Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

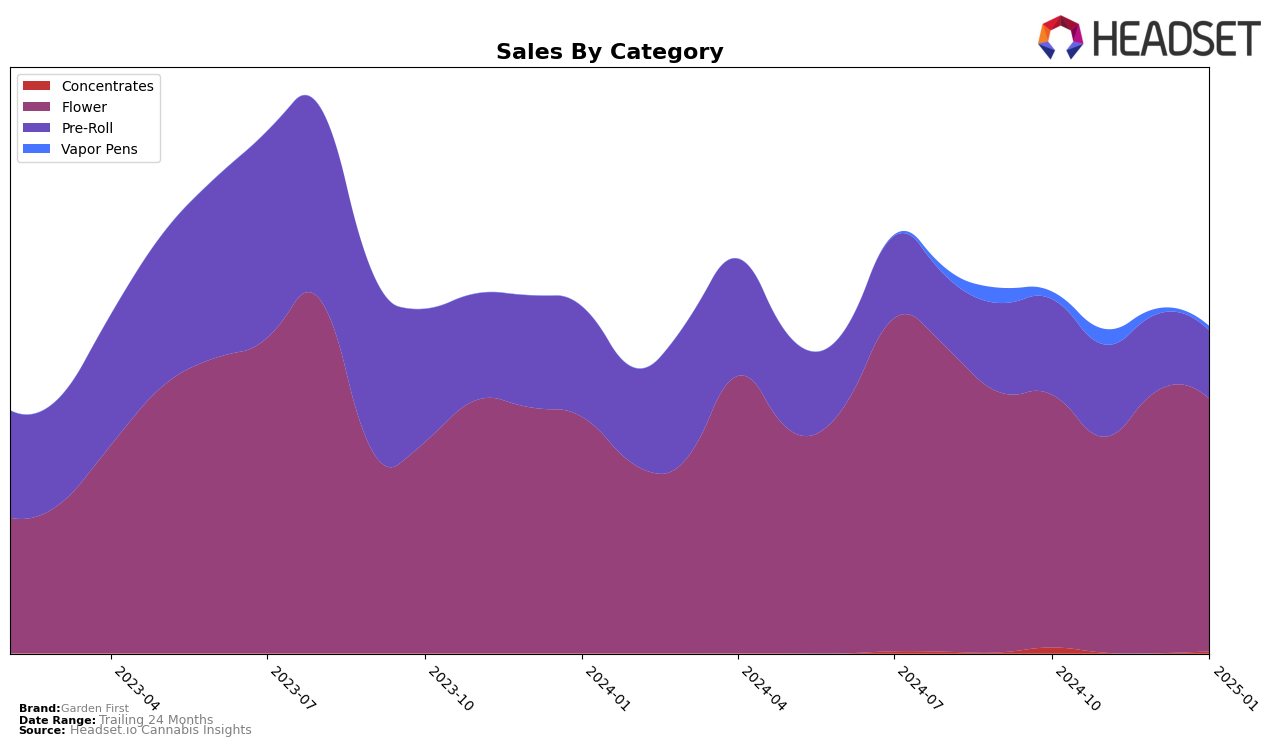

Garden First has shown varied performance across different product categories in Oregon. In the Flower category, the brand maintained a relatively stable presence, managing to stay within the top 30 from October 2024 to January 2025. Despite dropping to the 31st position in November, Garden First quickly bounced back to 26th in December and improved slightly to 25th in January. This indicates a resilient performance in the Flower market, with only a slight dip in November sales followed by a recovery. However, in the Pre-Roll category, Garden First struggled to maintain a top 30 position, consistently ranking 32nd in October and November before dropping further in December and January. This trend suggests challenges in increasing market share within this segment.

The Vapor Pens category presented a different scenario for Garden First in Oregon. The brand did not make it into the top 30 rankings, with its highest position being 89th in November 2024, indicating limited traction in this category. This absence from the top 30 suggests that Garden First might not be a significant player in the Vapor Pens market compared to its performance in Flower. The fluctuations in rankings and sales across these categories highlight the competitive dynamics Garden First faces in Oregon's cannabis market, pointing towards potential areas for strategic focus and improvement.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Garden First has experienced fluctuating rankings, reflecting a dynamic market environment. Despite not making it into the top 20 brands, Garden First saw a slight improvement in rank from 31st in November 2024 to 25th by January 2025, indicating a potential upward trend. Meanwhile, PDX Organics demonstrated a strong presence, peaking at 10th in November 2024 before dropping to 23rd by January 2025, suggesting volatility in their sales performance. Earl Baker showed a notable leap to 19th in December 2024, surpassing Garden First, but fell back to 27th by January 2025. Additionally, Growing Up, although not consistently ranked, made a significant jump to 24th in January 2025, closely trailing Garden First. These shifts highlight the competitive pressure Garden First faces, emphasizing the need for strategic adjustments to maintain and improve its market position.

Notable Products

In January 2025, the top-performing product for Garden First was Puff Jr - Gelato Cake Pre-Roll (0.5g), which rose to the number one spot with a notable sales figure of 2352. Rocky Mountain Moonshine (Bulk) closely followed in second place, maintaining its strong performance from previous months where it consistently ranked in the top four. Lime Dawg (Bulk) emerged as a new contender, securing the third position, while Strawberry Cough (Bulk) and MAC #1 (Bulk) rounded out the top five. This marks a shift in the rankings, as new products have entered the top spots that were previously unranked. The data indicates a dynamic change in consumer preferences, with pre-rolls and bulk flower products leading the sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.