Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

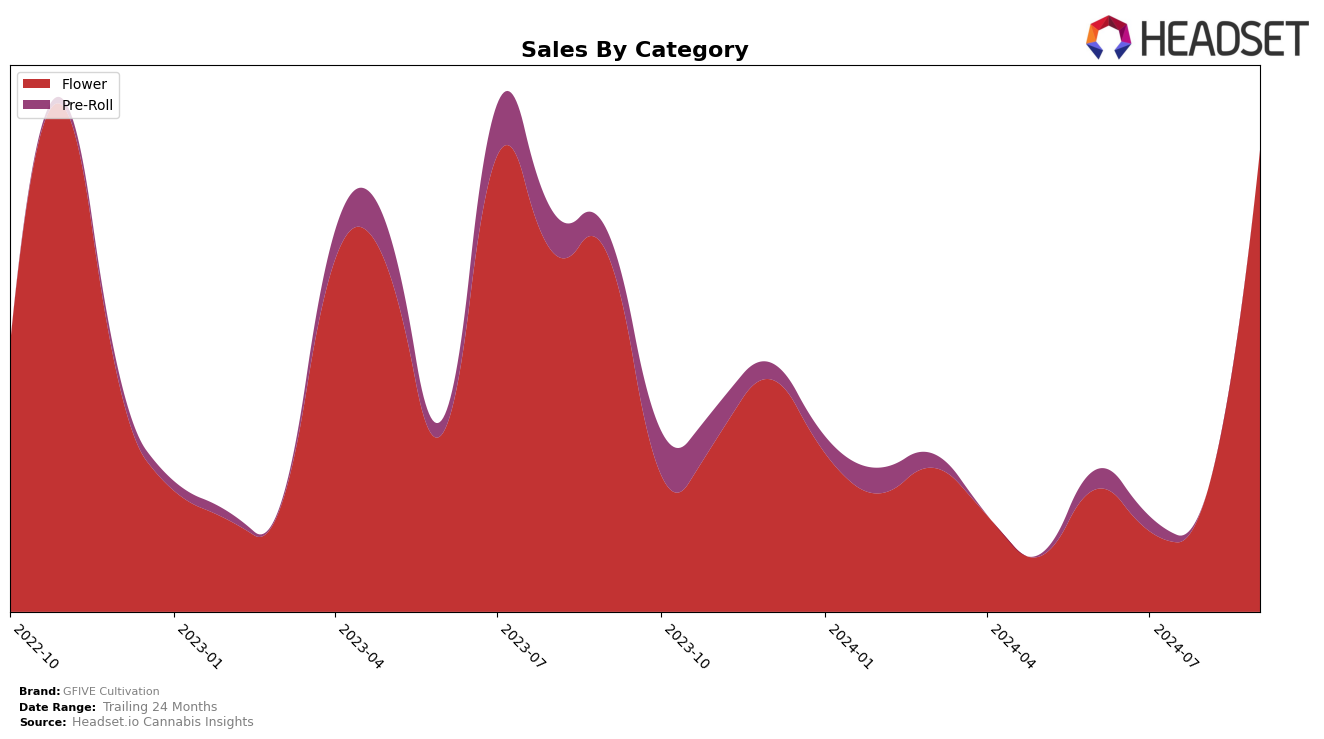

In the Nevada market, GFIVE Cultivation has shown a significant upward trajectory in the Flower category. From June to September 2024, their rank improved from being outside the top 30 to securing the 30th position. This notable climb in rankings suggests a strong recovery and increased consumer interest, especially considering their absence from the top 30 in the preceding months. This improvement is also reflected in their sales figures, which saw a substantial increase in September compared to earlier months, indicating successful strategies or product offerings that resonated well with the market.

The fluctuating rankings of GFIVE Cultivation across different months highlight both challenges and opportunities in maintaining consistent performance. While their absence from the top 30 in June, July, and August might indicate competition or market saturation challenges, their September performance demonstrates potential for sustained growth if current trends continue. This pattern of performance provides insight into the competitive landscape of the cannabis market in Nevada, where adaptability and market responsiveness are crucial for ongoing success.

Competitive Landscape

In the competitive landscape of the Nevada flower category, GFIVE Cultivation has demonstrated a remarkable turnaround in its market positioning from June to September 2024. Initially ranked 69th in June, GFIVE Cultivation surged to 30th place by September, showcasing a significant upward trajectory in rank. This improvement is particularly noteworthy when compared to competitors like BaM / Body and Mind, which experienced a decline from 8th to 31st place, and Stackhouse, which also fell from 12th to 28th. Meanwhile, Highlights climbed from outside the top 20 to 29th place by September, indicating a competitive environment. Despite lower sales figures earlier in the year, GFIVE Cultivation's strategic efforts have resulted in a substantial increase in sales by September, positioning them as a formidable player in the Nevada flower market.

Notable Products

For September 2024, the top-performing product from GFIVE Cultivation was Pynk Mynk (3.5g) in the Flower category, maintaining its first-place ranking from August with a significant sales increase to 6370 units. Daily Grape (3.5g) also retained its second position, showing a steady performance with 5681 units sold. High Five (3.5g) remained in the third position after re-entering the rankings in August, with sales reaching 1839 units. Pynk Mynk 2.0 (3.5g) and Hardcore Gelato (14g) remained consistent in fourth and fifth places, respectively, with slight sales improvements over the previous month. Overall, the rankings of these products have shown stability, with no changes in their positions from August to September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.