Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

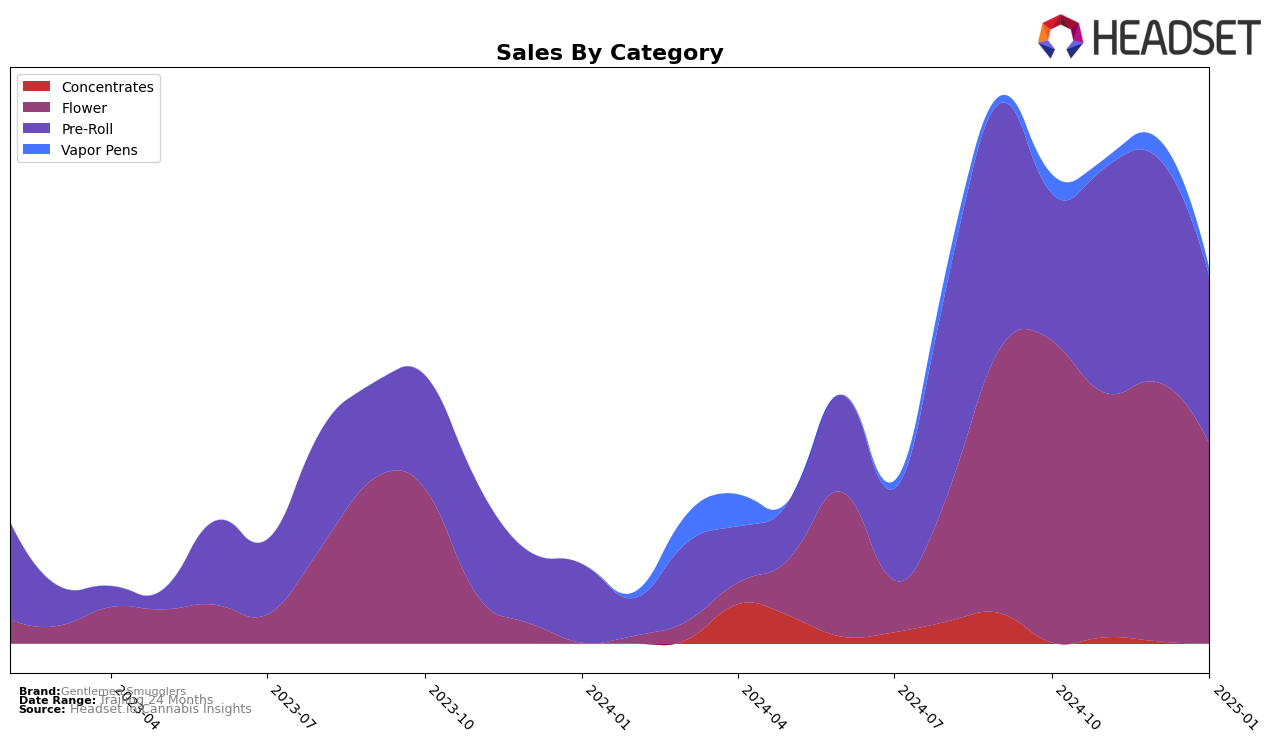

In examining the performance of Gentlemen Smugglers across various states and product categories, we observe notable trends and shifts. In Massachusetts, the brand's presence in the flower and pre-roll categories was outside the top 30 rankings as of October 2024, with ranks of 81 and 94, respectively. This indicates a challenge in penetrating the top tier of the market within the state. Despite this, their sales figures in Massachusetts suggest a foundation that could be built upon for future growth. Meanwhile, in Maryland, Gentlemen Smugglers showed a more competitive stance, consistently ranking within the top 50 for both flower and pre-roll categories from November 2024 to January 2025.

Focusing on Maryland, the brand demonstrated a positive trajectory in the pre-roll category, moving from 32nd place in November 2024 to 27th in December, before slightly adjusting to 29th in January 2025. This upward movement suggests a growing preference among consumers for their pre-roll products. In contrast, the flower category in Maryland saw a stable presence within the mid-40s ranking, indicating steady performance but also highlighting potential areas for strategic improvement to climb higher in the rankings. The absence of rankings for Massachusetts beyond October 2024 may point to a need for increased market penetration efforts to gain a foothold in the top 30, thereby enhancing visibility and competitiveness in that market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Maryland, Gentlemen Smugglers has shown a fluctuating performance in recent months. Starting from a non-ranking position in October 2024, the brand made a notable entry into the top 20 by November 2024, securing the 32nd position. By December 2024, Gentlemen Smugglers improved its rank to 27th, although it slightly declined to 29th in January 2025. This performance is particularly interesting when compared to competitors like Modern Flower, which consistently held higher ranks, peaking at 15th in December 2024 before dropping to 26th in January 2025. Similarly, Khalifa Kush maintained a stronger presence, despite a downward trend from 22nd in October 2024 to 30th in January 2025. The sales trajectory of Gentlemen Smugglers, with a peak in November 2024, suggests potential for growth, especially if the brand can capitalize on the declining trends of its competitors like Belushi's Farm, which showed an upward rank trend but may face challenges sustaining it. Overall, Gentlemen Smugglers' ability to navigate this competitive market will depend on strategic positioning and leveraging insights from these market dynamics.

Notable Products

In January 2025, the top-performing product from Gentlemen Smugglers was the Strawberry Cough Pre-Roll 2-Pack (1g) in the Pre-Roll category, which secured the number one rank with sales of 2100 units. The Maui Flower (3.5g) maintained its second-place position from December 2024, showing consistent popularity. The Maui Pre-Roll 2-Pack (1g) dropped from first place in December to third in January, indicating a shift in consumer preference. Watermelon Cloudz Pre-Roll 2-Pack (1g) climbed to fourth place, showing a slight increase in sales momentum. The GMO x Sour Diesel Pre-Roll 2-Pack (1g) held steady at fifth place, suggesting stable demand despite a significant drop in sales from November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.