Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

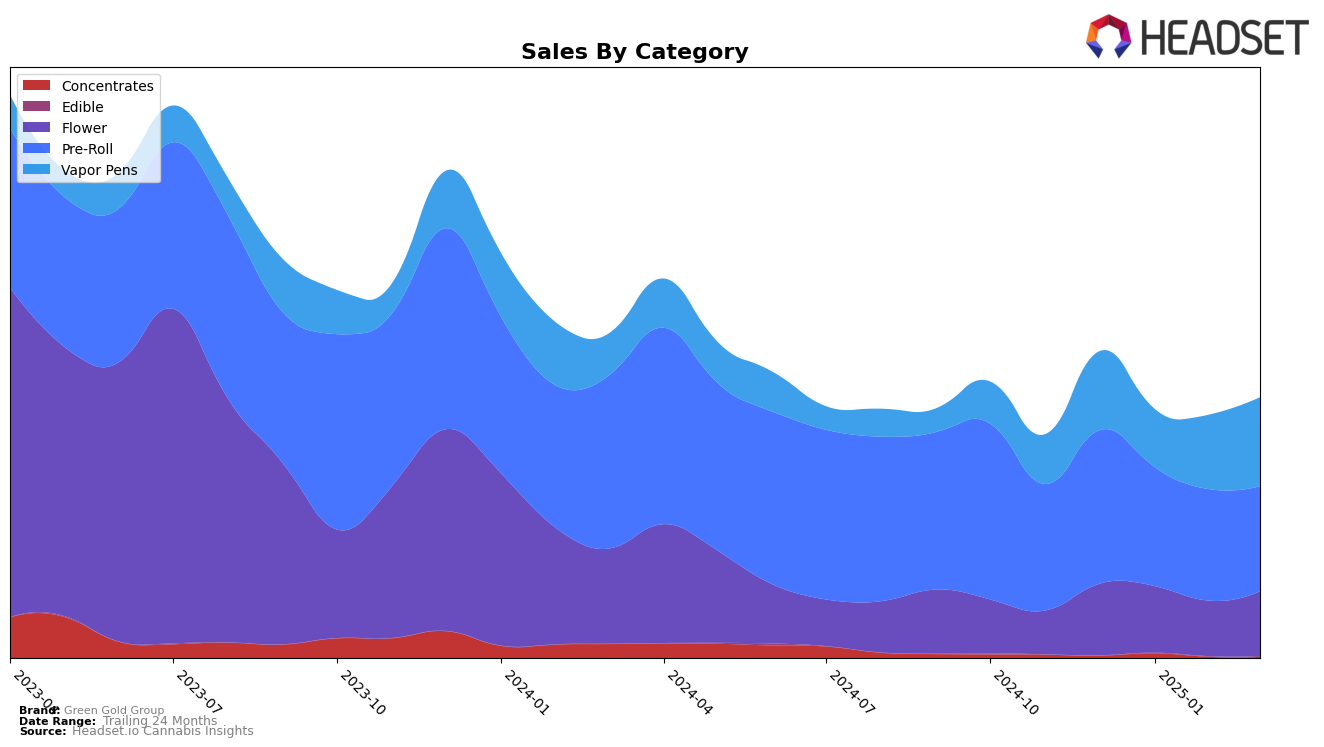

Green Gold Group's performance in the cannabis market shows varied results across different states and product categories. In Alberta, the brand's presence in the Flower category has been inconsistent, with rankings fluctuating from 82nd in December 2024 to 80th in March 2025. Although the brand did not break into the top 30, the slight improvement in March suggests a potential upward trend. In contrast, their performance in Massachusetts shows a more stable, yet competitive landscape. While Green Gold Group did not make the top 30 in the Flower category, their ranking improved from 81st in December 2024 to 84th in March 2025, indicating some positive movement despite not reaching the upper echelon.

In Massachusetts, Green Gold Group's performance in the Pre-Roll and Vapor Pens categories reveals intriguing dynamics. The brand maintained a top 30 position in Pre-Rolls, although their rank dropped from 18th in December 2024 to 30th in March 2025, suggesting a decline in market share. Meanwhile, in the Vapor Pens category, the brand's rank improved from 46th in January 2025 to 32nd by March, reflecting a significant positive trajectory. This improvement in Vapor Pens is particularly noteworthy given the competitive nature of this category, highlighting Green Gold Group's potential to strengthen its market position further.

Competitive Landscape

In the Massachusetts Pre-Roll category, Green Gold Group experienced a notable decline in its competitive ranking from December 2024 to March 2025. Initially ranked 18th, Green Gold Group's position slipped to 30th by March 2025, indicating a downward trend in market performance. This decline contrasts with the performance of competitors such as Hellavated, which maintained a relatively stable position around the 23rd to 31st rank, and Cheech & Chong's, which improved from 40th to 29th. Despite a decrease in sales from December to March, Green Gold Group's sales figures remained higher than those of Bountiful Farms and Cheech & Chong's throughout the period. However, the consistent performance of HighMark Provisions (HMP), which improved its rank from 33rd to 28th, suggests a competitive pressure that may have contributed to Green Gold Group's rank decline. This analysis highlights the importance of strategic adjustments to regain market share and improve competitive standing in the Massachusetts Pre-Roll market.

Notable Products

In March 2025, Green Gold Group's top-performing product was Mac n' Cheese Pre-Roll (1g), which climbed to the number one position after starting from fifth place in December 2024. The product achieved notable sales of 8117 units. Rainbow MAC Pre-Roll (1g) secured the second spot, showing a recovery from its dip to fifth place in January 2025. Cranberry Z Pre-Roll (1g) made a debut in the rankings at third place, indicating strong entry performance. Meanwhile, Afghani Pre-Roll (1g) entered the rankings at fourth place, while Jungle Breath Pre-Roll (1g) slipped to fifth, showing a decline from its top position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.