Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

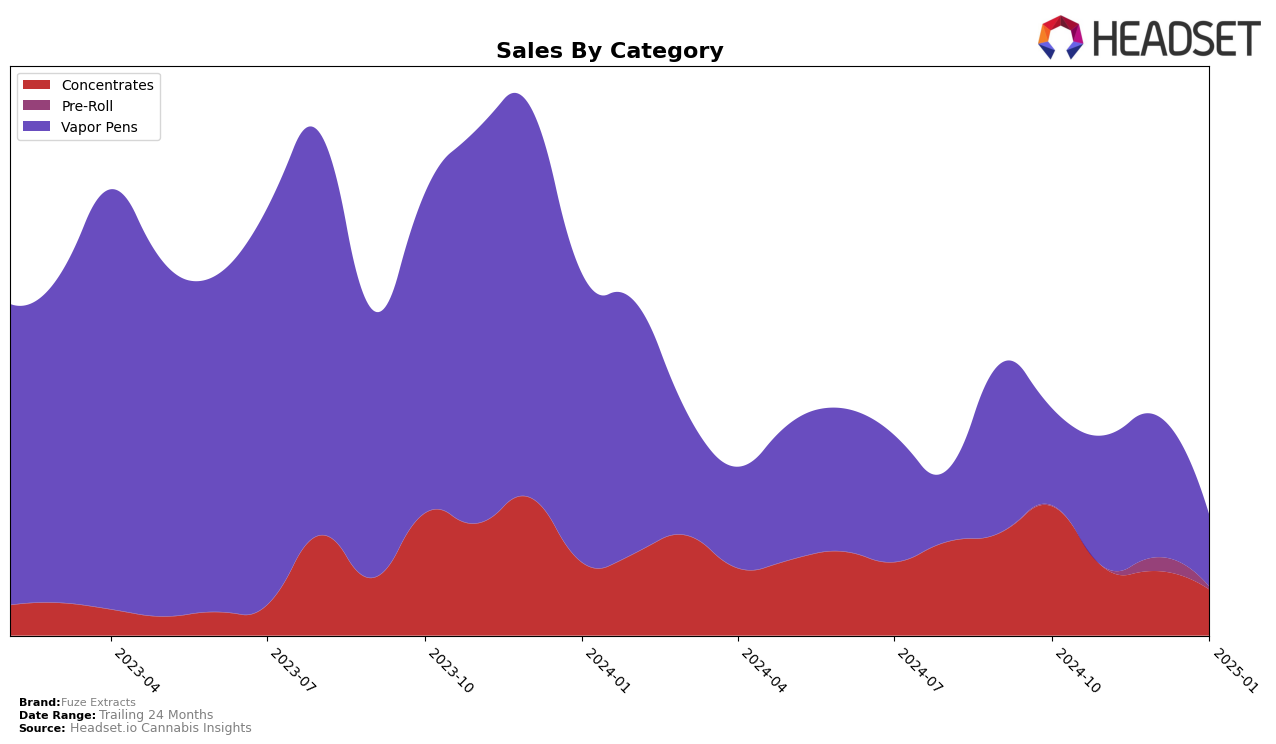

Fuze Extracts has shown a notable performance trajectory in the Nevada market, particularly within the Concentrates category. The brand experienced a gradual decline in rankings from October 2024 to January 2025, slipping from 13th to 23rd place. This downward trend suggests a potential challenge in maintaining market share amidst increasing competition or changing consumer preferences. The sales figures also reflect this decline, with a significant drop from October's sales to January's. This could be indicative of seasonal fluctuations or possibly a shift in consumer behavior that Fuze Extracts may need to address.

In the Vapor Pens category, Fuze Extracts did not manage to break into the top 30 brands in Nevada during the period from October 2024 to January 2025, with rankings hovering in the 40s. Despite this, there was an interesting spike in sales in December, which suggests a temporary boost, possibly due to holiday demand or promotional activities. However, the subsequent decline in January indicates that sustaining such sales levels may be challenging. The absence from the top 30 could be seen as a significant area for improvement, highlighting the need for strategic adjustments to enhance their competitive position in this segment.

Competitive Landscape

In the Nevada vapor pens category, Fuze Extracts has experienced fluctuating rankings over the past few months, indicating a competitive and dynamic market environment. While Fuze Extracts held a rank of 42 in October 2024, it saw a slight dip to 45 in November, before climbing back to 43 in December, and then dropping to 47 in January 2025. This volatility suggests that Fuze Extracts is facing stiff competition from brands like Boom Town Dabs, which consistently maintained a higher rank, peaking at 40 in November. Additionally, Mo-jo (NV) initially held a strong position at rank 27 in October but experienced a significant drop to 49 by January, indicating potential market share shifts that Fuze Extracts could capitalize on. Meanwhile, Tyson 2.0 showed resilience by improving its rank from 46 in December to 39 in January, suggesting a growing consumer preference that Fuze Extracts might need to address. Despite these challenges, Fuze Extracts' sales performance in December was notably strong, surpassing some competitors, which could be leveraged to regain and stabilize its market position in the coming months.

Notable Products

In January 2025, the top-performing product from Fuze Extracts was the Cosmic Live Rosin Disposable (0.5g) in the Vapor Pens category, securing the first rank with impressive sales of 147 units. The Chem Scout Cookies Live Resin Badder (0.5g) climbed to the second position in the Concentrates category, showing a significant increase from its previous fourth rank in November 2024. Secret Knight Live Resin Badder (0.5g) made its debut in the rankings, securing the third position with notable sales figures. Both Oreoz Glue Live Resin Sugar (1g) and Sour Chem Live Resin Sugar (1g) shared the fourth rank, marking their first appearance in the top rankings. This month marks a notable shift in product preferences, with new entries making a strong impact on the sales leaderboard.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.