Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

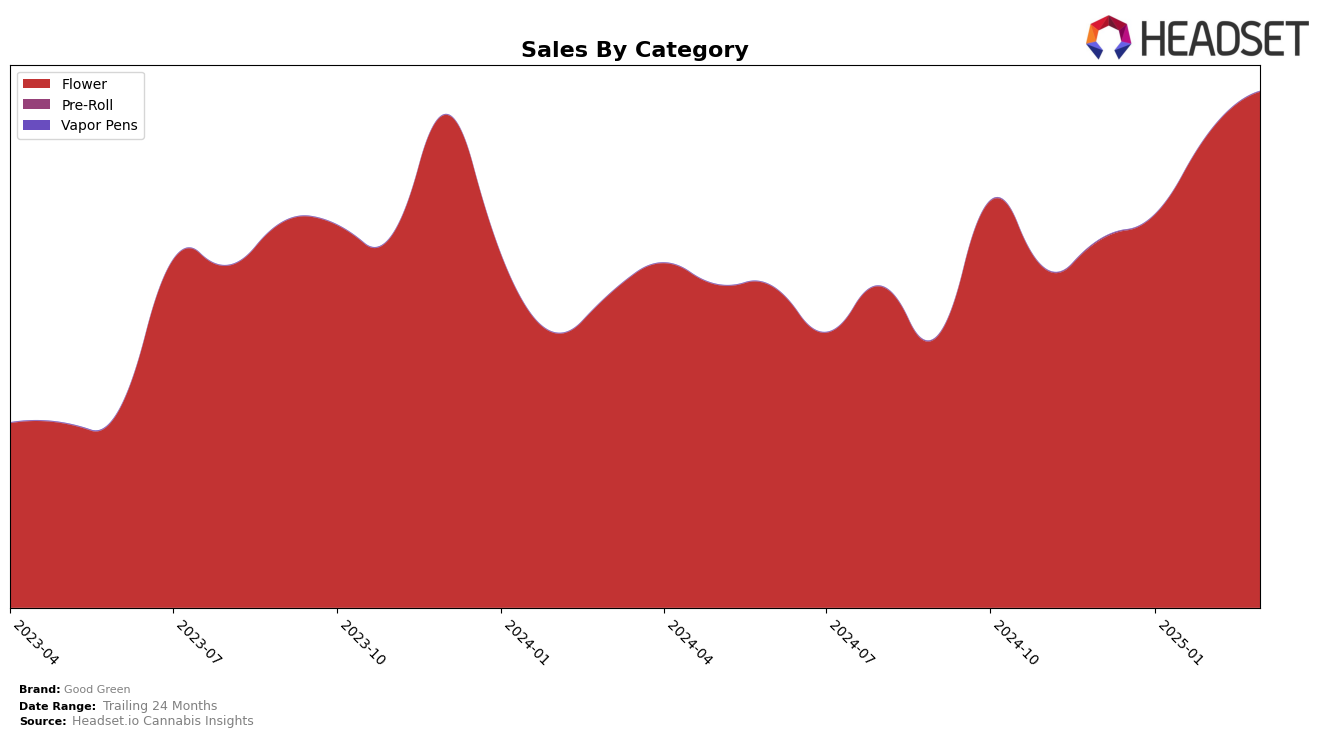

Good Green has demonstrated a dynamic performance across various states, with notable fluctuations in its rankings and sales. In Illinois, the brand has shown a strong presence in the Flower category, climbing from 9th place in January 2025 to 5th in February, before slightly dropping to 6th in March. This movement is accompanied by a significant increase in sales, indicating a positive trend in consumer demand. Meanwhile, in Maryland, Good Green has made impressive strides, moving from 38th in December 2024 to a consistent position around 15th and 16th from February to March 2025. This upward trajectory suggests a growing market share in the region, driven by a substantial rise in sales figures.

Conversely, Good Green's performance in Massachusetts reveals some challenges, as the brand has not managed to break into the top 30, with rankings slipping from 47th in December 2024 to 60th by March 2025. This decline is reflected in decreasing sales, pointing to a potential need for strategic adjustments. In New Jersey, however, the brand has shown resilience, improving its ranking from 36th in January 2025 to 24th by March, accompanied by a notable increase in sales. This suggests that Good Green is successfully capturing consumer interest in certain markets, while facing competitive pressures in others. The brand's ability to adapt and respond to these market dynamics will be crucial for its continued growth and success.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Good Green has shown notable fluctuations in its rank and sales over the past few months. Starting from December 2024, Good Green was ranked 7th, but it experienced a dip to 9th in January 2025 before climbing back to 5th in February and slightly dropping to 6th in March. This movement indicates a dynamic competitive positioning, particularly against brands like Nature's Grace and Wellness, which maintained a steady 8th rank, and Savvy, which consistently held the 6th or 7th position. Despite these rank changes, Good Green's sales showed a positive upward trend from January to March, contrasting with Rythm, which, although holding a higher rank, experienced a decline in sales from December to February before a slight recovery in March. This suggests that while Good Green may face stiff competition, its sales trajectory is on an upward path, indicating a strengthening market presence in Illinois.

Notable Products

In March 2025, the top-performing product from Good Green was Head Cracker Popcorn (2.83g) in the Flower category, ascending from its third-place position in February to claim the top spot. Jack Herer (3.5g) maintained its second-place rank consistently from February to March, with notable sales of 11,108. Fat Billy Smalls (2.83g) made a significant debut in March, securing the third position. Lemon Gelato Cookies Smalls (2.83g) held steady in fourth place, showing consistency in its ranking from January through March. Sherbanger #22 Mixed Buds (3.5g) entered the rankings in fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.