Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

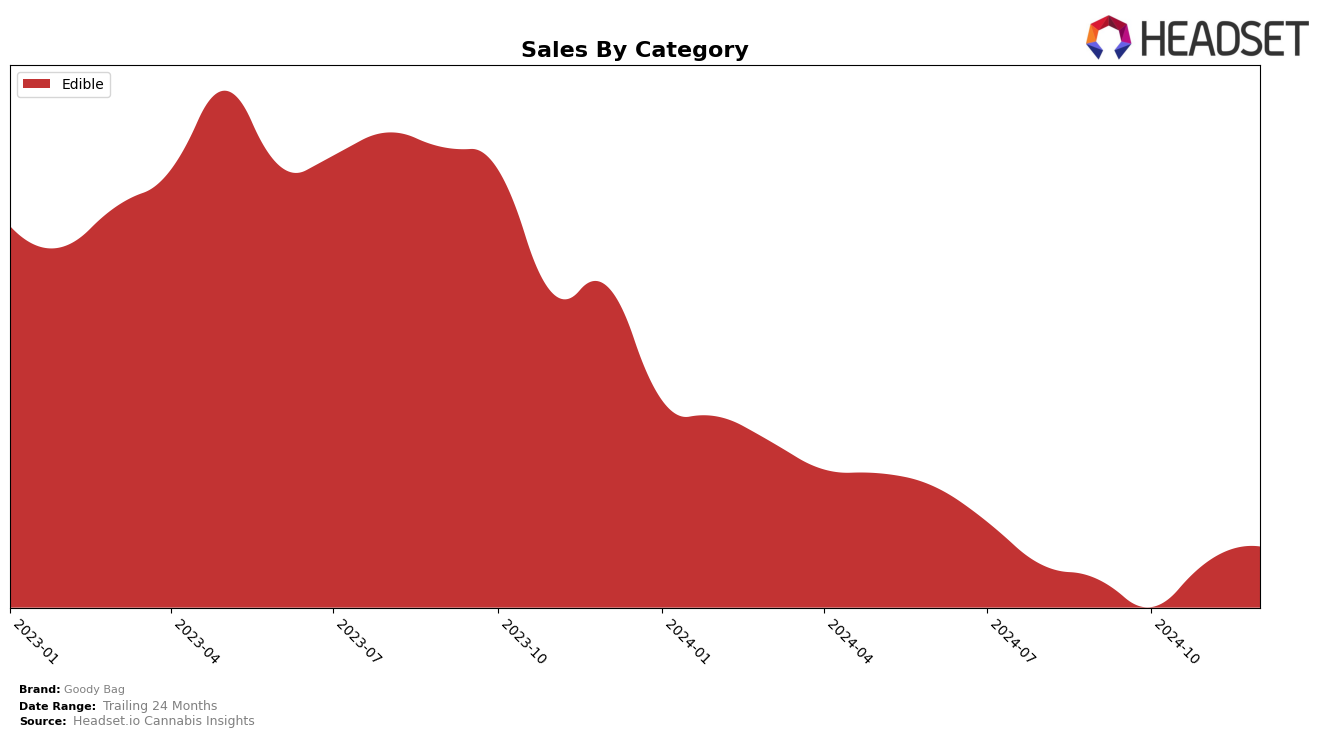

In the state of Illinois, Goody Bag's performance in the Edible category has seen a stable yet concerning downward trend in rankings from September to December 2024. While they managed to maintain a presence within the top 30, starting at rank 26 in September and slipping to rank 30 by December, this indicates a potential struggle to maintain market share against competitors. Despite this, their sales figures show a slight increase in November, suggesting a possible seasonal boost or successful promotional efforts during that month. However, the drop in December sales may require strategic adjustments to regain momentum.

Conversely, in Michigan, Goody Bag exhibited significant fluctuations in the Edible category rankings, initially starting outside the top 30 in September and climbing to rank 49 by December. This upward movement, especially the leap from rank 85 in October to 58 in November, could be indicative of effective market penetration or consumer preference shifts in the state. The substantial increase in sales from October to December supports this positive trajectory. However, the lack of top 30 placement in earlier months suggests that there is still room for improvement in maintaining consistent market presence.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Illinois, Goody Bag has experienced a slight decline in its market position from September to December 2024. Starting at a rank of 26 in September, Goody Bag dropped to 30 by December, indicating increased competition and a potential need for strategic adjustments. In contrast, In House has shown a steady improvement, climbing from rank 35 in September to 31 in December, with sales figures consistently rising each month. Bedford Grow maintained a stable rank of 24 through October before dropping to 30 in November, then slightly recovering to 28 in December, suggesting volatility in their performance. Meanwhile, nuEra demonstrated fluctuating ranks, peaking at 26 in October but falling to 33 in November before improving to 29 in December. Lastly, Terra experienced a decline in rank from 32 in September to 37 in November, before recovering to 33 in December. These dynamics highlight the competitive pressures Goody Bag faces and underscore the importance of strategic marketing and product differentiation to regain and enhance its market standing.

Notable Products

In December 2024, the top-performing product for Goody Bag was Green Apple Gummies 10-Pack (200mg), which rose to the number one rank with sales reaching 5,126 units. Pink Lemonade Gummies 10-Pack (200mg) followed closely in the second position, maintaining a strong presence from its previous third-place ranking in November. Citrus Gummies 20-Pack (200mg) experienced a slight drop, moving from first in November to third in December. Melon Gummies 10-Pack (200mg) entered the rankings at fourth place, while Hybrid Blue Raspberry Gummies 10-Pack (200mg) secured the fifth position. These shifts indicate a dynamic market where consumer preferences for specific gummy flavors are evolving rapidly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.