Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

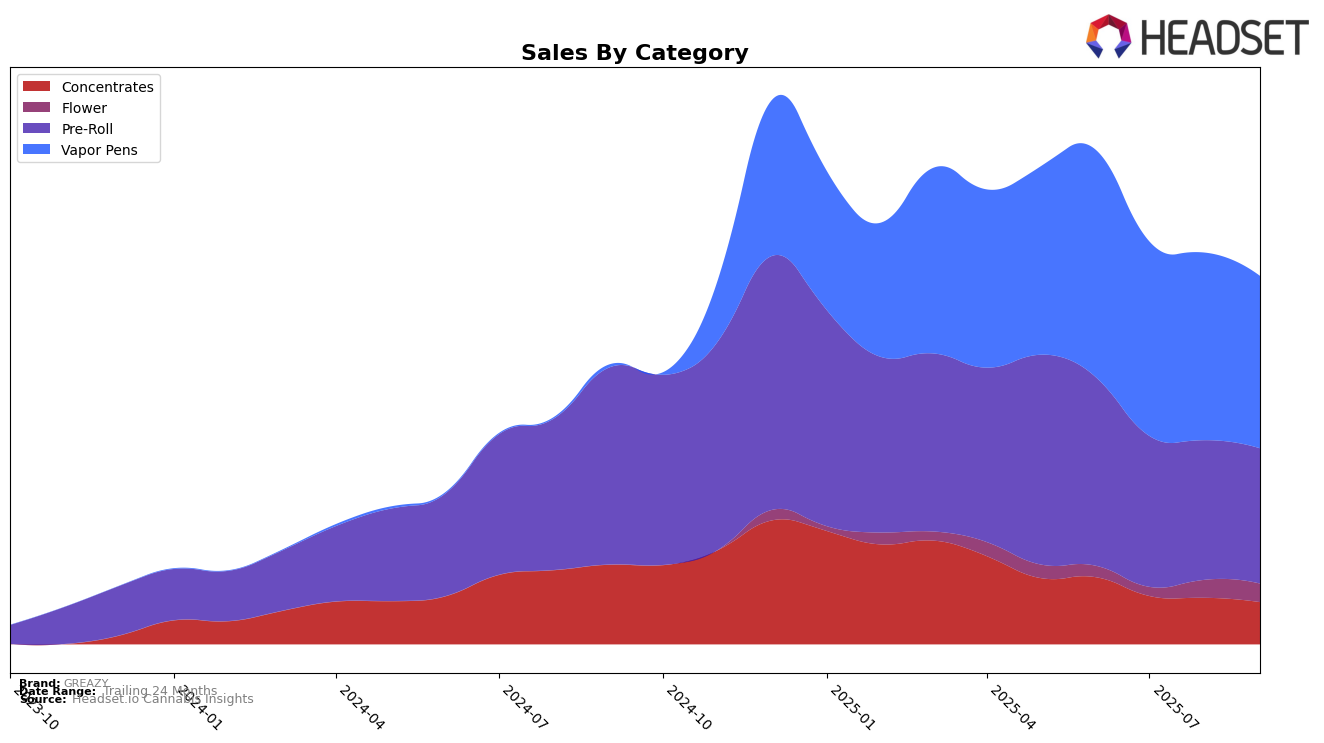

GREAZY's performance in the Canadian cannabis market has shown a mixed trajectory across different categories and provinces. In Alberta, the brand's presence in the Vapor Pens category has been declining, with a drop from 36th place in June 2025 to 48th in September 2025, indicating a steady fall in popularity. This downward trend is accompanied by a corresponding decrease in sales figures, suggesting that GREAZY is struggling to maintain its market position in this category. Such a decline might be concerning for the brand, as it hints at increasing competition or changing consumer preferences in Alberta's vapor pen market.

Meanwhile, in Ontario, GREAZY's performance varies across categories. In the Concentrates category, GREAZY has managed to stay within the top 30, though it dropped from 18th place in June 2025 to 25th in September 2025. This shows a slight decline but still reflects a relatively strong standing compared to Alberta. In the Pre-Roll category, GREAZY has not made it into the top 30, which could be an area of concern or opportunity for growth. However, GREAZY's Vapor Pens have maintained a top 30 position, albeit slipping to 30th place by September 2025. This suggests that while GREAZY faces challenges, there are still areas where it retains a foothold, particularly in Ontario's vapor pen market.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, GREAZY has experienced a slight decline in its market position over the past few months. Starting from a rank of 25th in June 2025, GREAZY slipped to 30th by September 2025. This downward trend in ranking is accompanied by a decrease in sales, contrasting with the performance of competitors like Iris, which improved its rank from 40th to 28th over the same period, indicating a significant upward trajectory in sales. Meanwhile, Platinum Vape and Gas also faced challenges, with Platinum Vape dropping out of the top 20 by August and Gas maintaining a relatively stable but lower rank. As GREAZY navigates this competitive environment, understanding these dynamics is crucial for strategizing future growth and maintaining market share.

Notable Products

For September 2025, the top-performing product from GREAZY is the MAC10 Diamonds & Sauce Infused Pre-Roll (1g), maintaining its first-place rank consistently since June 2025, with a notable sales figure of 4856 units. The Orange Kush CK Double Infused Pre-Roll (1g) holds the second position, consistent with its rank in August, despite a decrease in sales. The Peach Panther Liquid Diamonds Disposable (1g) remains in third place, showing a steady decline in sales over the months. The Grape God Liquid Diamonds Cartridge (1g) continues to rank fourth, with sales figures slightly decreasing each month. Finally, the Bling Infused Blunt (1.5g) retains its fifth position, experiencing a slight rebound in sales compared to August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.