May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

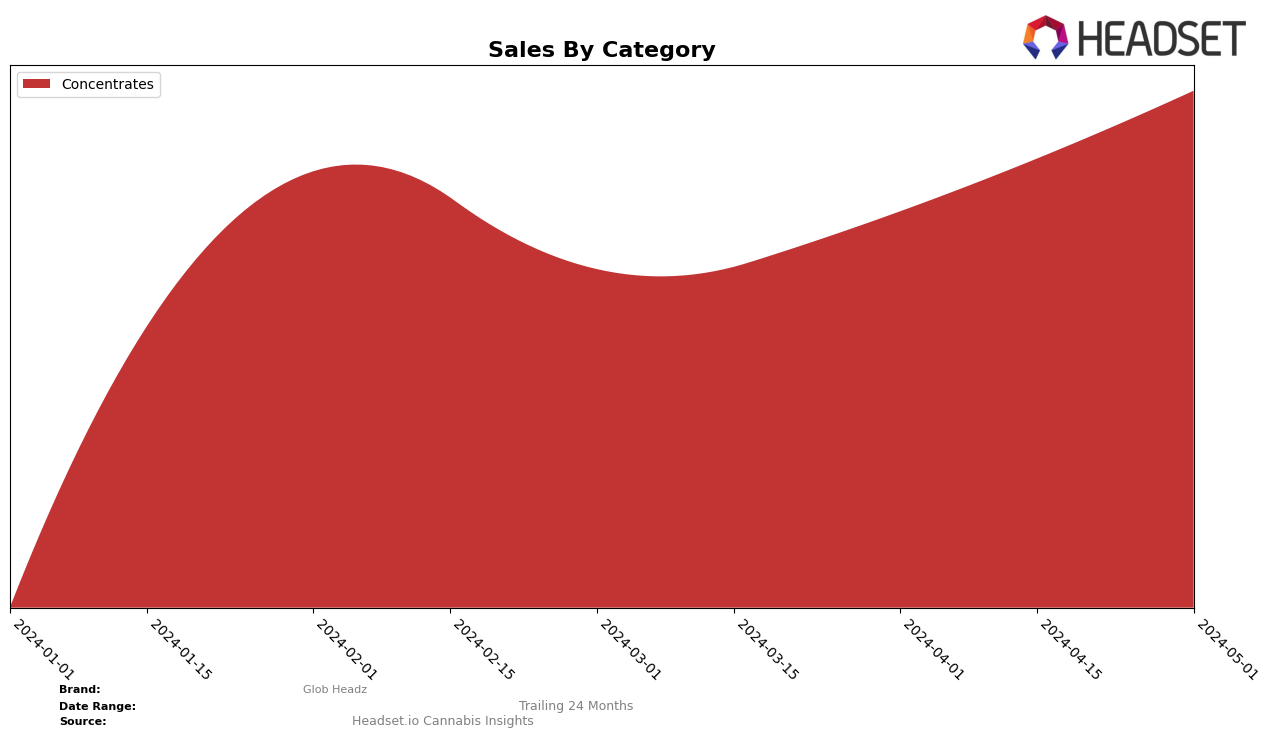

Glob Headz has shown notable performance fluctuations across different states and product categories. In Ontario, the brand's ranking within the Concentrates category saw some ups and downs. After slipping out of the top 30 in March 2024, Glob Headz managed to climb back to the 29th position by May 2024. This indicates a recovery phase and suggests that the brand is working to regain its market share. The sales figures also reflect this trend, with a significant increase from March to May, where sales jumped from $31,488 to $45,034, hinting at effective marketing or product improvements during this period.

Despite the challenges in Ontario, Glob Headz's ability to re-enter the top 30 is a positive sign, although the brand's absence from the top 30 in March was a clear setback. This could point to competitive pressures or internal issues that temporarily affected their market presence. However, the upward movement in rankings and sales in subsequent months suggests resilience and potential for continued growth. Observing these trends can provide valuable insights for stakeholders looking to understand the brand's trajectory and market dynamics. For more detailed analysis and data, further examination of their performance across other states and categories would be beneficial.

Competitive Landscape

In the Ontario concentrates market, Glob Headz has experienced notable fluctuations in rank and sales over recent months. Starting at rank 29 in February 2024, Glob Headz dropped to rank 36 in March, only to climb back to rank 31 in April and further to rank 29 in May. This volatility contrasts with competitors such as Purple Hills, which consistently stayed within the top 30, and 3Saints, which also maintained a relatively stable position despite a slight decline. Meanwhile, DEBUNK fell out of the top 20 in April, indicating a significant drop in performance, and Thrifty showed a downward trend from rank 20 in March to rank 30 in May. These dynamics suggest that while Glob Headz has faced challenges, it has shown resilience and potential for recovery, especially when compared to the more erratic performance of some competitors. This analysis highlights the importance of strategic adjustments to maintain and improve market position in a competitive landscape.

Notable Products

In May-2024, the top-performing product for Glob Headz was Hybrid Cold Cure Live Rosin (1g) in the Concentrates category, maintaining its number one rank for the fourth consecutive month with sales of 519 units. True HTFSE Live Resin (1g), also in the Concentrates category, emerged as the second-best seller, making its debut in the rankings. Hybrid Solventless Diamonds (1g), another Concentrates item, dropped to third place from its consistent second position in the previous months. Notably, Hybrid Cold Cure Live Rosin (1g) saw a decline in sales compared to April-2024. The rankings indicate a strong preference for concentrates among Glob Headz customers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.