Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

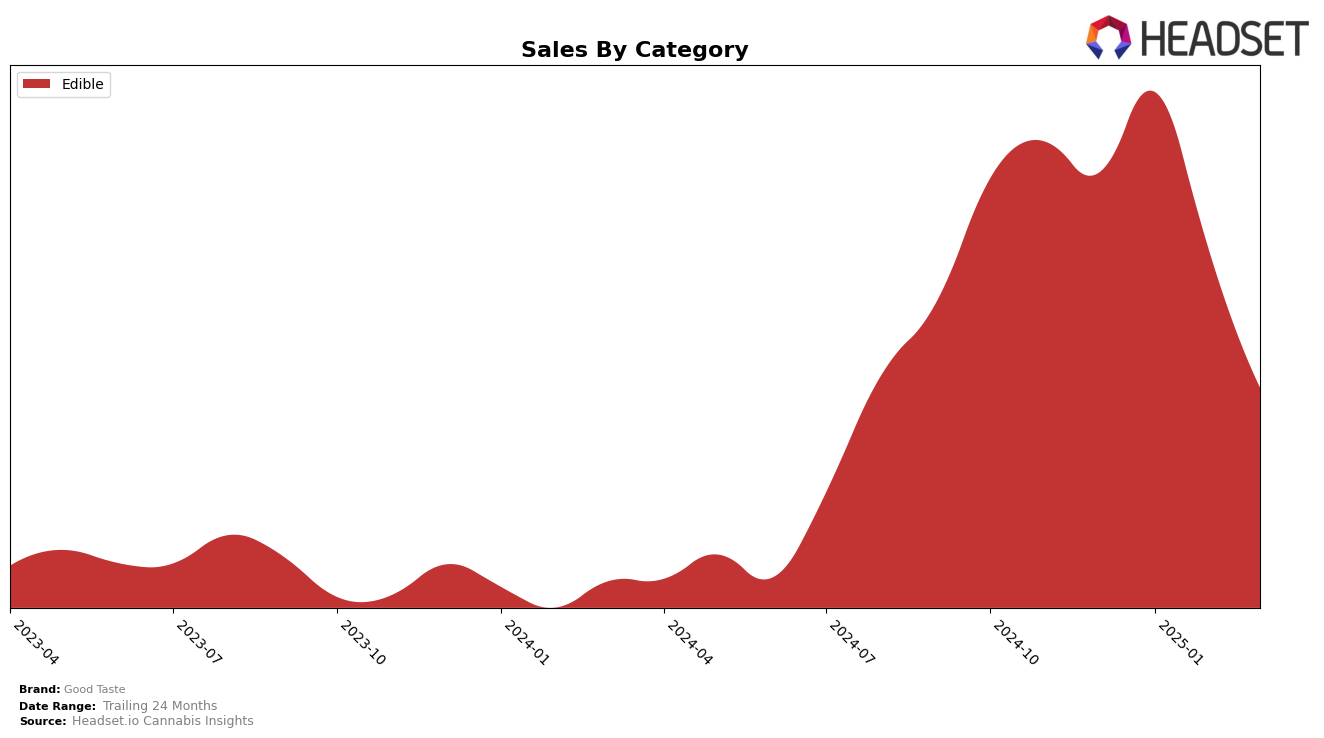

In the Missouri market, Good Taste has experienced notable fluctuations in the Edible category rankings over the first quarter of 2025. Starting off strong in December 2024 with a rank of 9th, the brand improved to 7th place in January 2025. However, this upward momentum did not sustain, as Good Taste slipped back to 9th in February and further down to 15th by March. This decline in ranking suggests increased competition or a shift in consumer preferences within the Edible category, which may warrant strategic adjustments by Good Taste to regain its earlier standing.

Despite the ranking fluctuations, the sales figures for Good Taste reveal some interesting insights. While the brand's sales peaked in January 2025, there was a noticeable decline in the following months, dropping from over half a million dollars in December to just above $370,000 by March. This trend could indicate seasonal purchasing behaviors or the impact of new entrants in the market. The absence of Good Taste from the top 30 in any other state or category highlights the brand's current regional focus, particularly within Missouri's Edible market. This could be seen as an opportunity for expansion or a need to consolidate and strengthen their presence in existing markets.

Competitive Landscape

In the Missouri edible cannabis market, Good Taste experienced notable fluctuations in its competitive standing from December 2024 to March 2025. Initially ranked 9th in December 2024, Good Taste improved to 7th in January 2025, indicating a strong start to the year. However, by March 2025, it dropped to 15th, signaling a significant decline in rank. This downward trend coincided with a decrease in sales, contrasting with the performance of competitors such as Greenlight, which improved its rank from 16th in January to 13th in March, and Smokey River Cannabis, which consistently improved its rank from 19th in January to 16th in March. Meanwhile, Dixie Elixirs maintained a stable position around the 14th rank despite a sales dip, suggesting resilience in brand loyalty. Good Taste's initial sales lead over these competitors diminished by March, emphasizing the need for strategic adjustments to regain its competitive edge in this dynamic market.

Notable Products

In March 2025, the top-performing product for Good Taste was Sativa Clementine Gummies 10-Pack (100mg), maintaining its first-place position from February with a sales figure of 5301 units. Blue Razzberry Gummies 10-Pack (100mg) held steady at second place, showing a notable sales increase from the previous month. Indica Strawberry Gummies 10-Pack (100mg) climbed to third place, up from fifth in February, indicating a significant rise in popularity. THC/CBN 1:1 Black Cherry Lavender Gummies 10-Pack (100mg THC, 100mg CBN) remained in fourth place, despite a decrease in sales. The CBD/THC 1:1 Watermelon Gummies 10-Pack (100mg CBD, 100mg THC) entered the rankings for the first time, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.