Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

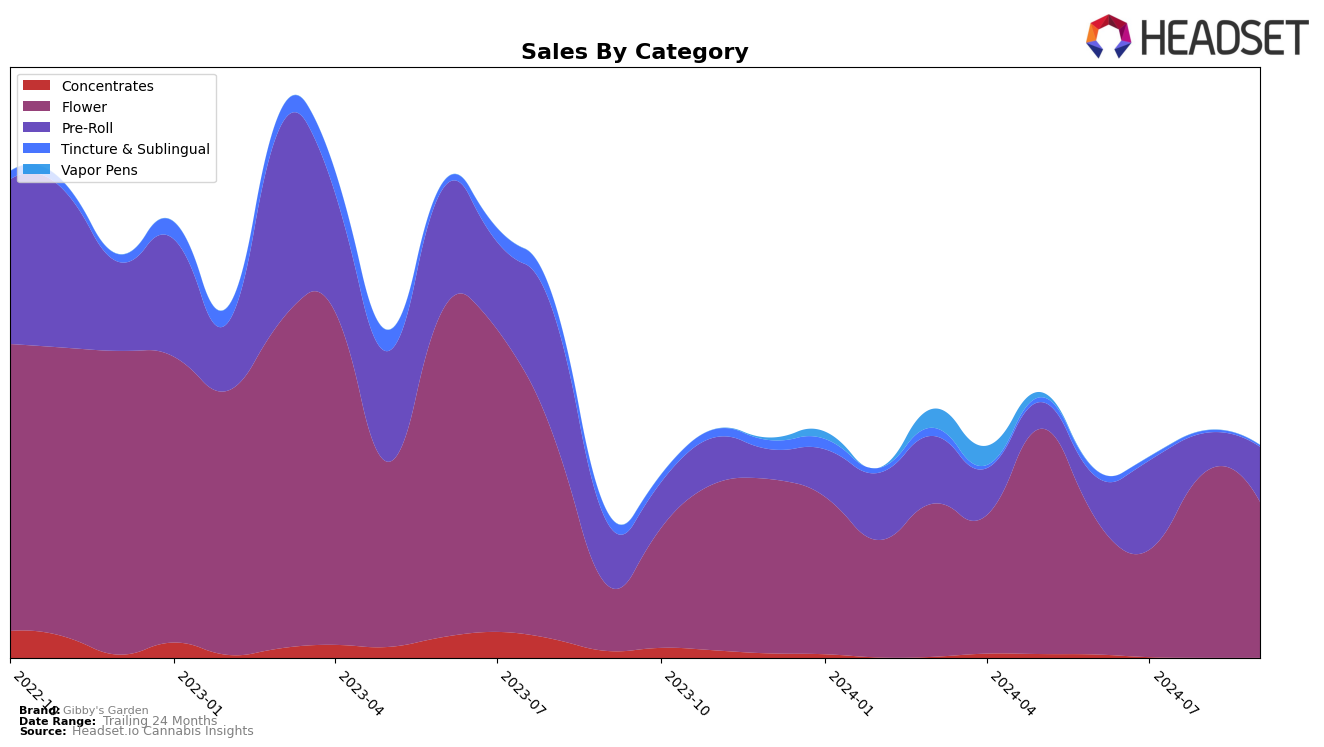

In recent months, Gibby's Garden has experienced notable shifts in its market performance, particularly in the state of Massachusetts. In the Flower category, Gibby's Garden did not make it into the top 30 brands from June through August 2024. However, by September, there was a slight upward movement, with the brand ranking 94th. This indicates a potential resurgence or strategic efforts to improve their standing in the competitive Massachusetts market. While the brand's sales numbers reflect a decline from June to September, with a notable dip from $57,321 in June to $48,189 in September, the improvement in ranking suggests a positive trajectory that could continue if current strategies are maintained or enhanced.

It is important to note that Gibby's Garden's absence from the top 30 rankings in the Flower category during the summer months could be viewed as a challenge for the brand, highlighting the fierce competition in the Massachusetts market. The brand's recent entry into the rankings by September might suggest a successful adaptation or a new marketing push that is beginning to yield results. Observing how Gibby's Garden continues to perform in the coming months will be crucial to understanding whether this upward trend is sustainable and if it can lead to a more significant presence in the Massachusetts Flower category. This performance analysis provides a glimpse into the brand's current standing, leaving room for speculation about its future growth strategies and market expansion plans.

Competitive Landscape

In the Massachusetts flower category, Gibby's Garden has shown a promising upward trend in rankings, moving from not being in the top 20 in June and July 2024 to securing the 97th and 94th positions in August and September 2024, respectively. This positive movement indicates a growing presence in the market, despite the competitive landscape. In contrast, Sanctuary Medicinals has experienced a decline, dropping from 64th in June to 100th by September, which may suggest potential opportunities for Gibby's Garden to capture some of their market share. Meanwhile, Berkshire Roots and TICAL have not maintained consistent top 20 rankings, with TICAL only appearing in September at 92nd, which could indicate fluctuating sales performance. Crispy Commission Concentrates entered the rankings in September at 93rd, slightly ahead of Gibby's Garden, suggesting close competition. Overall, Gibby's Garden's recent ranking improvements and the volatility among competitors highlight potential for continued growth in the Massachusetts flower market.

Notable Products

In September 2024, the top-performing product from Gibby's Garden was Blueberry (3.5g) in the Flower category, securing the first rank with a sales figure of 1228 units. Blue Dream Pre-Roll (1g) in the Pre-Roll category moved up to the second position, showing an increase from the third rank in August. Neville's Haze (3.5g) maintained a strong presence in the Flower category, ranking third after climbing from fourth in June. Sugar Bomb Punch Pre-Roll (1g) re-entered the rankings in September, securing the fourth position. Notably, Blue Dream (3.5g) experienced a drop to fifth place from its top position in August, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.