Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

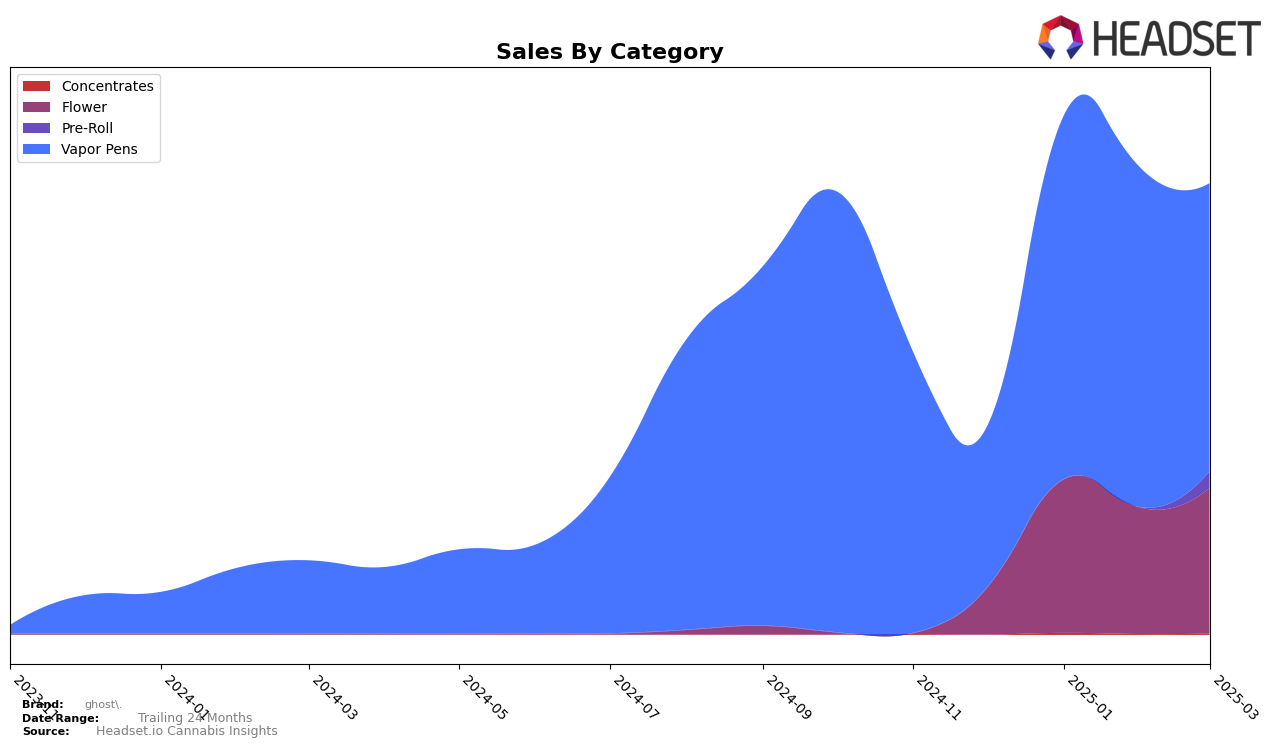

In the state of California, ghost. has shown a somewhat fluctuating performance in the Vapor Pens category. Starting from a rank of 79 in December 2024, the brand experienced a dip to 97 in January 2025 but managed to climb back up to 77 by March 2025. This indicates a potential recovery trend, although it remains outside the top 30 brands, which suggests that there is still significant room for improvement. The sales figures reflect this movement, with a noticeable increase from January to March, hinting at a positive trajectory despite the initial setback at the beginning of the year.

In contrast, ghost. has demonstrated a much stronger presence in New York, particularly in the Flower category, where it achieved a rank of 25 in January 2025 and maintained a stable position around 26 by March. This stability is complemented by impressive sales figures, with a marked increase from December to March. Additionally, in the Vapor Pens category, ghost. made significant strides, reaching as high as rank 10 in January before settling at 19 in March. However, in the Pre-Roll category, the brand was absent from the top 30 until March, when it appeared at rank 82, indicating a late but promising entry into this segment. This suggests that while ghost. is gaining traction in certain categories, there are still opportunities for growth and expansion in others.

Competitive Landscape

In the competitive landscape of vapor pens in New York, ghost. has shown a remarkable rise in rank from December 2024 to January 2025, jumping from 33rd to 10th place. This significant leap suggests a strong market entry or a successful marketing strategy that captured consumer interest. However, ghost. experienced a slight decline in the following months, settling at 19th place by March 2025. This fluctuation in rank could indicate increased competition or market saturation. Notably, Eureka maintained a relatively stable position, although it dropped from 13th to 20th place over the same period, while Bloom consistently hovered around the lower ranks, dropping out of the top 20 in February 2025. Meanwhile, Sapphire Farms showed improvement, climbing from 21st to 18th place by March 2025, and Florist Farms rose to 17th place, suggesting a competitive and dynamic market environment. These shifts highlight the need for ghost. to continue innovating and adapting to maintain its position and capitalize on its initial success.

Notable Products

In March 2025, the top-performing product for ghost was the Blueberry Dream Distillate Disposable 1g from the Vapor Pens category, maintaining its position at rank 1 with sales figures reaching 1108 units. Hot Glue 7g, from the Flower category, emerged as a strong contender, securing the second spot. Guava Distillate Disposable 1g fell to rank 3, showing a decline from its previous top position in December 2024. Gorilla Glue #4 Distillate Disposable 2g debuted at rank 4, indicating a positive reception. BBK 7g also entered the rankings at position 5, showcasing a growing interest in the Flower category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.