Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

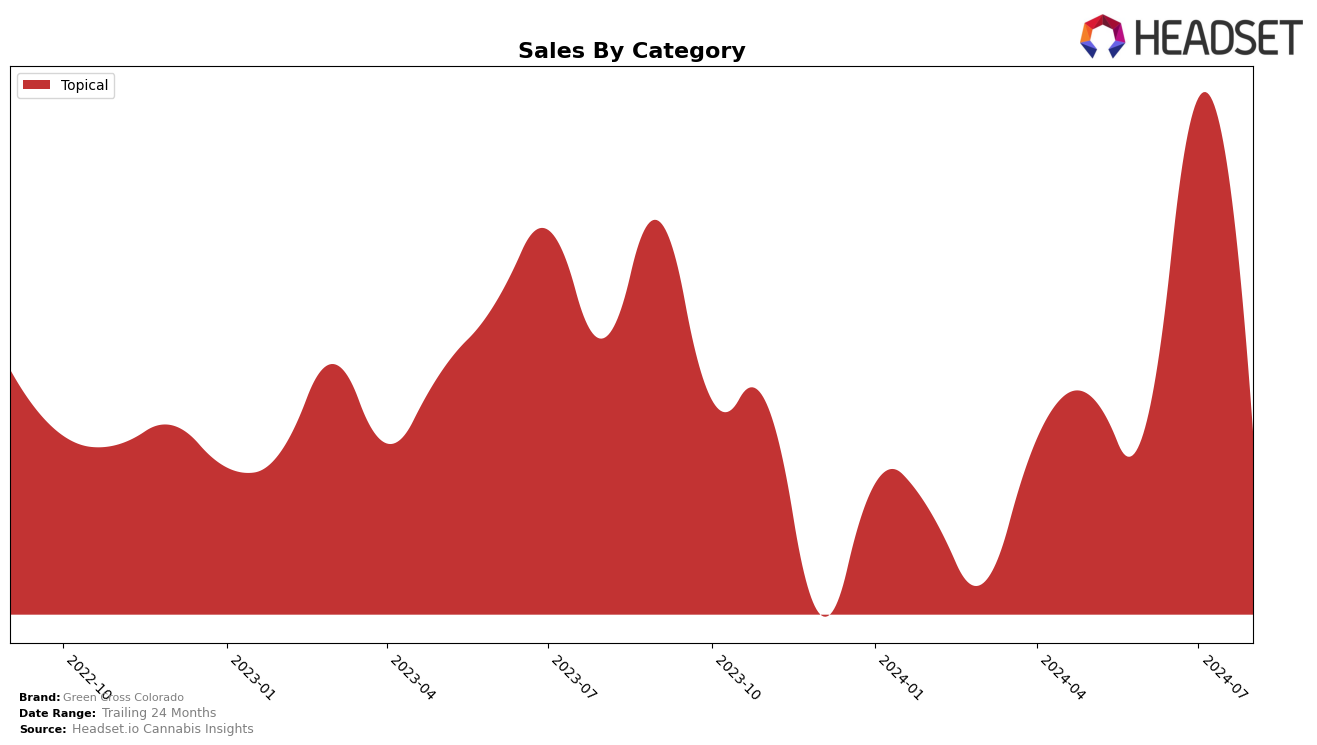

Green Cross Colorado has shown a significant improvement in the Topical category within the state of Colorado. After not appearing in the top 30 brands for the months of May, June, and July 2024, the brand made a notable entry in August 2024, ranking 11th. This upward movement highlights a positive trend and suggests that Green Cross Colorado's efforts in this category are starting to pay off. The exact sales figures are not disclosed, but the brand's sudden appearance in the rankings indicates a substantial increase in market penetration and consumer interest.

However, the absence of Green Cross Colorado from the top 30 brands in the preceding months could be seen as a concern, reflecting a period of underperformance or market strategy adjustment. The brand's resurgence in August is a promising sign, but it will be essential to monitor whether this momentum is sustained in the coming months. This performance analysis provides a snapshot of the brand's fluctuating presence in the market, offering valuable insights for stakeholders and consumers alike.

Competitive Landscape

In the Colorado Topical cannabis category, Green Cross Colorado experienced notable fluctuations in its competitive positioning over recent months. While the brand did not rank in the top 20 for May, June, or July 2024, it managed to secure the 11th position in August 2024. This upward movement indicates a positive trend in market presence, though it still trails behind competitors such as Highly Edible and ioVia, which consistently maintained higher ranks throughout the same period. Notably, Aliviar also outperformed Green Cross Colorado, achieving the 10th rank in August. These insights suggest that while Green Cross Colorado is making strides, there is still significant ground to cover to catch up with the leading brands in the Colorado Topical market.

Notable Products

In August 2024, the top-performing product from Green Cross Colorado was CBD:THC 1:1 Wranglers Relief - Body Balm (100mg CBD, 100mg THC) in the Topical category. This product maintained its first-place ranking consistently from May through August, despite a slight decrease in sales to 239 units in August. The stability in its top ranking highlights its strong market presence and customer preference. Notably, the sales figures peaked in July with 637 units, indicating a seasonal spike. This product's consistent performance suggests it is a staple for consumers within its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.