Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

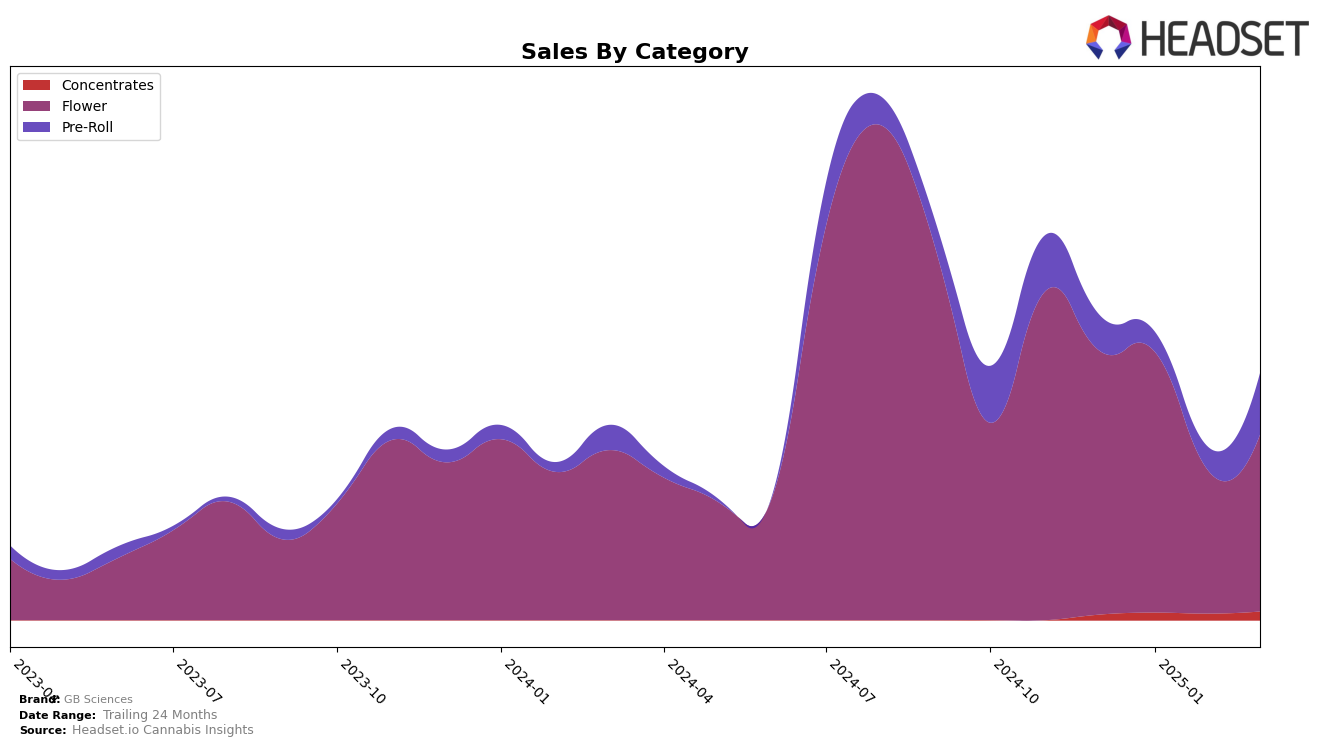

GB Sciences has shown a varied performance across different product categories and states, particularly in Nevada. In the Flower category, the brand started off at the 24th position in December 2024 and improved slightly to the 23rd position by January 2025. However, the subsequent months saw a decline, with rankings falling out of the top 30 by February and March 2025. This drop might indicate a challenge in maintaining their competitive edge in this category within the state. Despite this, the Flower category did see a noticeable increase in sales from February to March, suggesting some recovery or strategic adjustments that may have positively impacted their sales volume.

In contrast, the Pre-Roll category for GB Sciences in Nevada displayed a more dynamic movement. Starting outside the top 40 brands in December 2024, the brand's ranking fluctuated, reaching the 51st position in January 2025 but then improving to the 28th position by March 2025. This upward trend in the latter months could reflect successful marketing strategies or product innovations that resonated well with consumers. The shift from the 46th position in February to the 28th in March is particularly noteworthy, as it suggests a significant gain in market share within a short period. While exact sales figures are not detailed here, the directional movement in rankings offers a glimpse into the brand's potential growth trajectory in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Nevada flower category, GB Sciences has experienced notable fluctuations in rank and sales over the past few months. Starting from December 2024, GB Sciences held a solid position at rank 24, but by March 2025, it had slipped to rank 36. This decline in rank is mirrored by a significant drop in sales from December to February, although there was a slight recovery in March. In contrast, Greenway Medical maintained a relatively stable presence, consistently ranking in the top 30, despite a downward trend in sales. Meanwhile, The Grower Circle and Remedy have shown varying performance, with Remedy notably improving its rank from 51 in December to 34 in March, indicating a positive sales trajectory. These dynamics suggest that while GB Sciences faces challenges in maintaining its rank amidst fluctuating sales, competitors like Remedy are gaining ground, potentially impacting GB Sciences' market share in the Nevada flower category.

Notable Products

In March 2025, the top-performing product for GB Sciences was Jenny Kush Pre-Roll (1g) in the Pre-Roll category, climbing from a consistent second place in the previous months to the top spot with impressive sales of 10,372 units. Jenny Kush (3.5g) in the Flower category, which had maintained the first position from December through February, dropped to the second spot. Alien Rock Candy Crumble (0.05g) in the Concentrates category remained stable, holding the third position for two consecutive months. Prometheus Badder (0.05g), another Concentrate, improved its ranking from fifth to fourth place in March. Meanwhile, Jenny Kush Crumble (0.5g) saw a decline, moving from third place in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.