Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

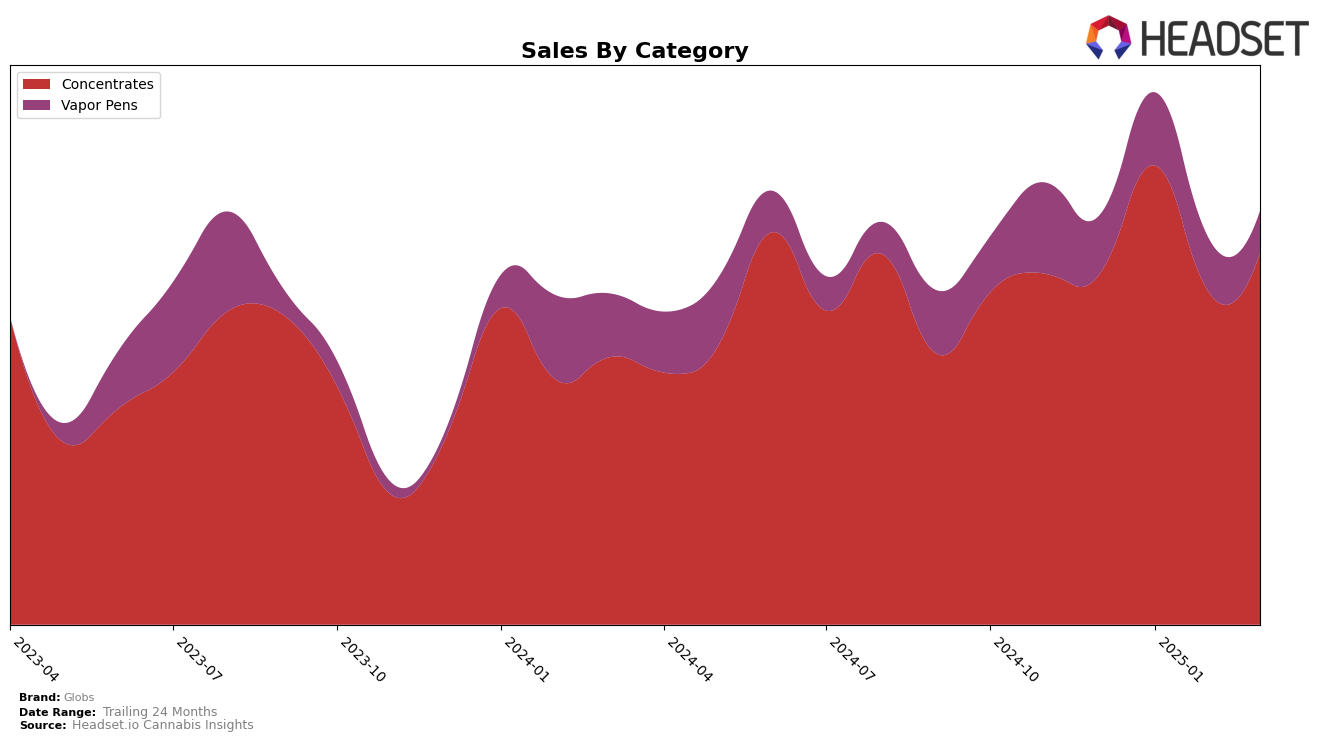

In the competitive landscape of cannabis concentrates, Globs has shown notable performance trends in California. Over the span from December 2024 to March 2025, the brand climbed from a rank of 23rd to 15th in January, marking a significant upward movement. However, this momentum did not sustain, as the brand slipped back to 21st in February before slightly improving to 20th in March. This fluctuation suggests a dynamic market presence where Globs has the potential to capture higher rankings but faces challenges in maintaining consistent momentum. Such movements are critical for stakeholders to monitor, as they indicate both the volatility of the market and the brand's resilience amidst competition.

While Globs has managed to stay within the top 30 brands in the concentrates category in California, the absence of rankings in other states or categories could be interpreted as a missed opportunity for expansion. The brand's sales figures in California reflect these ranking changes, with a peak in January 2025, followed by a dip in February, and a slight recovery in March. This pattern highlights the importance of strategic initiatives to maintain growth and address market challenges. Observing these trends can provide insights into the brand's market strategies and potential areas for growth in other regions or product categories.

Competitive Landscape

In the competitive landscape of California's concentrates market, Globs has demonstrated a dynamic performance over the recent months. Starting from December 2024, Globs held the 23rd rank, which improved significantly to 15th in January 2025, indicating a strong surge in sales momentum. However, by February and March 2025, Globs experienced a slight decline to 21st and 20th positions, respectively, suggesting a need for strategic adjustments to maintain its upward trajectory. In contrast, Pistil Whip consistently outperformed Globs, maintaining a top 20 position throughout the period, peaking at 13th in January. Meanwhile, Nasha Extracts and Have Hash showed fluctuating ranks, with Nasha Extracts climbing to 19th by March, and Have Hash recovering to 21st after a dip to 40th in January. These insights highlight the competitive pressures Globs faces and underscore the importance of strategic marketing and product innovation to enhance its market position.

Notable Products

In March 2025, Sour Durban Badder (1g) from Globs emerged as the top-performing product in the Concentrates category, achieving the highest rank with sales of 892 units. Kush Mint Cookies Sauce (1g) followed closely in second place, while Ice Cream Paint Job Badder (1g) secured the third position. Notably, Blue Diesel Badder (1g) maintained its strong performance, coming in fourth, while Peanut Butter Cup Badder (1g) dropped slightly to fifth place from its previous fourth position in February 2025. These rankings reflect a dynamic shift in consumer preferences, as Sour Durban Badder (1g) ascended to the top, surpassing its competitors in both rank and sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.