Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

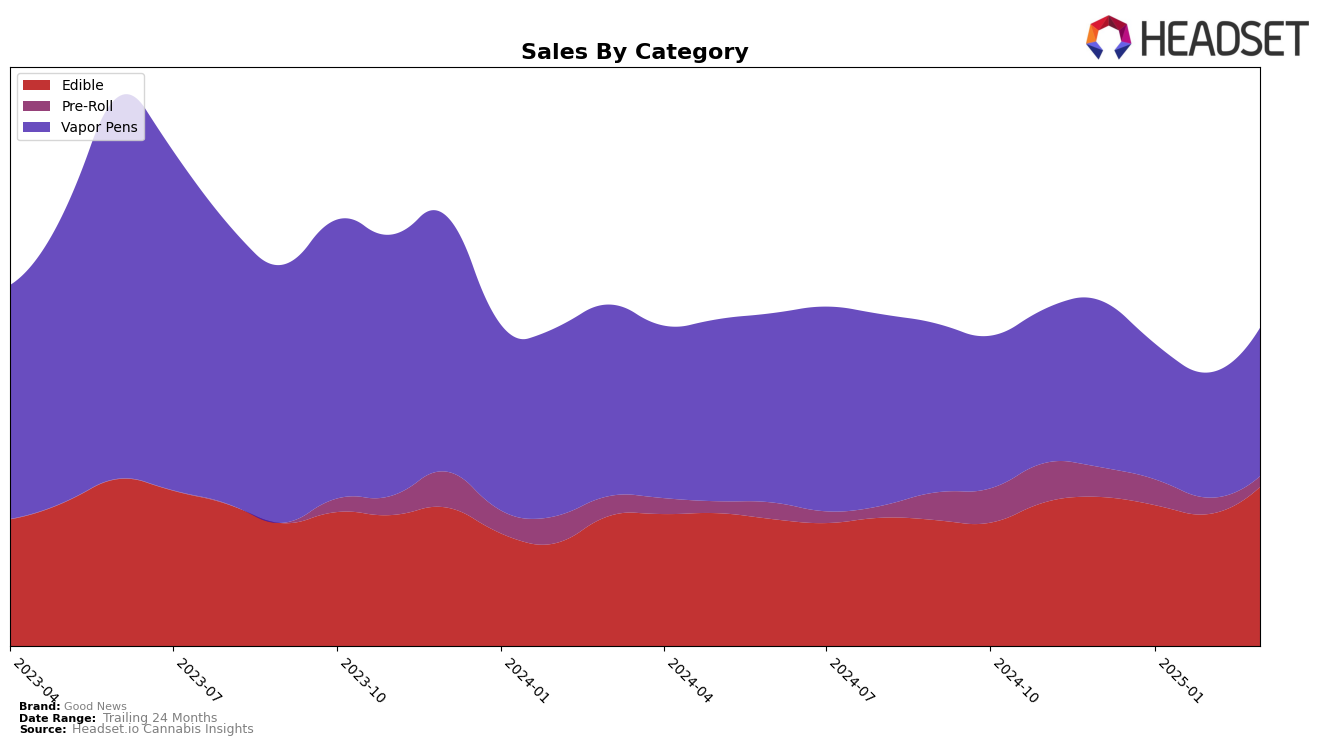

Good News has shown a varied performance across different categories and states, with notable movements in rankings. In Illinois, the brand has maintained a consistent 12th position in the Edible category from December 2024 through March 2025, despite fluctuations in sales. However, their presence in the Pre-Roll category has been inconsistent, missing the top 30 in March 2025 after briefly reaching 31st in January. Meanwhile, in the Vapor Pens category, Good News saw a slight dip in February 2025, moving from 16th to 18th, but managed to recover to 17th by March. This indicates a stable performance in Edibles, but challenges in maintaining a solid foothold in Pre-Rolls and Vapor Pens.

In Massachusetts, Good News has maintained a strong position in the Edible category, improving from 10th to 9th by March 2025, with a notable increase in sales. However, the Pre-Roll category has been less favorable, with the brand dropping out of the top 30 after January. Their Vapor Pens ranking has seen slight fluctuations, ending March in 16th position, suggesting a need for strategic adjustments to improve standings. In Ohio, Good News has made significant strides in the Edible category, climbing from 19th in December to 13th by March, reflecting a positive trend in sales. Yet, the Vapor Pens category remains a challenge, as the brand did not rank within the top 30 by March, indicating potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Good News has maintained a relatively stable position, ranking between 16th and 18th from December 2024 to March 2025. Despite a slight dip in sales from December to February, Good News saw a rebound in March, indicating a positive trend. In comparison, The Botanist consistently outperformed Good News, holding ranks between 11th and 15th, with sales peaking significantly in January. Meanwhile, Bloom demonstrated a remarkable climb from 25th in December to 15th in March, showcasing a strong upward trajectory in sales. Redbud Roots and Crystal Clear maintained positions close to Good News, with Redbud Roots showing a slight improvement in March. The competitive dynamics suggest that while Good News is holding its ground, it faces significant competition from both established and emerging brands, highlighting the need for strategic initiatives to enhance its market position.

Notable Products

In March 2025, the top-performing product from Good News was Friyay - Watermelon Gummies 10-Pack (100mg), maintaining its number one rank consistently from previous months with sales of 11,914 units. Me Time - Indica Blue Raspberry Gummies 20-Pack (100mg) held steady at the second position, showing a recovery in sales to 10,688 units after a dip in February. Counting Sheep - THC/CBN 2:1 Black Cherry Gummies 10-Pack (100mg THC, 50mg CBN) climbed back to the third position from fourth in February, demonstrating a strong sales increase. Brunch - Orange Gummies 20-Pack (100mg) remained stable at fourth place, mirroring its February ranking. A new entry, Counting Sheep - THC/CBN 2:1 Black Cherry Gummies 20-Pack (200mg THC, 100mg CBN), debuted at fifth place, indicating a positive market reception.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.