Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

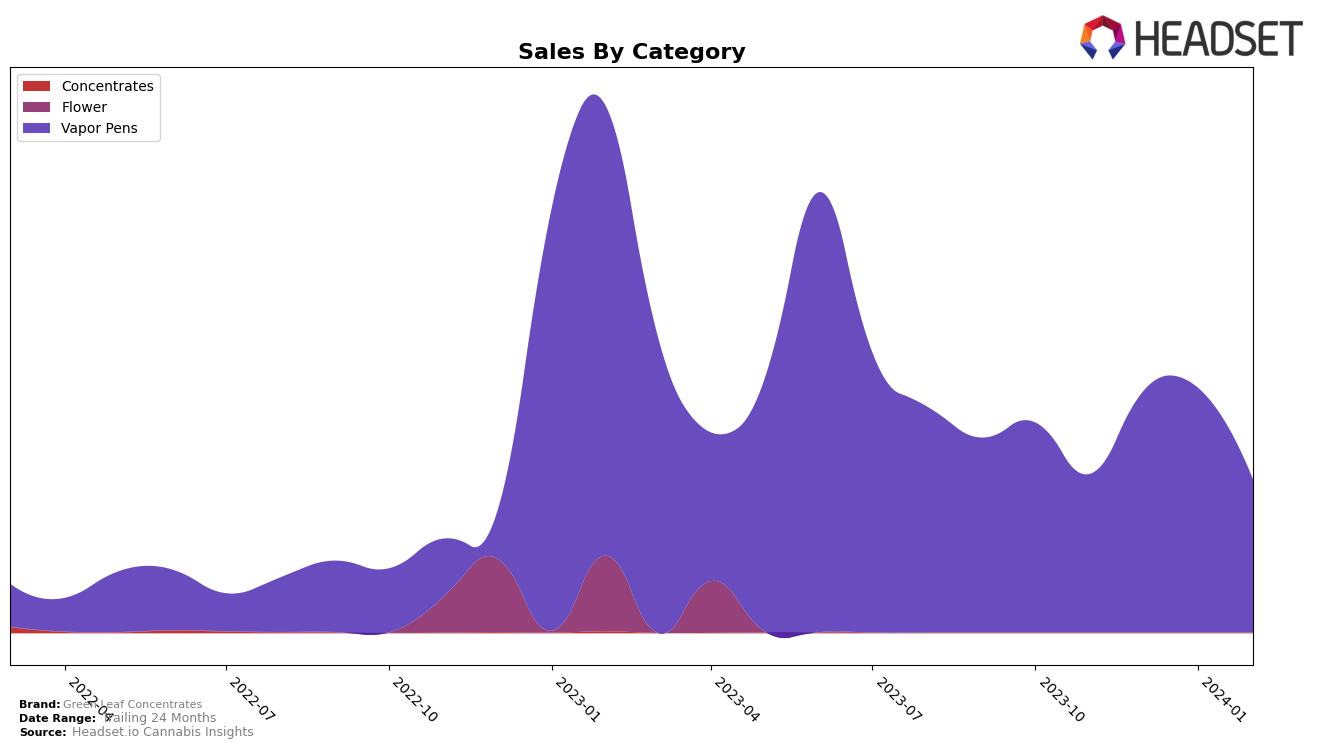

In the competitive landscape of Colorado, Green Leaf Concentrates has shown a notable performance within the Vapor Pens category. The brand maintained a presence in the top 30 from November 2023 through February 2024, with rankings fluctuating slightly: 28th in November, improving to 25th in December, reaching its peak at 24th in January, and then dipping back to 28th in February. This trajectory, particularly the peak in January with sales reaching approximately 302,883 dollars, indicates a robust demand for their offerings during the winter months. However, the subsequent drop in February, both in ranking and sales (down to 188,900 dollars), suggests a potential volatility in consumer preference or possible inventory challenges that could be worth monitoring for those closely watching the cannabis market trends in Colorado.

On the other hand, Green Leaf Concentrates' venture into the Nevada market tells a different story. Their presence in the Vapor Pens category was short-lived, with a ranking of 91st in November 2023 and no subsequent rankings in the top 30 for the following months. This absence from the top rankings after November—despite an initial sales figure of 483 dollars—highlights significant challenges in either market penetration or consumer retention in Nevada. The stark difference in performance between Colorado and Nevada underscores the importance of understanding regional market dynamics and consumer preferences. For investors and stakeholders, this contrast may signal the need for a strategic reassessment or targeted marketing efforts to bolster Green Leaf Concentrates' market share in Nevada.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, Green Leaf Concentrates has experienced a fluctuating performance in terms of rank and sales from November 2023 to February 2024. Initially ranked 28th in November, it improved to 24th by January 2024, before dropping to 28th in February. This volatility reflects a challenging market, with sales peaking in January before a significant drop in February. Notably, Harmony Extracts and Dabble Extracts showed remarkable resilience and growth, with Harmony Extracts climbing from a rank outside the top 20 to 26th by February, and Dabble Extracts making a notable jump into the 30th position by February, despite starting from the 50th rank in November. Amber, another competitor, demonstrated a slight decline in rank over the same period but remained ahead of Green Leaf Concentrates until February. Meanwhile, Wavelength Extracts made an impressive entry into the rankings in December and surpassed Green Leaf Concentrates by February. This competitive analysis underscores the importance of strategic positioning and innovation for Green Leaf Concentrates to enhance its market share and rank in the dynamic Colorado Vapor Pens category.

Notable Products

In February 2024, Green Leaf Concentrates saw Forbidden Fruit Distillate Cartridge (1g) leading the sales in the Vapor Pens category, achieving the top spot with 813 units sold. Following closely, Bubblegum OG Distillate Cartridge (1g) secured the second position, marking a significant jump as it was not ranked in the previous month. Banana Mimosa Distillate Cartridge (1g), which was the top product in January, slid to the third rank in February. The fourth and fifth positions were held by Clementine Distillate Cartridge (1g) and Cherry Pie Distillate Cartridge (1g) respectively, both showing notable shifts in their rankings compared to previous months. This fluctuation in rankings highlights a dynamic consumer preference within the Vapor Pens category for Green Leaf Concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.