Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

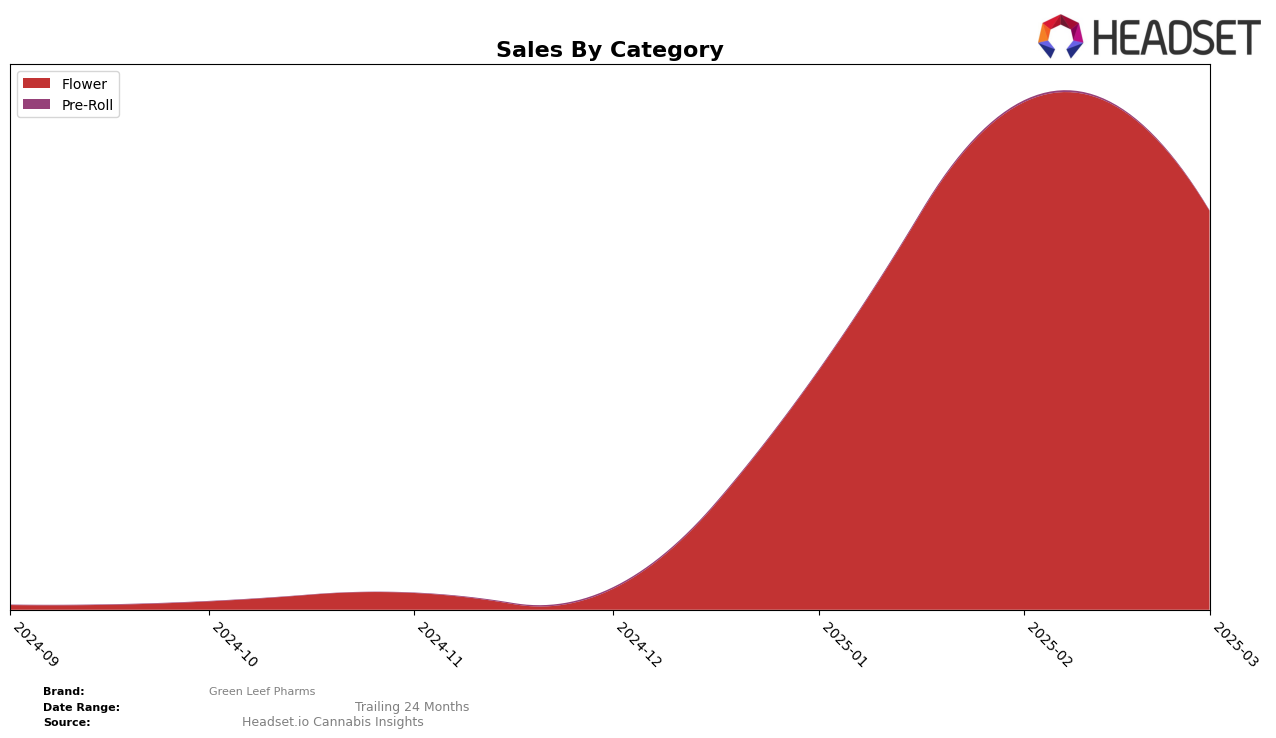

Green Leef Pharms has demonstrated a notable upward trajectory in the Arizona market, particularly within the Flower category. Starting from December 2024, the brand was not in the top 30, ranking at 65th, but by January 2025, it made a significant leap to 26th place. This momentum continued into February 2025, where it achieved a commendable 14th position, indicating a strong consumer reception and strategic market positioning. However, March 2025 saw a slight dip to 18th place, which suggests potential market saturation or competitive pressures. Despite this, the overall trend remains positive, reflecting robust brand growth and consumer engagement within the state.

While the performance in Arizona is promising, the absence of Green Leef Pharms from the top 30 rankings in other states and categories points to areas that may require strategic focus or expansion efforts. This absence could be seen as a missed opportunity to capture a broader market share or diversify their product offerings across different segments. The data highlights the importance of maintaining momentum in key markets while exploring avenues for growth in untapped regions. This dual approach could ensure sustained brand prominence and resilience in the competitive cannabis landscape.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Green Leef Pharms has demonstrated a remarkable upward trajectory in brand rank and sales over the past few months. Starting from a rank of 65 in December 2024, Green Leef Pharms made a significant leap to 26 in January 2025, further climbing to 14 in February before settling at 18 in March. This upward movement is indicative of a strong market presence and growing consumer preference. In contrast, Sunday Goods experienced a slight decline, moving from rank 14 in December to 17 by March, while Aeriz showed volatility, peaking at 11 in February but dropping to 16 in March. Meanwhile, MADE and Sublime maintained relatively stable positions, albeit outside the top 10. The data suggests that Green Leef Pharms is effectively capturing market share from its competitors, positioning itself as a formidable player in the Arizona flower market.

Notable Products

In March 2025, the top-performing product for Green Leef Pharms was Gorilla Cream (3.5g) in the Flower category, climbing to the number one rank with impressive sales of 16,299 units. Peanut Butter Breath (3.5g) secured the second spot, marking its first appearance in the top rankings. Cheetah Piss (3.5g) dropped from first place in February to third in March, with sales figures showing a decline. Himalayan OG (3.5g) entered the rankings at fourth place, while Tire Fire #10 (3.5g) rounded out the top five. Notably, Gorilla Cream (3.5g) demonstrated a significant rise from its previous position in January, showing strong upward momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.