Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

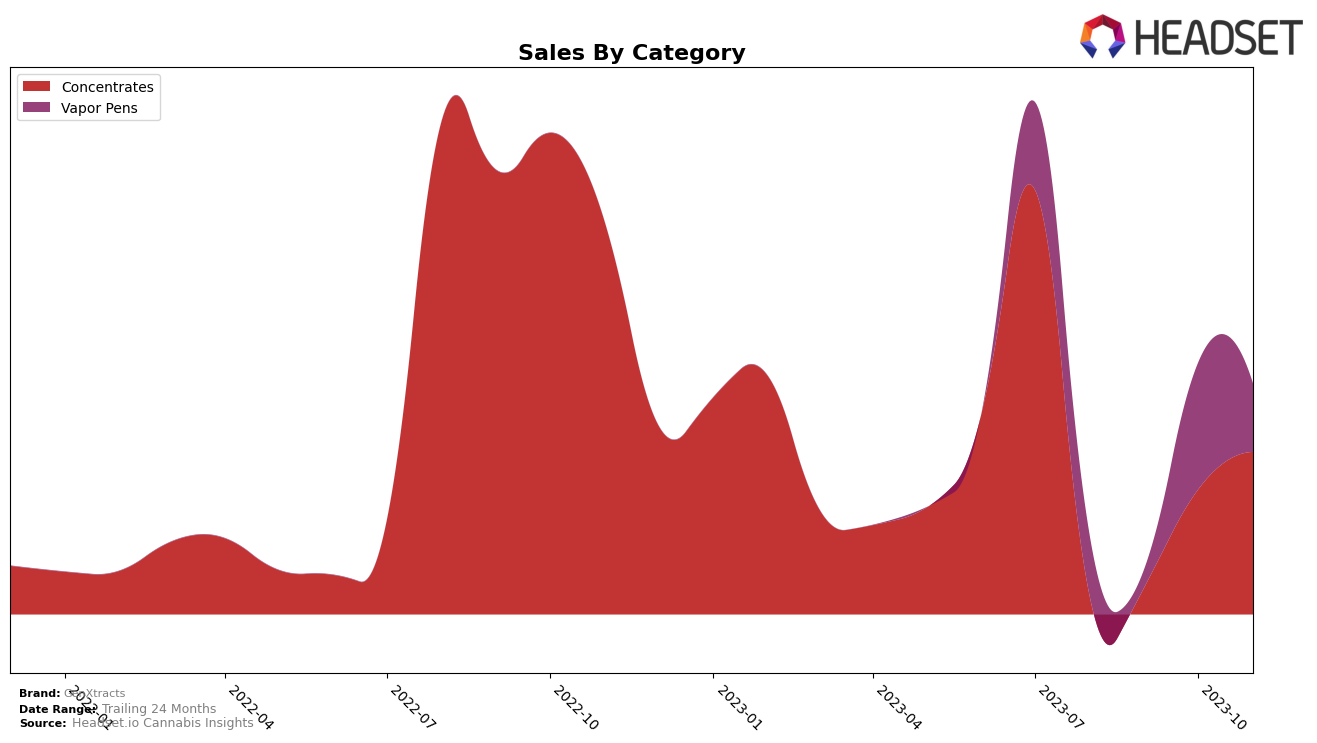

GenXtracts, a prominent cannabis brand, has been performing quite remarkably in Arizona. In the Concentrates category, the brand has made a significant leap from ranking 44th in August to 14th in November 2023. This upward trend suggests a growing popularity and market acceptance for GenXtracts' concentrates in Arizona. Although exact sales numbers are proprietary, the increasing ranking indicates a substantial growth in sales over this period, reflecting the brand's successful strategies and high-quality products.

On the other hand, GenXtracts' performance in the Vapor Pens category in Arizona has been somewhat fluctuating. The brand was not among the top 20 in August and September 2023, indicating a need for improvement. However, there was a significant improvement in October, with the brand jumping to the 29th spot. This improvement, unfortunately, could not be sustained in November as the brand slipped to the 35th position. This oscillation in rankings suggests a volatile market scenario for GenXtracts' vapor pens in Arizona, and it might be beneficial for the brand to investigate the causes behind this.

Competitive Landscape

In the Concentrates category in Arizona, GenXtracts has shown a significant upward trend in its ranking, moving from 44th place in August 2023 to 14th place by November 2023. This is a notable improvement compared to competitors such as WTF Extracts and Undisputed Extracts, which have shown less consistent performance over the same period. However, GenXtracts still trails behind other brands like IO Extracts and Goldsmith Extracts, which have maintained their positions within the top 15 throughout these months. Despite this, the rapid rise of GenXtracts suggests a positive sales trend, potentially outpacing these competitors in the future.

Notable Products

In November 2023, GenXtracts' top-performing product was the Devil Fruit Shatter (1g) from the Concentrates category, with remarkable sales of 1777 units. Following closely was the Eleven Roses Shatter (1g), also from the Concentrates category, ranking second. The Green Crack Shatter (1g) secured the third spot, while the Devil Fruit Badder (1g) came in fourth, both also in the Concentrates category. Interestingly, the Tahoe OG Distillate Cartridge (0.5g) from the Vapor Pens category, which was the second best-seller in October, dropped to the fifth position in November. This indicates a significant shift in consumer preference within GenXtracts' product range.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.