Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

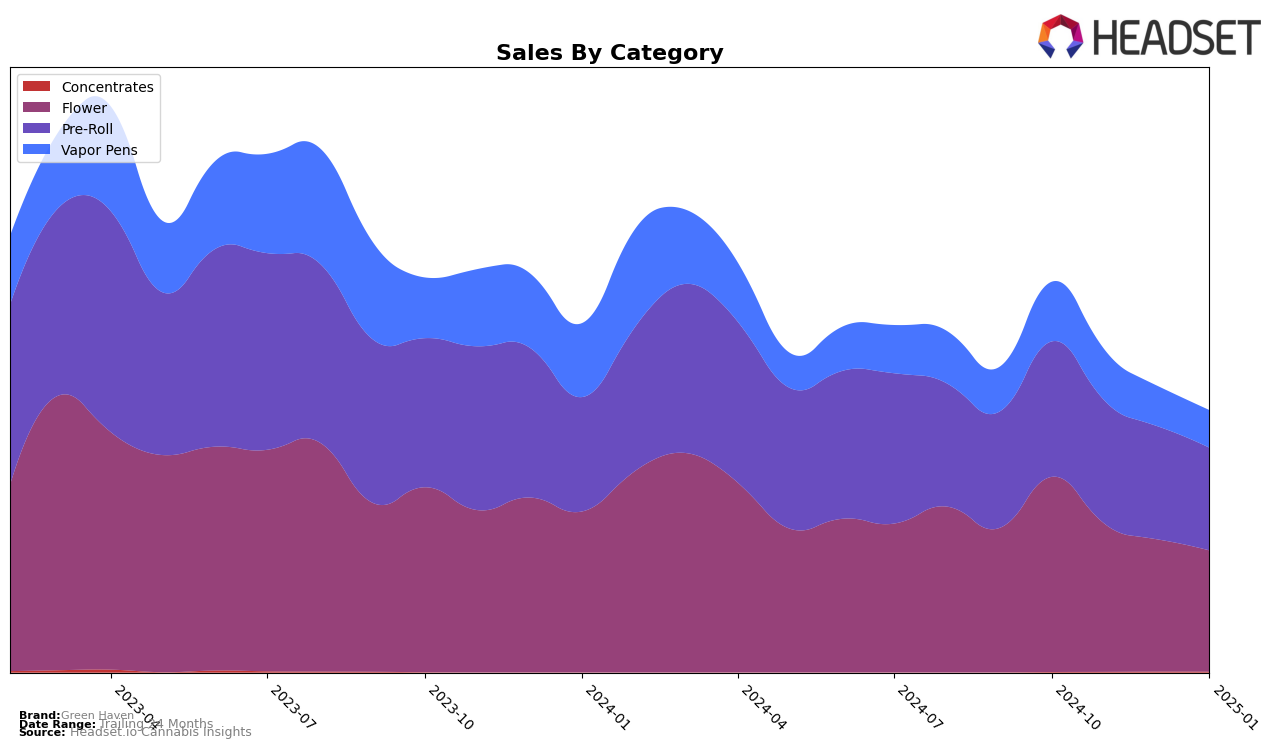

In the state of Washington, Green Haven has shown varying performance across different product categories. In the Flower category, Green Haven's ranking saw a consistent decline from October 2024 to January 2025, starting at 34th and dropping to 50th, reflecting a downward trend in sales from $240,621 to $149,432. This consistent drop indicates potential challenges in maintaining market share within this highly competitive segment. On the other hand, their performance in the Pre-Roll category has been relatively more stable, with rankings fluctuating between 25th and 29th, suggesting a steadier presence despite a gradual decline in sales. The Vapor Pens category, however, shows a more significant challenge, as Green Haven's rankings fell from 71st to 84th, indicating a struggle to compete effectively in this segment.

It is noteworthy that Green Haven did not rank within the top 30 brands in any category in Washington during this period, which could be seen as a point of concern for the brand's market positioning. The absence from the top 30 suggests that Green Haven might need to reassess its strategies, particularly in categories where they are experiencing a steeper decline. The data highlights the importance of adapting to market demands and possibly innovating product offerings to regain competitive advantage. Understanding these movements can provide valuable insights into the brand's performance dynamics and potential areas for improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Green Haven has experienced a notable decline in its market position from October 2024 to January 2025. Starting at rank 34 in October, Green Haven fell to rank 50 by January, indicating a consistent downward trend. This decline in rank correlates with a decrease in sales over the same period. In contrast, Snickle Fritz showed a more volatile pattern, initially ranking lower than Green Haven in October but surpassing it by November, although it ended up just above Green Haven in January at rank 48. Meanwhile, Bacon Buds also demonstrated fluctuations, briefly overtaking Green Haven in December before settling just below it in January. Other competitors like Washington Bud Company and The Happy Cannabis maintained relatively stable positions, with Washington Bud Company showing a slight improvement in rank, which could signal a potential threat if their upward trend continues. These dynamics suggest that Green Haven may need to reassess its strategies to regain its competitive edge in the Washington Flower market.

Notable Products

In January 2025, the top-performing product for Green Haven was Thai Stick Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from December 2024 with sales of 1711 units. Where's My Bike ? (3.5g) from the Flower category held steady at the second rank, consistent with its position in December. Gelato Cake (3.5g) also remained stable at the third rank, showing a slight increase in sales compared to the previous month. Thai Stick Infused Pre-Roll 2-Pack (1g) continued its fourth-place position, while Indica Diamond Stick Infused Pre-Roll (1g) entered the rankings at fifth place in January. Notably, Thai Stick Infused Pre-Roll (1g) has shown resilience by consistently holding the top rank since December, indicating strong consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.