Caramel Drip (7g) maintained its strong performance, holding the second spot consistently for three consecutive months. Purple Gelato Punch (28g) climbed to the third position with sales of 714 units, showing a marked improvement from previous months. Bamboo Honey (28g) saw a decline, dropping from the top rank in May to fourth place in June. Caramel Drip Pre-Roll 3-Pack (1.5g) remained steady in fifth place, with a slight increase in sales compared to May.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.