Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

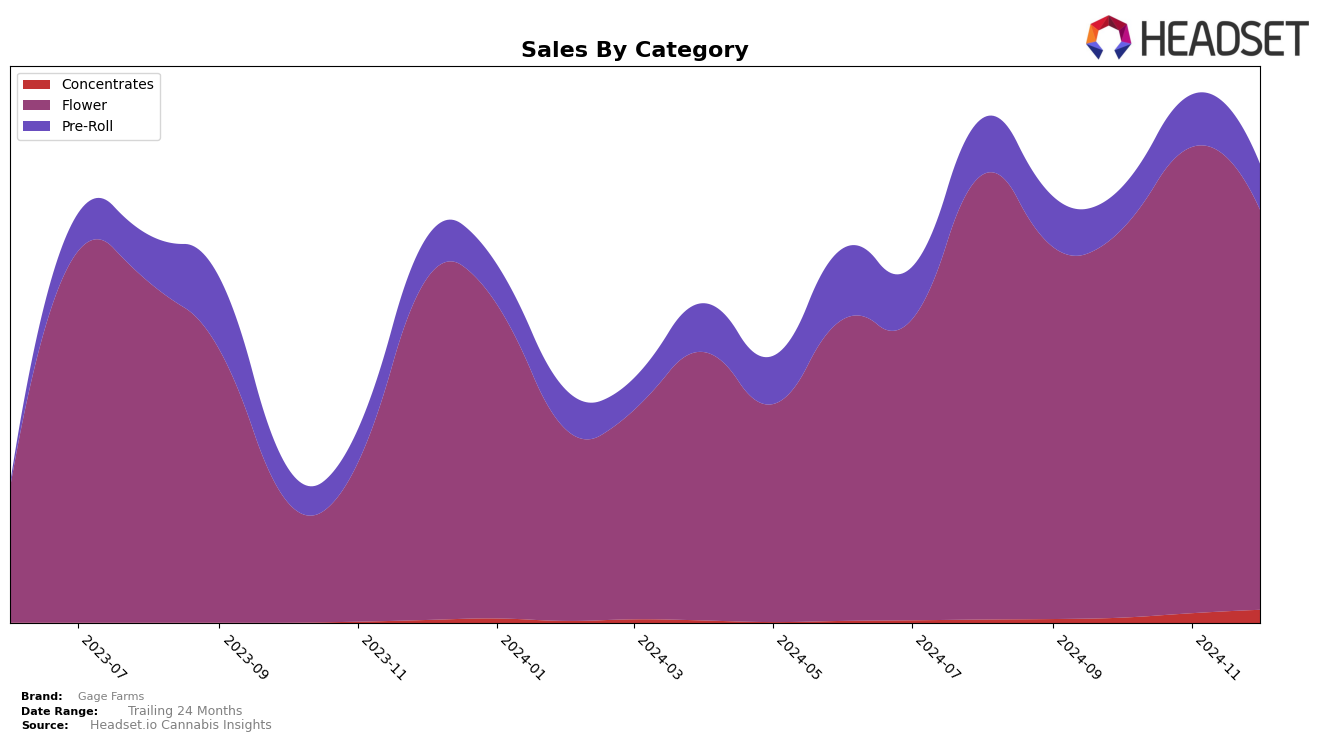

Gage Farms has shown a fluctuating performance in the New York market, particularly within the Flower category. The brand's ranking hovered around the 50s, with a minor dip in November 2024 when it fell to 59th place, before slightly recovering to 58th in December. This fluctuation suggests a competitive landscape where Gage Farms is struggling to maintain a foothold within the top 50. Despite these challenges, the sales figures reveal a peak in November, indicating a possible seasonal demand or a successful marketing campaign during that period. This upward sales trend, however, was not sustained into December, reflecting the volatility in consumer preferences or market dynamics.

In the Pre-Roll category, Gage Farms did not make it into the top 30 rankings for most of the months analyzed, only appearing in December with a rank of 99. This indicates a significant opportunity for improvement or a need to reassess their strategy in this category. The absence from the top rankings for the majority of the period could be seen as a negative indicator of their market penetration or brand appeal in the Pre-Roll sector within New York. Such insights suggest that while Gage Farms has a presence in the Flower category, there is considerable room for growth and strategic adjustments in their Pre-Roll offerings to better compete with leading brands.

Competitive Landscape

In the competitive landscape of the New York flower category, Gage Farms has experienced fluctuating ranks over the last few months, indicating a dynamic market presence. While Gage Farms maintained a relatively stable position, moving from 53rd in September 2024 to 58th by December 2024, its competitors have shown varying trends. Notably, High Peaks started strong at 42nd in September but saw a decline to 51st by December, suggesting potential challenges in sustaining growth. Meanwhile, Good Green made a significant leap from not being in the top 20 in September to 46th in October, although it dropped to 61st in December, highlighting volatility in its sales performance. Flower by Edie Parker showed a consistent upward trend, improving from 68th to 55th, which may indicate a strengthening brand presence. These shifts suggest that while Gage Farms holds a competitive position, it faces pressure from brands like Flower by Edie Parker, which are gaining momentum in the market.

Notable Products

In December 2024, AK-47 (3.5g) from the Flower category continued its streak as the top-performing product for Gage Farms, maintaining its number one rank since September despite a dip in sales to 1369 units. Blue Cheese (3.5g), also in the Flower category, emerged as the second top-selling product, making its debut in the rankings this month. Blueberry Cupcake (3.5g) retained its consistent third position, showing a slight increase in sales compared to November. Punch Runtz (3.5g) entered the rankings at fourth place, indicating a new interest in the Flower category. Sour Diesel Pre-Roll (0.75g) slipped to fifth place, down from fourth in November, showcasing a shift in consumer preference towards flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.