Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

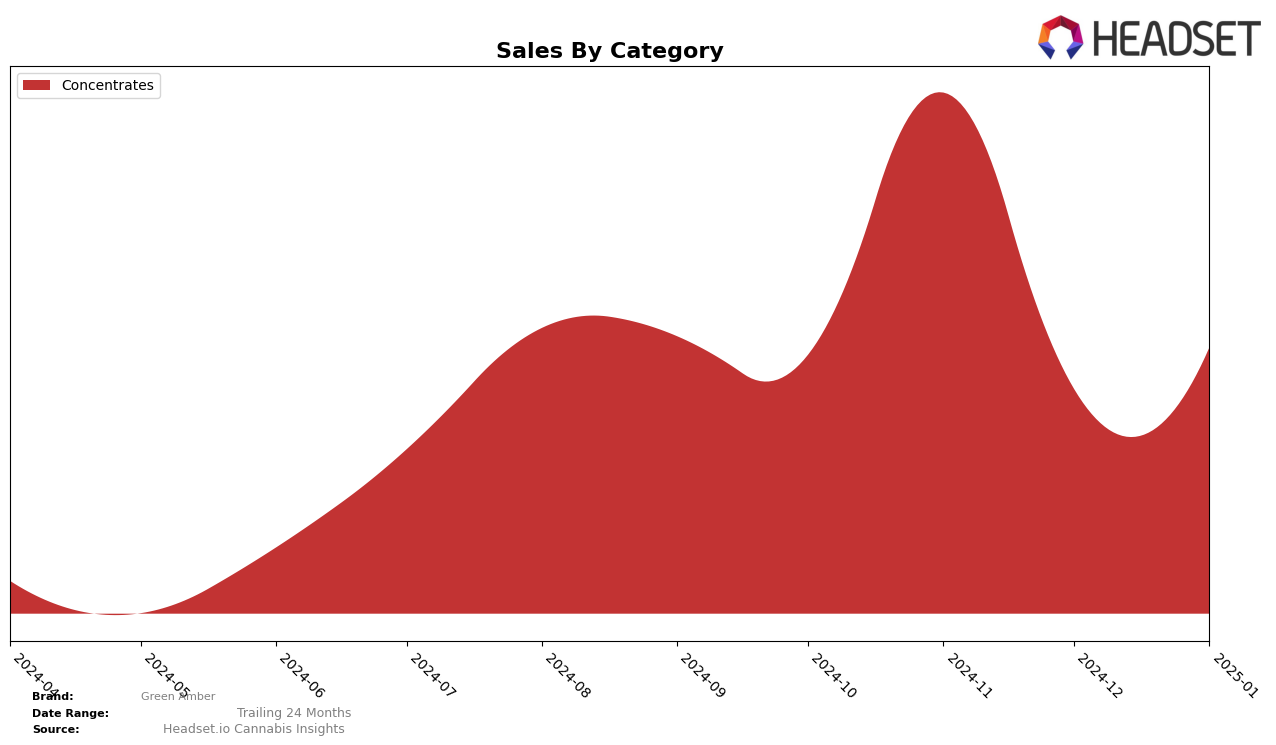

Green Amber has shown substantial movement in the British Columbia market, particularly within the concentrates category. Over the span of four months, the brand's ranking fluctuated significantly. Starting at rank 17 in October 2024, Green Amber improved to rank 11 in November, indicating a positive reception and possibly effective marketing strategies or product offerings during that period. However, December saw a decline to rank 26, suggesting potential challenges or increased competition. The brand managed to recover slightly in January 2025, climbing back to rank 19. This volatility highlights the competitive nature of the concentrates category in British Columbia and underscores the importance of consistent performance for maintaining market position.

In terms of sales, Green Amber experienced a notable increase from October to November, with sales nearly doubling, which aligns with their improved ranking during that time. However, the subsequent decrease in December sales correlates with their drop in rankings. Despite this setback, the brand's sales in January showed a slight recovery, mirroring their ranking improvement. This pattern of sales and ranking fluctuations suggests that while Green Amber has the potential to perform well, sustaining momentum is crucial to avoid slipping out of the top 30, as seen in December. The data implies that strategic adjustments may be necessary to maintain and enhance their presence in the British Columbia concentrates market.

Competitive Landscape

In the competitive landscape of the Concentrates category in British Columbia, Green Amber has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked at 17th place in October 2024, Green Amber saw a significant improvement to 11th in November, coinciding with a substantial increase in sales. However, by December, the brand's rank dropped to 26th, indicating a potential challenge in maintaining its previous momentum. Despite this dip, Green Amber rebounded to 19th place in January 2025, suggesting a recovery in its market strategy. In comparison, Terra Labs showed a remarkable rise from being unranked in October to 10th place in December, highlighting a strong upward trend. Meanwhile, Tremblant Cannabis and BLAST demonstrated more stable trajectories, with BLAST achieving a peak rank of 18th in December. These dynamics underscore the competitive pressures Green Amber faces, emphasizing the need for strategic adjustments to sustain and enhance its market position.

Notable Products

In January 2025, the top-performing product for Green Amber was Cereal Milk Live Rosin (1g) in the Concentrates category, maintaining its number one rank from the previous month with sales reaching 689 units. Cherry Punch Live Rosin (1g), also in the Concentrates category, climbed to the second position, despite a decline in sales from December 2024. GSC Live Rosin (1g) consistently held the third spot over the past three months, although it experienced a significant drop in sales to just 17 units in January. Compared to October 2024, Cereal Milk Live Rosin (1g) has shown remarkable growth, moving from second to first place by November 2024 and sustaining that lead. The data indicates a strong preference for Cereal Milk Live Rosin (1g) among consumers, while the other products have seen fluctuations in their rankings and sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.