Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

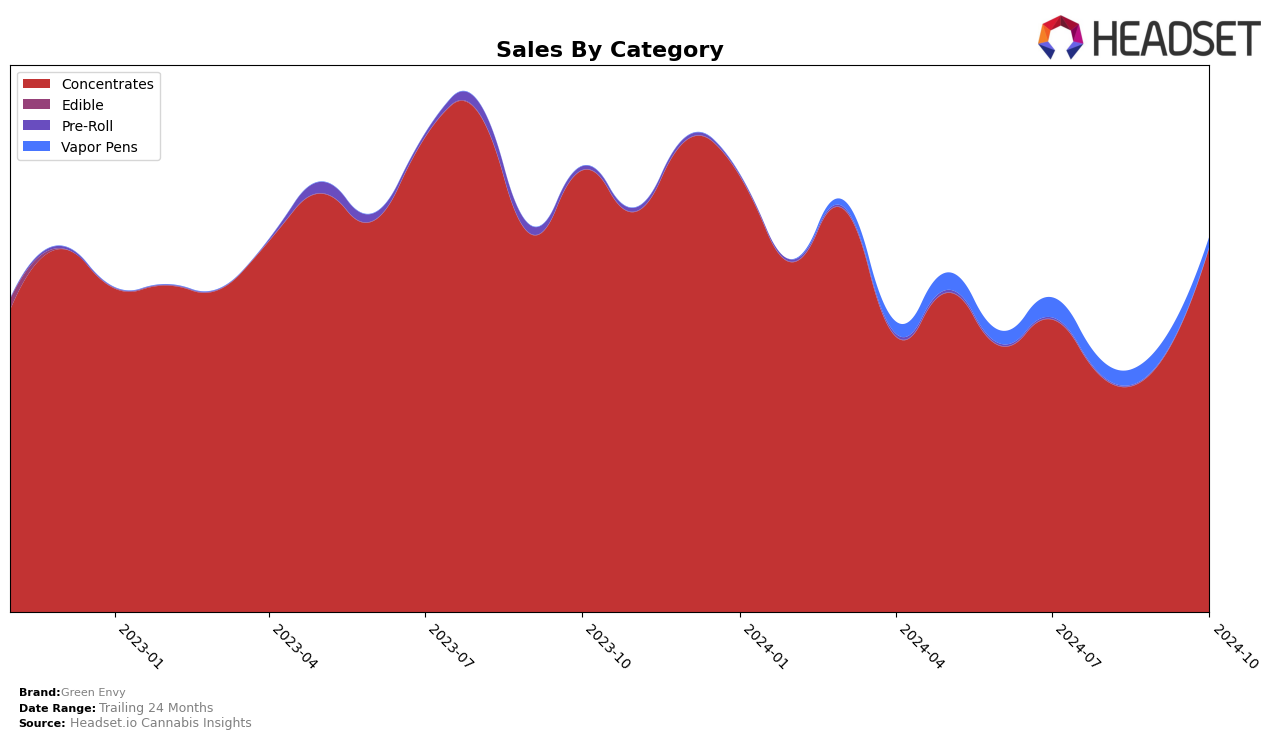

Green Envy has shown a notable performance in the Concentrates category in the state of Washington. In October 2024, Green Envy improved its ranking to 20th, up from 25th in July and 30th in August. This positive trajectory is indicative of the brand's increasing market presence and appeal among consumers in the state. Notably, the brand's sales in October reached a significant peak, suggesting a strong demand for its products. However, the brand's absence from the top 30 in other states or provinces across categories could be seen as a potential area for growth and expansion.

The upward movement in Washington's rankings for Green Envy suggests strategic adjustments or successful marketing efforts that have resonated well with the local consumer base. Despite fluctuating sales figures in the earlier months, the brand's ability to climb back into a higher rank by October indicates resilience and potential for continued growth. The absence of Green Envy in the top 30 rankings in other regions and categories might suggest a more localized strength in Washington, or perhaps a need to replicate successful strategies from Washington in other markets. This presents both a challenge and an opportunity for Green Envy to expand its footprint and explore new territories for growth.

Competitive Landscape

In the Washington concentrates market, Green Envy has shown a notable improvement in its rank from July to October 2024, climbing from 25th to 20th position. This upward trend is indicative of a significant increase in sales, particularly in October, where Green Envy's sales surged, narrowing the gap with competitors. For instance, Agro Couture also improved its rank from 23rd to 18th, with a consistent rise in sales, but Green Envy's growth trajectory in October was more pronounced. Meanwhile, Constellation Cannabis experienced a decline in rank, dropping from 14th to 21st, suggesting a potential opportunity for Green Envy to capture more market share. Additionally, Toasted Farms and VENOM (WA) maintained relatively stable positions, with VENOM (WA) consistently outperforming Green Envy in sales, though its rank slightly decreased from 18th to 19th. These dynamics highlight Green Envy's potential to continue its upward momentum in the competitive landscape.

Notable Products

In October 2024, Fruity Pebbles Wax (1g) emerged as the top-performing product for Green Envy, climbing from a consistent third place in previous months to secure the number one spot, with a notable sales figure of 1715 units. Blackberry Cobbler Wax (1g) maintained a strong position, ranking second, though it had previously held the top rank in July and September. 9lb Hammer Wax (1g) experienced a slight decline, moving from the top three ranks in the past months to third place. Apple Jax Wax (1g) made its debut in the rankings, securing the fourth position. Huckleberry Pie Wax (1g) remained steady at fifth place, marking a minor improvement from its absence in the August ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.