Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

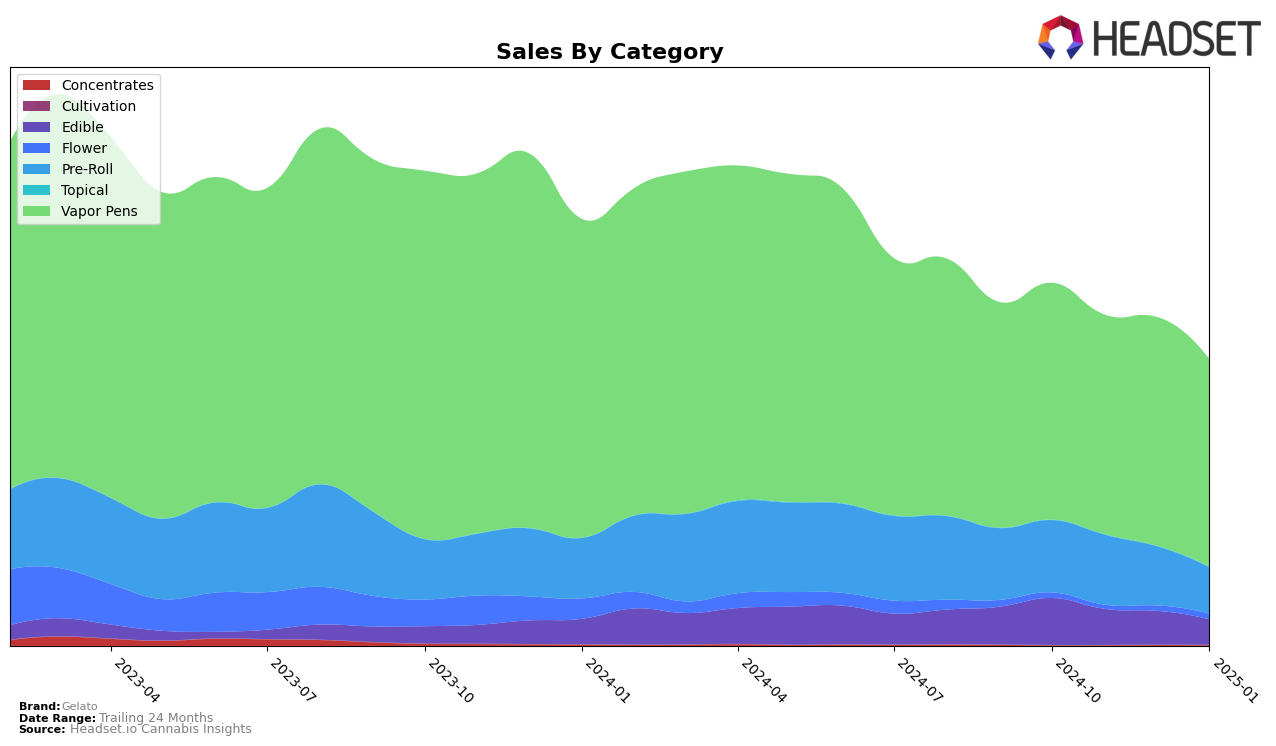

In the evolving cannabis market, the performance of the Gelato brand across different categories and states reveals intriguing trends. In California, Gelato's ranking in the Vapor Pens category showed resilience, maintaining a strong position with a slight improvement from 13th to 11th by January 2025. This indicates a steady consumer demand despite a general decline in sales. Conversely, the Edible category in California saw a decline in Gelato's ranking, slipping from 30th to 33rd, reflecting a more challenging market environment or increased competition. The Pre-Roll category also witnessed a downward trend, moving from 19th to 25th, suggesting potential shifts in consumer preferences or market dynamics.

In Michigan, Gelato's performance was mixed across categories. The brand's ranking in the Edible category deteriorated, moving out of the top 30 by November 2024 and settling at 36th by January 2025. This decline might indicate a loss of market share or increased competition within the state. Similarly, in the Vapor Pens category, Gelato's ranking fluctuated significantly, dropping from 23rd in October to 32nd by January. Such volatility could point to changing consumer tastes or the introduction of new competitors. The data suggests that while Gelato remains a notable player in certain categories, it faces challenges in maintaining its position across the board.

Competitive Landscape

In the competitive landscape of vapor pens in California, Gelato has shown a consistent yet slightly fluctuating performance in terms of rank and sales. Over the observed months from October 2024 to January 2025, Gelato's rank oscillated between 11th and 13th position, indicating a stable presence but with room for improvement. Notably, Jeeter demonstrated a significant upward trajectory, climbing from 16th to 10th place, which suggests a strong increase in market share and could pose a competitive threat to Gelato. Meanwhile, Dime Industries and Dabwoods Premium Cannabis showed more volatility in their rankings, with Dabwoods peaking at 10th in November before dropping to 13th by January. Rove maintained a steady 9th position throughout, indicating a solid and consistent market performance. Gelato's sales figures show a slight decline over the period, which, coupled with the competitive movements, suggests that while Gelato remains a key player, strategic adjustments might be necessary to enhance its competitive edge in the California vapor pen market.

Notable Products

In January 2025, the top-performing product for Gelato was the Strawberry Gelato Pre-Roll (1g) in the Pre-Roll category, securing the number 1 rank with sales of 6448 units. The Mowie Wowie Distillate Cartridge (1g) in the Vapor Pens category, which held the top position in November and December 2024, dropped to the second rank with 6419 units sold. Skywalker OG Pre-Roll (1g) maintained its third-place ranking from December 2024 into January 2025. Strawberry Cough Pre-Roll (1g) and Grape Pie Pre-Roll (1g) followed in fourth and fifth place, respectively, marking their first appearance in the top five rankings. Notably, the shift in rankings highlights the rising popularity of pre-roll products in Gelato's lineup for the start of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.