Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

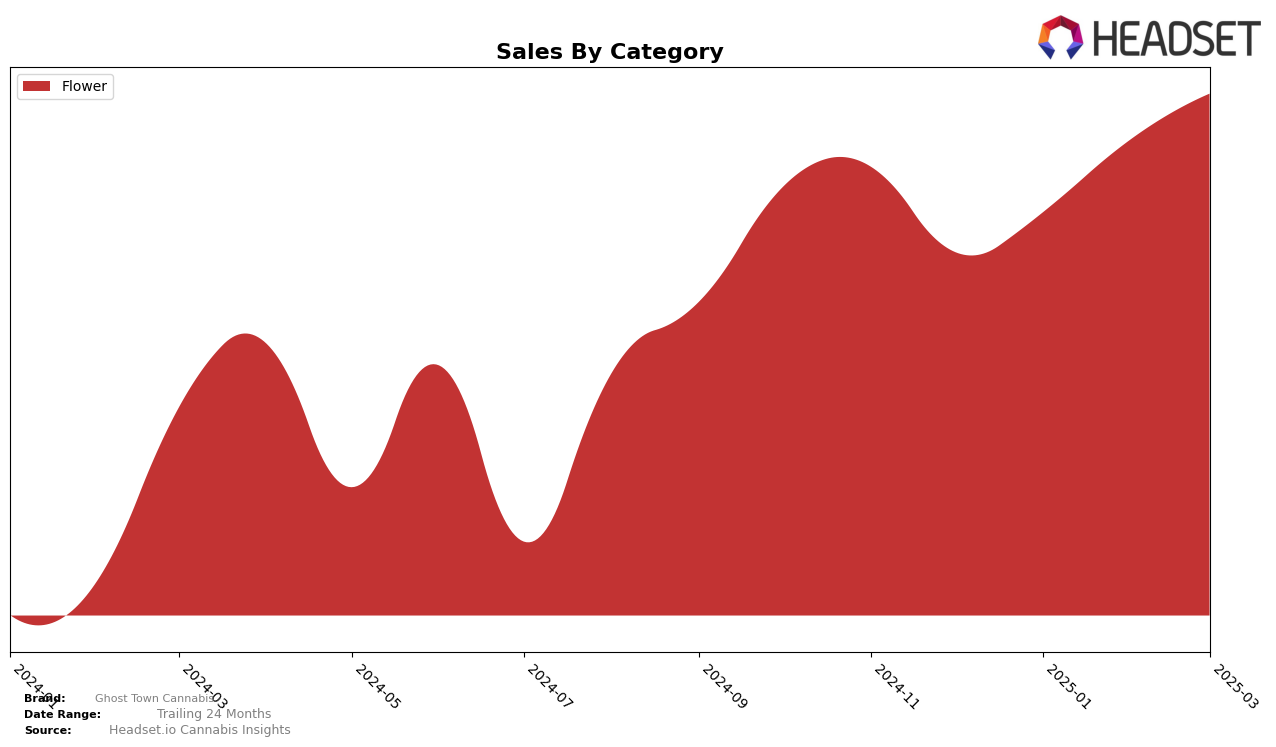

Ghost Town Cannabis has shown notable performance in the Flower category across several months in Nevada. Starting from December 2024, the brand was ranked 11th, which then saw a slight dip to 14th in January 2025. However, the brand quickly rebounded, climbing to 8th position by February and maintaining a strong presence at 9th place in March. This upward trend in rankings is indicative of the brand's growing popularity and market penetration within the state. The sales data corroborates this trend, reflecting a consistent increase over the months, with March 2025 showing significant growth compared to December 2024. This positive trajectory suggests that Ghost Town Cannabis is effectively capturing consumer interest and expanding its market share in Nevada's competitive Flower category.

Across other states and categories, however, Ghost Town Cannabis did not make it into the top 30 rankings, which could be seen as a potential area for improvement or expansion. The absence from these rankings highlights the challenge the brand faces in gaining a foothold outside of its stronghold in Nevada. This lack of presence in other markets could be due to various factors such as limited distribution, regional competition, or differing consumer preferences. While the brand's performance in Nevada is commendable, expanding its reach and improving its rankings in other states could be a strategic focus for Ghost Town Cannabis moving forward. This could involve exploring new marketing strategies, expanding product lines, or enhancing distribution networks to increase visibility and consumer engagement in other regions.

Competitive Landscape

In the competitive landscape of the flower category in Nevada, Ghost Town Cannabis has shown notable resilience and growth. Starting from December 2024, Ghost Town Cannabis was ranked 11th, and despite a slight dip to 14th in January 2025, it rebounded to 8th in February and maintained a strong position at 9th in March. This upward trend in rankings is indicative of a positive sales trajectory, contrasting with brands like Green Life Productions, which fluctuated from 9th to 16th before climbing back to 8th, and Find., which experienced a decline from 6th to 13th before slightly recovering to 10th. Meanwhile, Hustler's Ambition consistently performed well, maintaining a top 10 position throughout the period. Ghost Town Cannabis's ability to improve its rank and sales amidst such competition highlights its growing market presence and potential for further expansion.

Notable Products

In March 2025, the top-performing product for Ghost Town Cannabis was Skittlez Cookies (3.5g) in the Flower category, maintaining its leading position from February with sales reaching 2274 units. Peanut Butter Breath (3.5g) also showed strong performance, climbing to the second rank from an unranked position in previous months, with 2225 units sold. Mango Sherb (3.5g) entered the ranks for the first time in March, securing the third spot. Drops of Jupiter (3.5g) and Strawnana (3.5g) debuted in fourth and fifth positions, respectively, indicating a fresh interest in these products. The rankings highlight a dynamic shift in consumer preferences with new entries making a significant impact.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.