Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

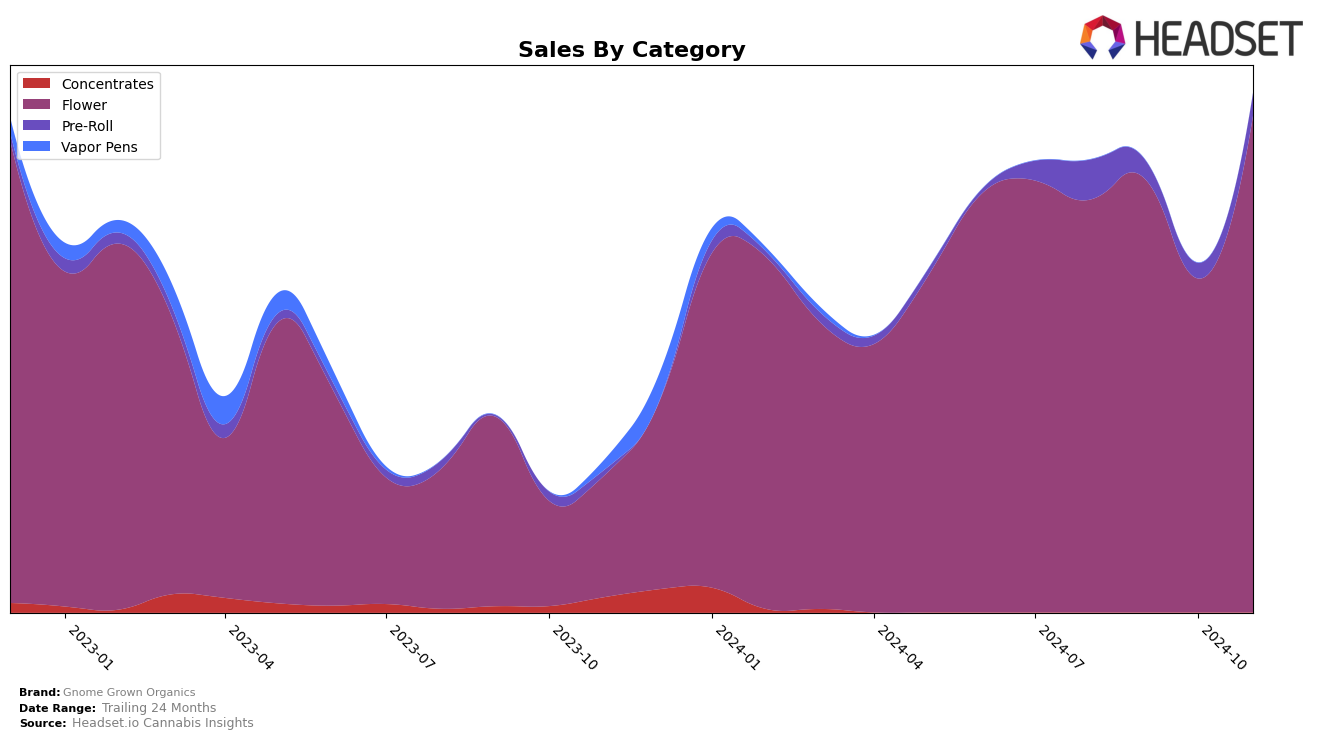

Gnome Grown Organics has shown notable fluctuations in its performance across various categories and states, particularly in the Oregon market. In the Flower category, the brand experienced a dynamic ranking journey, starting at 28th place in August 2024, dropping out of the top 30 in October, and then making a strong comeback to 23rd place by November. This rebound is indicative of a significant increase in sales, with November figures reaching $299,471, suggesting a strategic adjustment or a successful promotional effort. The absence from the top 30 in October, however, highlights a potential vulnerability or market challenge that the brand faced during that period.

In the Pre-Roll category, Gnome Grown Organics' performance was less stable, as it failed to secure a spot in the top 30 rankings for October 2024. The brand's rank fluctuated from 76th in August to 98th in September, eventually re-entering the rankings at 82nd in November. This inconsistency suggests a competitive landscape in the Pre-Roll market, with Gnome Grown Organics needing to refine its approach to maintain a stronger presence. While November sales saw a modest increase, the brand's sporadic ranking indicates potential areas for improvement in product positioning or market engagement strategies. The brand's journey across these months offers insights into the challenges and opportunities it faces in sustaining its market position.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Gnome Grown Organics has demonstrated notable fluctuations in its market position over recent months. Despite not being in the top 20 in October 2024, Gnome Grown Organics made a significant comeback in November 2024, climbing to the 23rd rank, showcasing a positive trend in sales performance. This upward movement contrasts with Frontier Farms, which has seen a steady decline, dropping from 13th in August 2024 to 24th by November 2024. Meanwhile, Dog House also experienced a downward trajectory, falling from 7th to 21st over the same period. On the other hand, Juicy Farms made a remarkable leap from being outside the top 20 in August to securing the 25th spot by November, indicating a surge in sales. Midnight Fruit Company maintained a relatively stable presence, only slightly dropping from 15th to 22nd. These dynamics suggest that Gnome Grown Organics' recent sales strategies might be effectively capturing market share amidst a competitive and fluctuating environment.

Notable Products

In November 2024, GMO (Bulk) from Gnome Grown Organics held the top position in sales, maintaining its rank from October and achieving a notable sales figure of 3,191 units. Mule Fuel (Bulk) secured the second spot, consistent with its ranking from the previous month, indicating stable popularity. Ice Cream Cake (Bulk) retained its third-place position from October, showing steady demand. White AK-47 (Bulk) reappeared in the rankings, moving up to fourth place after being unranked in October. Trap Fuel (Bulk) entered the rankings for the first time in fifth place, suggesting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.