Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

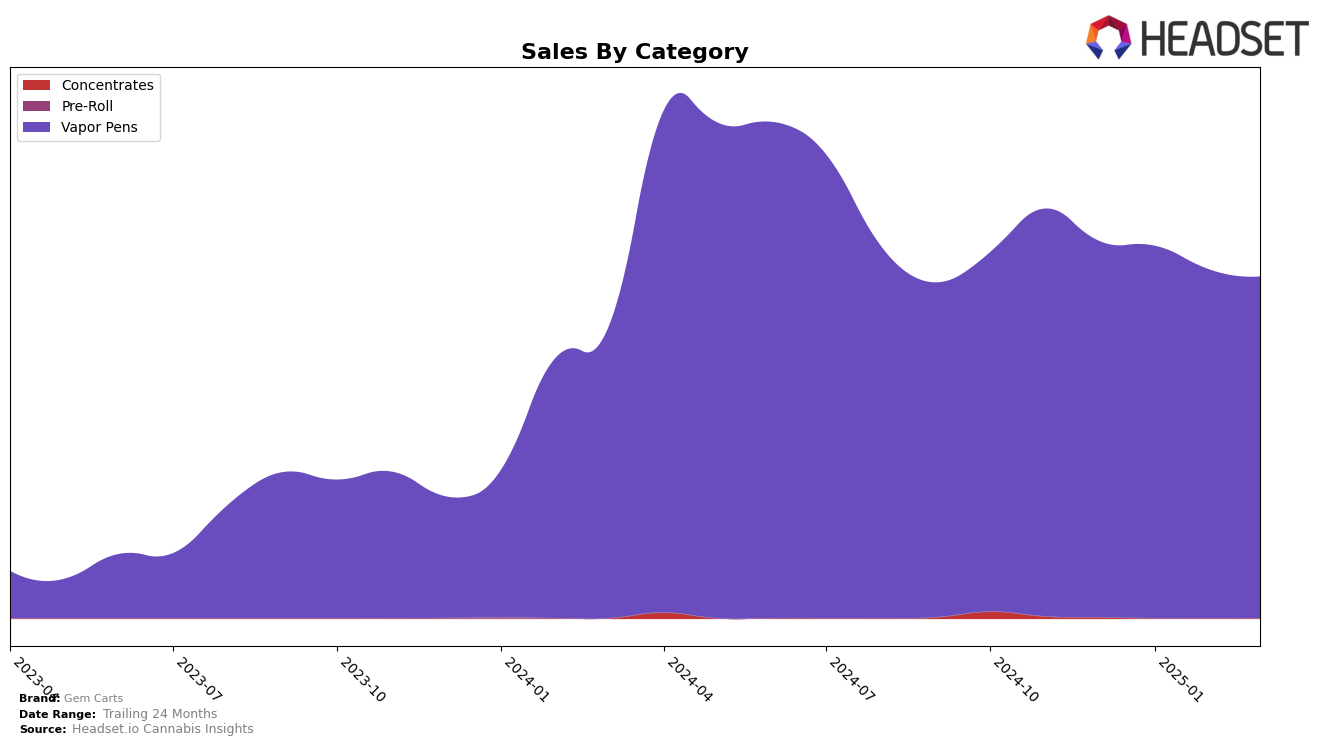

Gem Carts has shown a notable presence in the Vapor Pens category in Oregon. Starting at a rank of 9 in December 2024, the brand experienced a slight decline, ending at rank 13 by March 2025. This downward trend in the rankings suggests that while Gem Carts has maintained its presence within the top 15, it faces increasing competition in the state. The sales figures also reflect this trend, with a decrease from $611,946 in December 2024 to $555,621 by March 2025, indicating a need for strategic adjustments to regain higher rankings and stabilize sales.

In other states and categories, Gem Carts did not make it into the top 30 rankings, which can be seen as a significant area for potential improvement or expansion. The absence from these rankings suggests that the brand's market penetration and consumer recognition are limited outside of Oregon's Vapor Pens category. This could either be due to a highly competitive market landscape or perhaps a lack of targeted marketing and distribution efforts in those areas. Identifying key strategies to enhance visibility and product differentiation could be crucial for Gem Carts to establish a stronger foothold across more states and categories in the future.

```Competitive Landscape

In the competitive landscape of Oregon's Vapor Pens category, Gem Carts experienced fluctuations in its ranking over the months from December 2024 to March 2025, indicating a dynamic market environment. Starting at 9th place in December 2024, Gem Carts slipped to 13th by March 2025, despite maintaining relatively stable sales figures. This decline in rank could be attributed to the performance of competitors like Oregrown, which consistently hovered around the 11th to 14th positions, and Rogue Gold, which made a notable leap from 18th in February to 11th in March. Meanwhile, Verdant Leaf Farms and Boujee Blendz also showed competitive movements, with Verdant Leaf Farms improving its rank from 17th in January to 13th in February, and Boujee Blendz peaking at 12th in January. These shifts highlight the competitive pressures Gem Carts faces, as other brands either improved their sales or strategically positioned themselves to capture market share, impacting Gem Carts' relative standing in the market.

Notable Products

In March 2025, the top-performing product for Gem Carts was the Double Stuffed Oreoz Live Cured Resin Cartridge (1g) in the Vapor Pens category, achieving the number 1 rank with sales of 2,214 units. Following closely were Donut Face Cured Resin Cartridge (1g) and Super Boof Cured Resin Cartridge (1g), both sharing the second rank with identical sales figures. Spaceman Jack Cured Resin Cartridge (1g) secured the third position, while Frosted Cookie Muffle Cured Resin Cartridge (1g) took the fourth rank. Compared to previous months, Double Stuffed Oreoz has maintained its top position, indicating consistent high demand. Notably, Donut Face and Super Boof have climbed to a shared second place, showing a significant rise in popularity since earlier months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.