Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

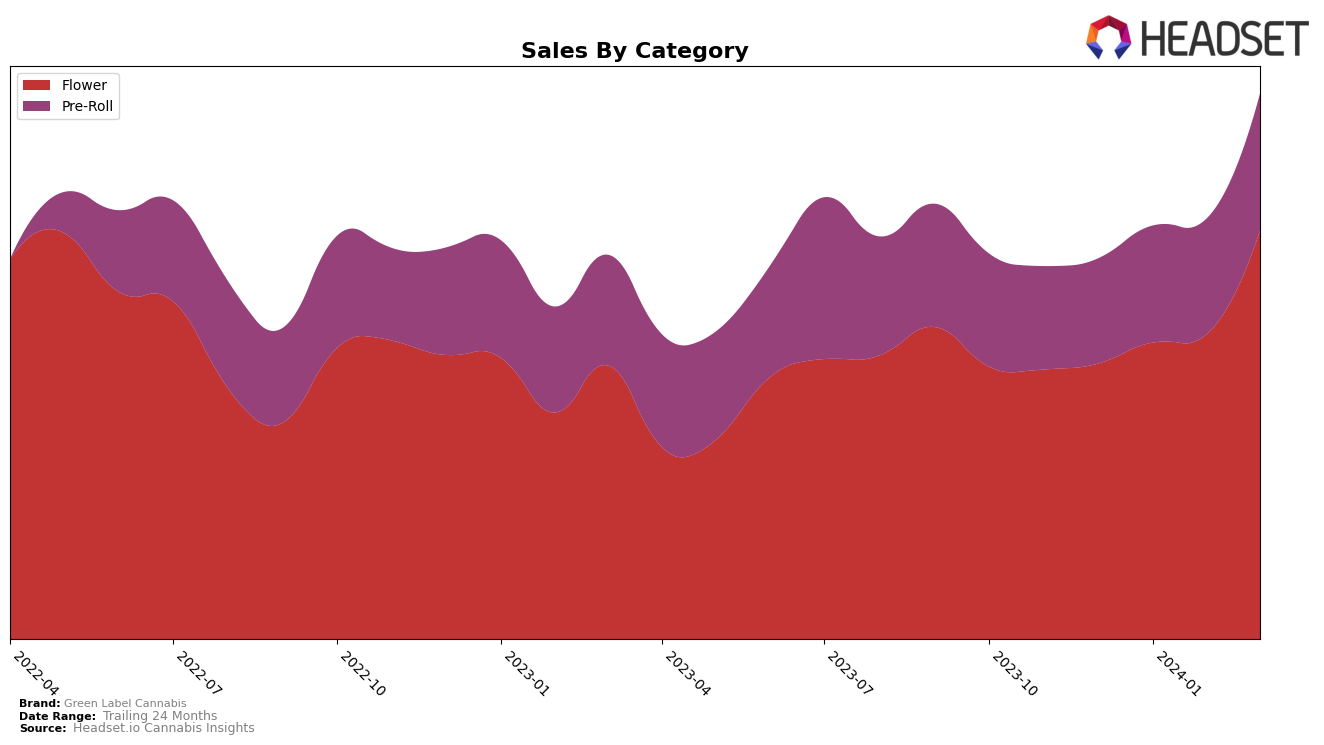

In the competitive cannabis market of Colorado, Green Label Cannabis has demonstrated a notable performance across two key categories: Flower and Pre-Roll. In the Flower category, their ranking improved from fourth in December 2023 to first in March 2024, showcasing a consistent upward trajectory. This is reflected in their sales figures which saw a significant jump from December's $1,696,770 to $2,501,262 by March 2024. Similarly, in the Pre-Roll category, Green Label Cannabis maintained a strong position, ranking second in December 2023 and February 2024, before climbing to the top spot in March 2024. The sales in this category also saw a healthy increase, moving from $666,869 in December 2023 to $859,297 by March 2024. This upward trend in both rankings and sales across the Flower and Pre-Roll categories indicates a growing consumer preference for Green Label Cannabis products in the Colorado market.

However, the absence of Green Label Cannabis from the top 30 brands in any other state or province suggests a potential area for growth and expansion. The brand's strong performance in Colorado, particularly in the Flower and Pre-Roll categories, could serve as a solid foundation for entering new markets. The fact that they were not ranked in the top 30 in other regions for the months observed could be viewed as an untapped opportunity for the brand. Capitalizing on the momentum gained in Colorado could pave the way for Green Label Cannabis to replicate their success in other states or provinces, leveraging their proven track record in product popularity and sales performance. The brand's strategic movements and category dominance in Colorado highlight its potential for broader market penetration and success in the burgeoning cannabis industry.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Colorado, Green Label Cannabis has demonstrated a notable performance trajectory, climbing from the 4th position in December 2023 to leading the pack by March 2024. This upward movement in rank is underscored by a consistent increase in sales, ultimately positioning Green Label Cannabis ahead of its closest competitors, Good Chemistry Nurseries and Maggie's Farm. Good Chemistry Nurseries, despite a strong start at the beginning of the period, saw a slight dip in March, moving down to the 2nd rank, while Maggie's Farm experienced a more pronounced fluctuation, dropping from 2nd to 3rd place by March 2024. The dynamic shifts in rank and sales among these top contenders highlight the competitive intensity within the Colorado flower market, with Green Label Cannabis emerging as a formidable leader by the end of the period.

Notable Products

In March 2024, Green Label Cannabis saw Blue Dream Pre-Roll (1g) as its top-selling product with impressive sales of 15,727 units, marking a significant jump to the number one spot from not being ranked in the previous two months. Following closely, Lilac Diesel Pre-Roll (1g) held the second position, slightly down from its top rank in February, showcasing the consistent demand for this product. The third-ranking product was Green Label - Garlicane Pre-Roll (1g), which also showed a notable improvement, moving up from the second position in February. Chem #4 OG Pre-Roll (1g) dropped to the fourth rank after being the top product in January, indicating a shift in consumer preferences. Lastly, Mimosa Pre-Roll (1g) maintained its fifth position, demonstrating steady popularity among consumers despite the competitive market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.