Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

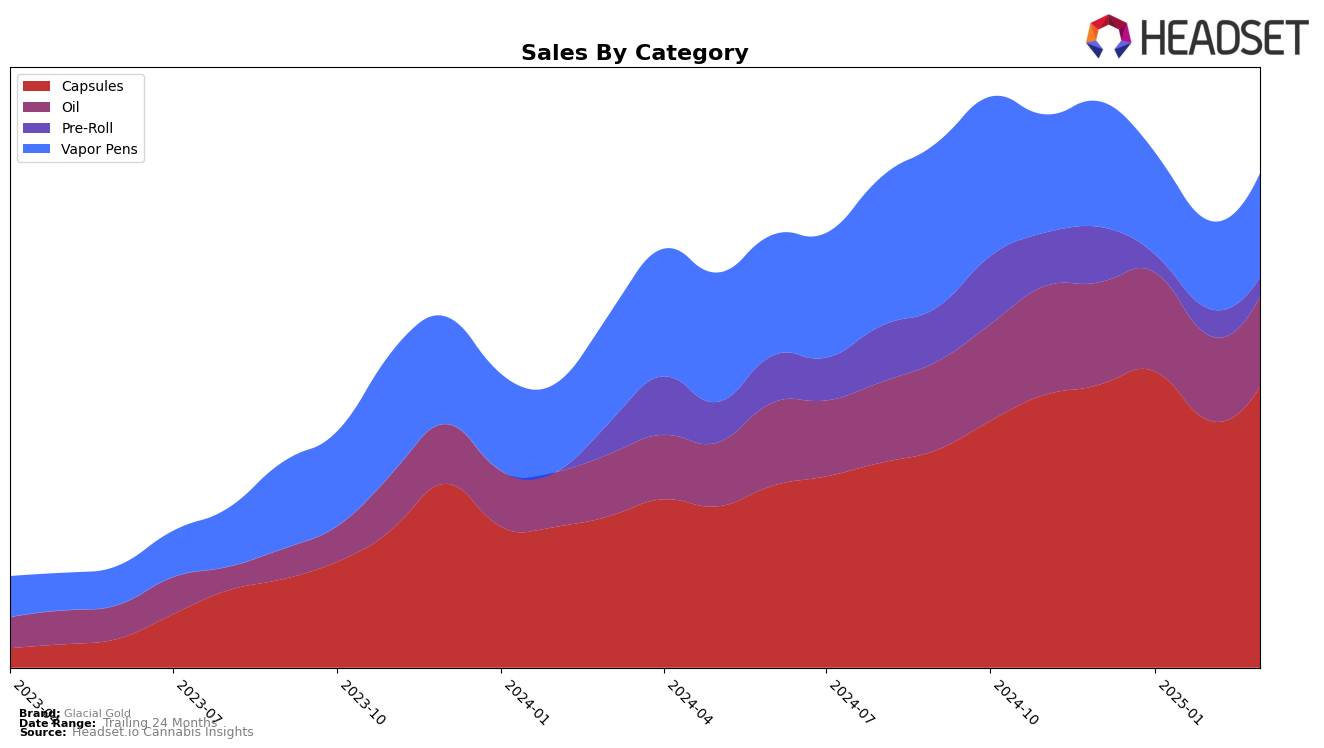

Glacial Gold has shown a strong performance in the capsules category across multiple Canadian provinces. In British Columbia, the brand consistently held the top rank from December 2024 through March 2025, indicating a robust market presence. Similarly, in Alberta, Glacial Gold maintained a steady second position in the capsules category, despite a noticeable dip in sales during February 2025. However, in Ontario, the brand held a solid fourth position throughout the same period. Meanwhile, in Saskatchewan, Glacial Gold appeared on the rankings only in December 2024, suggesting a potential area for growth or a shift in market dynamics.

In the oil category, Glacial Gold's performance varied across provinces. In British Columbia, the brand oscillated between the first and second ranks, showcasing its competitive edge. Alberta saw Glacial Gold's rank fluctuate, reaching as high as fourth in February 2025 before settling at sixth in March. Interestingly, the pre-roll category presented challenges, as Glacial Gold did not make it into the top 30 in Alberta in March 2025, a significant drop from its earlier presence. The vapor pens category also highlighted some inconsistencies, with Glacial Gold maintaining a steady but lower presence across Ontario and other provinces, indicating potential opportunities for strategic improvement.

Competitive Landscape

In the competitive landscape of the Capsules category in British Columbia, Glacial Gold has consistently maintained its top position from December 2024 through March 2025, demonstrating its strong market presence and consumer preference. Despite fluctuations in sales figures, Glacial Gold's leadership remains unchallenged, with its sales significantly outpacing those of competitors. For instance, Emprise Canada, which consistently ranks second, has not managed to close the gap, even as its sales show a positive trend. Similarly, Indiva holds the third position, with sales figures that are substantially lower than those of Glacial Gold. This consistent ranking and sales performance highlight Glacial Gold's dominance and suggest a robust brand loyalty among consumers in the region.

Notable Products

In March 2025, the top-performing product from Glacial Gold was the THC Softgels 100-Pack (1000mg) in the Capsules category, maintaining its first-place ranking for the fourth consecutive month with a sales figure of 6,659 units. The CBD/THC 1:1 Balanced Softgel 50-Pack (500mg CBD, 500mg THC) also held steady in second place, showing consistent demand. The High THC Banger Distillate Cartridge (1g) in Vapor Pens retained its third-place position, indicating stable sales performance. Notably, THC 10 Softgels 10-Pack (100mg) improved its ranking to fourth place from fifth in previous months, while THC 10 Softgels 50-Pack (500mg) slipped to fifth place. These shifts suggest a slight change in consumer preferences within the Capsules category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.