Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

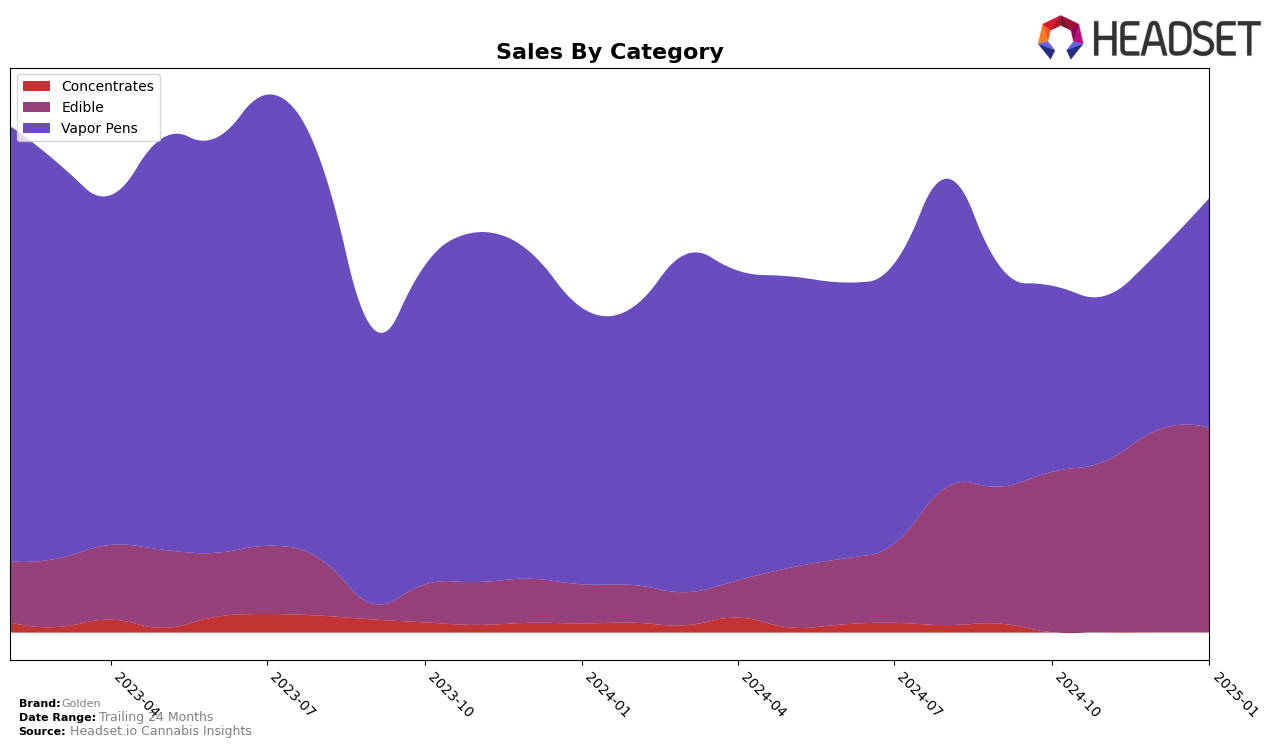

Golden has shown notable performance improvements in the Oregon market, particularly in the Edible category. Starting in October 2024, Golden was ranked 24th, and by January 2025, they had climbed to 18th place. This upward trajectory is indicative of a successful strategy in increasing their market share within this category. The consistent rise in rankings over these months suggests that Golden is gaining traction and possibly attracting a loyal customer base. However, it's worth noting that in the Vapor Pens category, Golden has not yet broken into the top 30, which may indicate a need for strategic adjustments or increased focus in this segment.

While Golden's performance in the Oregon Edible market is commendable, their journey in the Vapor Pens category presents a different narrative. Despite not being in the top 30, there was a significant sales increase from November to January, suggesting potential for growth. This increase could be an early indicator of future success if the brand continues to innovate and market effectively. The absence of a top 30 ranking in Vapor Pens, however, highlights an area ripe for development and strategic investment. Observing these trends could provide valuable insights for stakeholders looking to understand Golden's market dynamics and potential areas for expansion or improvement in the coming months.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Golden has shown a fluctuating yet promising trajectory in terms of rank and sales. Over the months from October 2024 to January 2025, Golden improved its rank from 53rd to 47th, indicating a positive trend despite not being in the top 20. This upward movement is significant when compared to competitors like Dr. Jolly's, which experienced a decline from 26th to 40th, and Mana Extracts, which saw a drop from 34th to 51st. Meanwhile, Fire Dept. Cannabis made a notable leap from 78th to 41st, surpassing Golden in January 2025. Despite these shifts, Golden's sales have shown resilience, with a notable increase in January 2025, contrasting with the declining sales of Dr. Jolly's. This suggests that Golden is gaining traction in the market, potentially positioning itself for further growth against its competitors.

Notable Products

In January 2025, Golden's top-performing product was the Hybrid Apple Solutely The Best Fruit Chew Blast (100mg) in the Edible category, maintaining its number one rank for four consecutive months with a notable increase in sales to 2184 units. The Private Stash Legacy Line - Maui Wowie Distillate Cartridge (1g) in the Vapor Pens category climbed to the second position, up from fifth in December 2024, with a significant sales performance. The CBD/THC 2:1 Kiwi Strawberry Fruit Chews 10-Pack (100mg CBD, 50mg THC) made its debut in the rankings, securing the third spot with 1332 units sold. Meanwhile, the Private Stash Legacy Line - Jack Herer Distillate Cartridge (1g) dropped to fourth place, despite a steady sales increase. The Private Stash - Blueberry Distillate Cartridge (1g) re-entered the rankings at fifth, showing a recovery in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.