Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

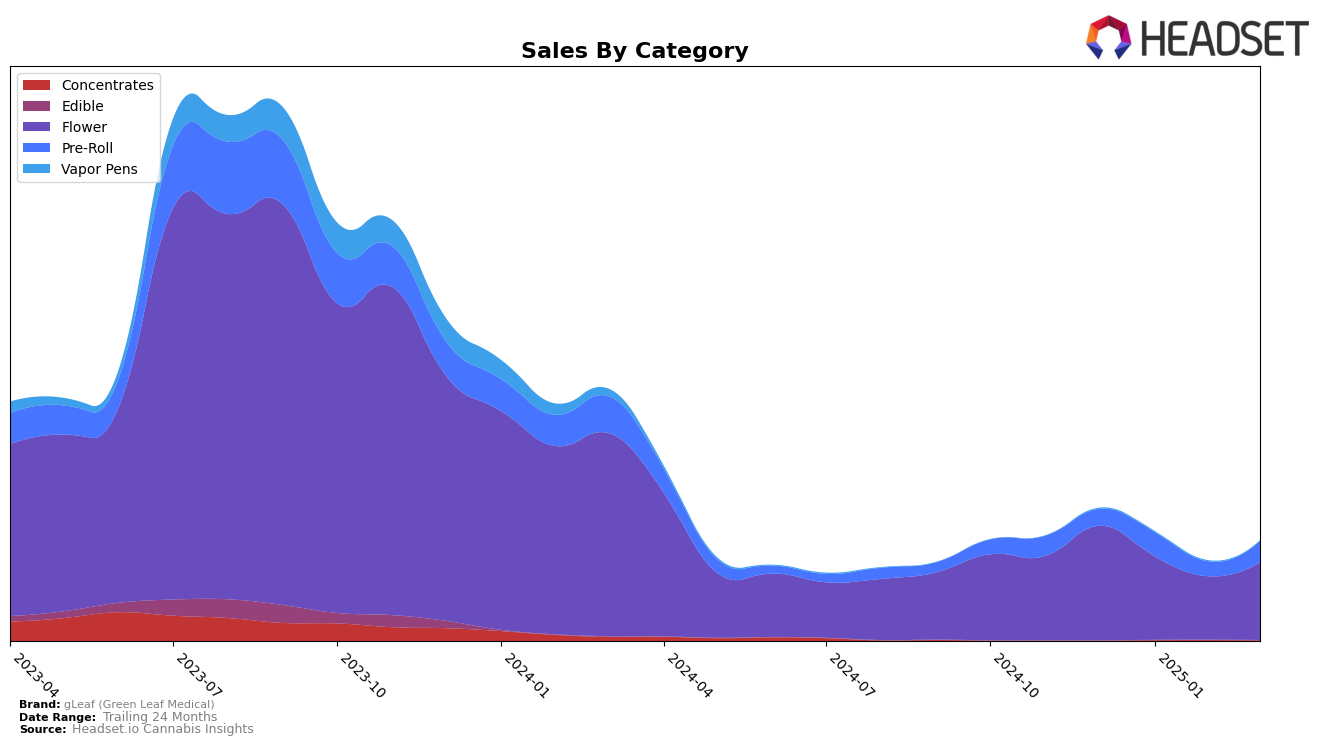

In the state of Maryland, gLeaf (Green Leaf Medical) has shown a dynamic performance across different cannabis categories. In the Flower category, the brand experienced fluctuations in rankings, starting at 20th in December 2024, dropping to 23rd by February 2025, and then slightly recovering to 21st in March 2025. This indicates a volatile market presence, with sales peaking at $738,757 in December before experiencing a decline in the following months. Meanwhile, in the Pre-Roll category, gLeaf saw a promising rise to 17th in January 2025, only to see its rank slip back to 21st by March. These movements suggest that while gLeaf maintains a presence, competition is fierce, and maintaining a top position requires strategic adjustments.

Interestingly, gLeaf's sales data across these categories reflect the challenges and opportunities within the Maryland market. The fluctuations in rankings and sales volumes highlight the competitive nature of the cannabis industry in the state. The brand's ability to climb to the 17th position in the Pre-Roll category in January suggests potential areas of strength or effective marketing strategies that month. However, not appearing in the top 30 in other states or categories could indicate either a lack of presence or a need for strategic expansion. This analysis underscores the importance for gLeaf to continuously adapt and refine its approach to stay competitive in the ever-evolving cannabis market landscape.

Competitive Landscape

In the competitive landscape of the Maryland flower category, gLeaf (Green Leaf Medical) has experienced fluctuations in its market position from December 2024 to March 2025. Starting at rank 20 in December, gLeaf saw a slight decline to rank 22 in January and 23 in February, before improving to rank 21 in March. This movement indicates a competitive struggle amidst brands such as JustFLOWR, which maintained a higher rank, starting at 16 and ending at 22, and LivWell, which consistently hovered around the 19th position. Notably, Old Pal made a significant leap from being outside the top 20 to reaching rank 20 in March, suggesting a potential threat to gLeaf's market share. Despite these challenges, gLeaf's sales showed a recovery in March, indicating resilience and potential for regaining higher ranks in the future.

Notable Products

In March 2025, Pineapple Skunk (3.5g) from gLeaf (Green Leaf Medical) reclaimed its top position as the best-selling product in the Flower category, with impressive sales figures reaching 4084 units. Colonel Crasher Pre-Roll 2-Pack (1g) followed closely in the Pre-Roll category, climbing to second place from its previous absence in February. Schism Pre-Roll 2-Pack (1g) entered the rankings for the first time, securing the third spot. Romscootti Pre-Roll (1g) and Octane Mint Sorbet Pre-Roll 2-Pack (1g) were also notable entries, ranking fourth and fifth, respectively. This shift in rankings highlights a dynamic change in consumer preferences towards pre-rolls, as these products were not consistently ranked in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.