Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

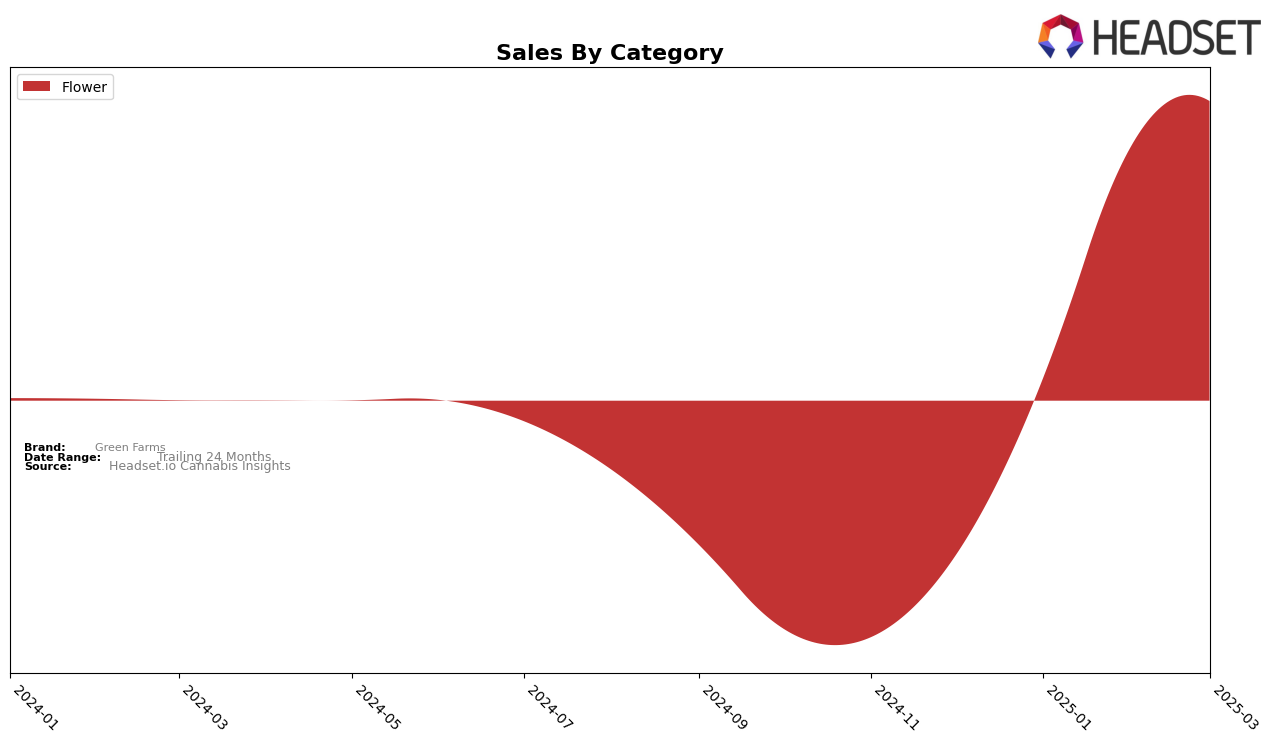

Green Farms has shown a remarkable improvement in its performance in the Flower category within Colorado. In December 2024, the brand was not even in the top 30, but by January 2025, it made an impressive leap to rank 85. The upward trajectory continued, with Green Farms securing the 12th position in February and maintaining a strong presence by ranking 14th in March. This significant climb in rankings indicates a growing consumer preference and increasing market share for Green Farms in the Flower category in Colorado, suggesting a robust strategic approach or product appeal driving this success.

While Green Farms has gained traction in Colorado, it's important to note that the brand did not appear in the top 30 rankings in December 2024, which may suggest a previous lack of market penetration or competitive edge. However, the subsequent rise in rankings and sales figures indicates a positive turnaround. The lack of presence in the top 30 initially could have been a concern, but the rapid improvement suggests that the brand has effectively addressed previous challenges. The increase in sales from January to March further underscores the brand's growing popularity and successful market strategies in recent months.

Competitive Landscape

In the competitive landscape of the flower category in Colorado, Green Farms has shown remarkable progress in its rankings and sales over the recent months. Starting from a non-ranking position in December 2024, Green Farms surged to 12th place by February 2025, before slightly slipping to 14th in March 2025. This upward trajectory is notable compared to competitors like In The Flow, which consistently improved from 20th to 16th place, and Vera, which jumped from 23rd to 13th place by March 2025. Despite the fluctuations, Green Farms' sales have shown a strong upward trend, surpassing Billo, which saw a decline in February 2025. Meanwhile, Artsy Cannabis Co experienced a drop from 9th to 15th place, indicating potential volatility in the market. These insights suggest that Green Farms is gaining momentum and could capitalize on its recent growth to further solidify its position in the Colorado flower market.

Notable Products

In March 2025, Green Farms saw Jet Fuel x Gelato (Bulk) leading the sales chart, securing the top position among all products. Divorce Cake Shake (14g) followed closely as the second best-selling product, while White 99 Shake (14g) captured the third spot. Miracle Alien Cookies Shake (14g) ranked fourth, showing a strong market presence. Notably, Member Berry #3 (28g) maintained its fifth position from February, after climbing from fourth in January, with sales reaching 1,390 units. This reflects a consistent demand for the Flower category, particularly for bulk and shake products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.