Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

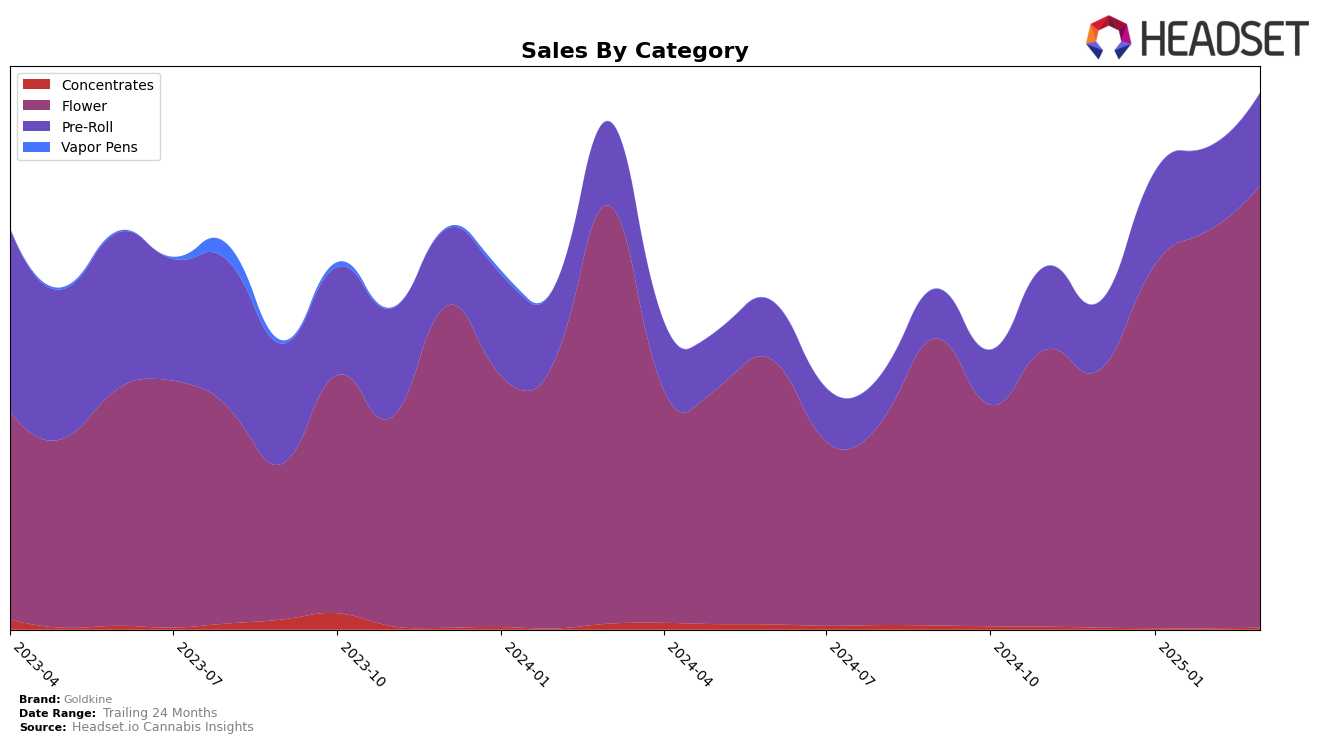

Goldkine has demonstrated notable progress in the Michigan cannabis market, particularly in the Flower category. The brand showed a significant upward trajectory from December 2024 to March 2025, climbing from the 23rd position to the 10th. This consistent rise indicates a strong foothold in the market, with sales figures reflecting a robust increase over this period. However, it's worth noting that Goldkine was not among the top 30 brands in any other states or provinces, suggesting that their influence is currently concentrated in Michigan. This could either be a strategic focus on a specific market or a limitation in their broader market penetration.

In the Pre-Roll category within Michigan, Goldkine's performance has been more volatile, with rankings fluctuating between 16th and 24th over the same period. Despite this variability, the brand managed to maintain its position within the top 20 for most of the months, which is a positive indicator of its resilience and potential for growth. The sales figures reflect a slight dip in February, but a recovery was observed in March 2025, suggesting that the brand is capable of bouncing back from short-term declines. This pattern of performance emphasizes the brand's ability to adapt and sustain its presence in a competitive category.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Goldkine has shown a commendable upward trajectory in rankings, moving from 23rd place in December 2024 to a peak of 9th in February 2025, before slightly settling at 10th in March 2025. This positive trend in rank is mirrored by a steady increase in sales, indicating a growing consumer preference for Goldkine's offerings. In contrast, Redemption has experienced a more dramatic rise, climbing from 26th to 8th place over the same period, suggesting a significant boost in market presence and consumer appeal. Meanwhile, Zones faced fluctuations, dropping out of the top 20 in January 2025 but rebounding to 12th by March. The Limit maintained a strong position, consistently ranking within the top 14 and peaking at 6th in February, while Pure Options remained a stable competitor, hovering around the top 10. These dynamics highlight the competitive pressure on Goldkine to not only maintain but also enhance its market strategies to sustain its upward momentum amidst strong contenders.

Notable Products

In March 2025, Glitter Bomb Smalls (14g) emerged as the top-performing product for Goldkine, achieving the number one rank with sales of 6200 units. Rum Cakes Smalls (14g) followed closely in second place, while Hash Burger Smalls (14g) secured the third spot. Lemon Headz Smalls (14g) and Ghost Rider (3.5g) occupied the fourth and fifth ranks, respectively. Compared to previous months, Glitter Bomb Smalls (14g) and Rum Cakes Smalls (14g) maintained their lead positions, while Hash Burger Smalls (14g) showed a consistent presence in the top ranks. Lemon Headz Smalls (14g) and Ghost Rider (3.5g) also demonstrated stable performance, retaining their positions from prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.