Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

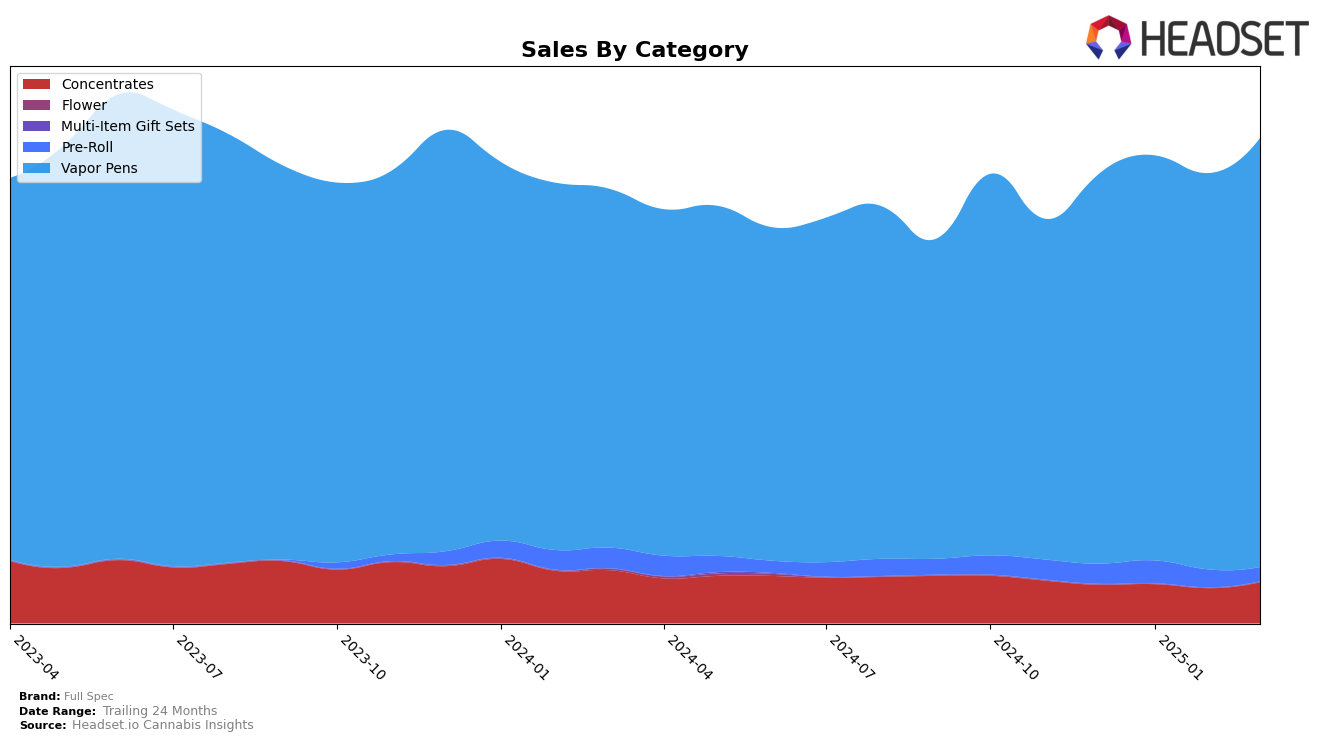

In the state of Washington, Full Spec has shown varied performance across different cannabis product categories. Notably, in the Concentrates category, Full Spec has consistently improved its ranking, moving from 19th in December 2024 to 14th by March 2025. This upward trajectory is indicative of a strengthening presence in the Concentrates market. On the other hand, the Vapor Pens category has seen Full Spec maintaining a stable position at 6th place throughout the observed months, suggesting a strong foothold and consistent consumer preference in this segment. The Pre-Roll category, however, tells a different story, where Full Spec's ranking has fluctuated, dropping from 58th in January 2025 to 82nd in March 2025, indicating challenges in maintaining market share in this competitive category.

The sales performance in these categories further highlights the brand's market dynamics. While the Vapor Pens segment has experienced a steady increase in sales, reaching over $1.2 million by March 2025, the Pre-Roll category has seen a decline, with sales falling from $63,911 in January to $39,359 in March. This contrast suggests that while Full Spec is capitalizing on the popularity of vapor pens in Washington, it may need to reassess its strategy in the Pre-Roll market to regain its position. The absence of a top 30 ranking in the Pre-Roll category for March 2025 is a point of concern and highlights the competitive nature of this category. Full Spec's ability to maintain and grow its presence in the Concentrates category amidst these challenges reflects its strategic focus and potential areas for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Full Spec consistently maintained its position at rank 6 from December 2024 to March 2025. Despite stable rankings, Full Spec's sales showed a positive growth trend, peaking in March 2025. This growth trajectory is noteworthy when compared to competitors like EZ Vape and Snickle Fritz, which held steady ranks at 7 and 8 respectively, but with less pronounced sales increases. Meanwhile, Plaid Jacket and Micro Bar experienced fluctuations in their rankings, with Plaid Jacket dropping from 4 to 5 and Micro Bar moving from 5 to 4, indicating a competitive push and pull at the higher ranks. Full Spec's ability to sustain its rank while increasing sales suggests a strong market presence and effective sales strategies, positioning it well against its competitors in the Washington vapor pen market.

Notable Products

In March 2025, the top-performing product for Full Spec was the Elite Candy Apple Live Resin Cartridge in the Vapor Pens category, maintaining its leading position from February with notable sales of 4320 units. The Elite Lemon Snuggle Live Resin Cartridge climbed to the second position, despite a slight decrease in sales from February to March. The Elite Blackberry Tart Live Resin Cartridge entered the top rankings for the first time, securing the third position. Meanwhile, the Cadet Lemon Diesel Live Resin Cartridge debuted at fourth place, showcasing a strong performance among new entries. The Apple Sundae Live Resin Cartridge dropped from its previous top positions in December and January to fifth place in March, reflecting a decrease in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.