Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

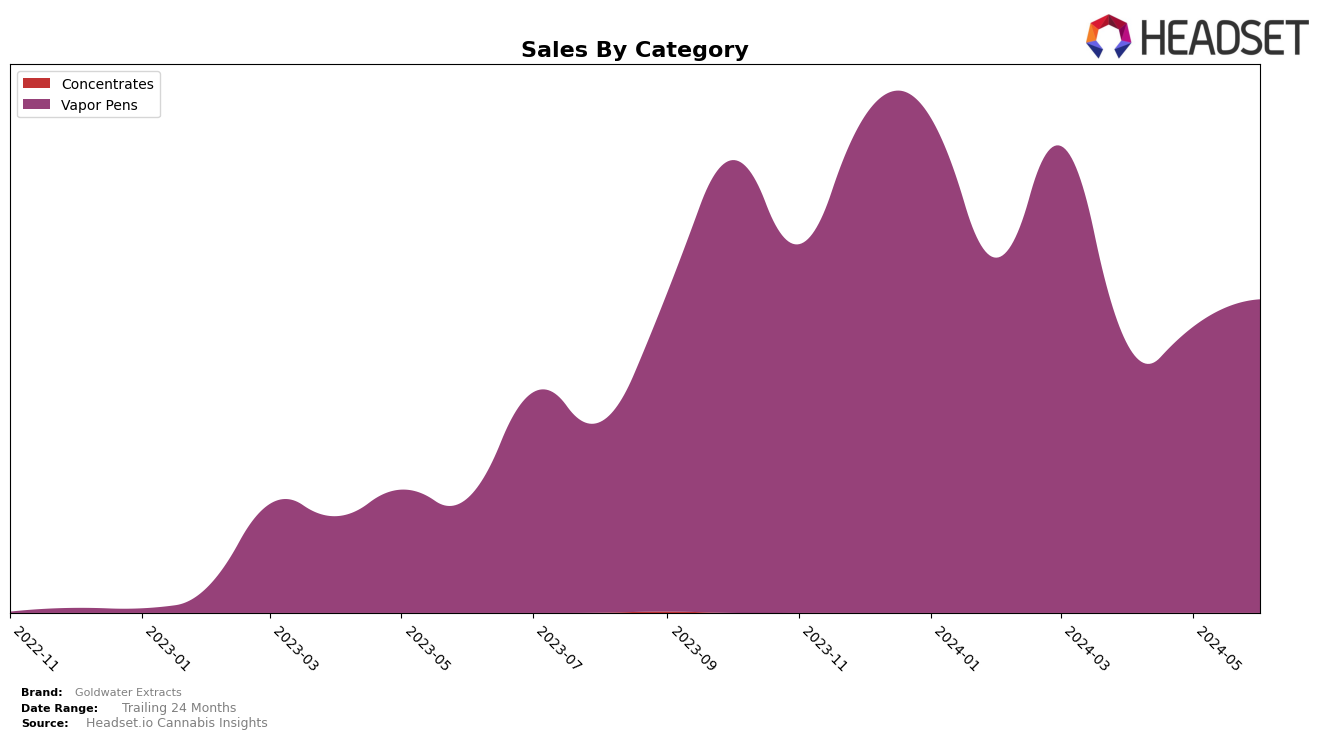

Goldwater Extracts has shown a fluctuating performance in the Vapor Pens category across several states. In Colorado, the brand has oscillated in and out of the top 30 rankings. Starting at rank 27 in March 2024, they dropped out of the top 30 in April, re-entered at rank 31 in May, and managed to climb back to rank 29 in June. This indicates a somewhat volatile presence in the market, with sales showing a noticeable dip in April followed by a gradual recovery in the subsequent months. The movement suggests that while Goldwater Extracts has a foothold in the Colorado market, it faces significant competition that affects its consistency in rankings.

Across other states, the performance of Goldwater Extracts remains a mixed bag. The absence of rankings in the top 30 for several months in various states highlights areas where the brand could potentially improve its market penetration and visibility. For instance, not being in the top 30 in April in Colorado could be seen as a negative indicator of market performance during that period. However, the ability to re-enter the rankings in subsequent months shows resilience and potential for growth. These movements provide a snapshot of the brand's market dynamics, offering insights into both opportunities and challenges in different regions.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, Goldwater Extracts has experienced notable fluctuations in rank and sales over recent months. Starting at rank 27 in March 2024, Goldwater Extracts saw a dip to 33 in April, before recovering slightly to 31 in May and 29 in June. This volatility contrasts with the steady upward trend of West Edison, which improved its rank from 37 to 27 over the same period, indicating a consistent increase in consumer preference. Similarly, Dablogic showed strong performance, peaking at rank 22 in May before a slight drop to 28 in June. On the other hand, Revel (CO) and Co2lors have shown more erratic patterns, with Co2lors making a significant leap from rank 51 to 30 in June. These dynamics suggest that while Goldwater Extracts remains a competitive player, its market position is under pressure from brands like West Edison and Dablogic, which are gaining traction. This competitive analysis highlights the importance for Goldwater Extracts to strategize effectively to maintain and improve its market share in the evolving Vapor Pens category in Colorado.

Notable Products

In June 2024, the top-performing product for Goldwater Extracts was Acapulco Gold Distillate Cartridge (1g) in the Vapor Pens category, which achieved the number one rank with a notable sales figure of $3,898. The Granola Skunk Distillate Cartridge (1g) debuted strongly at the second position. Violet Daze Distillate Cartridge (1g) maintained a consistent performance, securing the third spot. Tropical Trainwreck Distillate Cartridge (1g) experienced a slight decline, dropping to fourth place from its peak at second in April. Blue Zherbert Distillate Cartridge (1g) also saw a decline, holding the fifth position for June, down from third in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.