Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

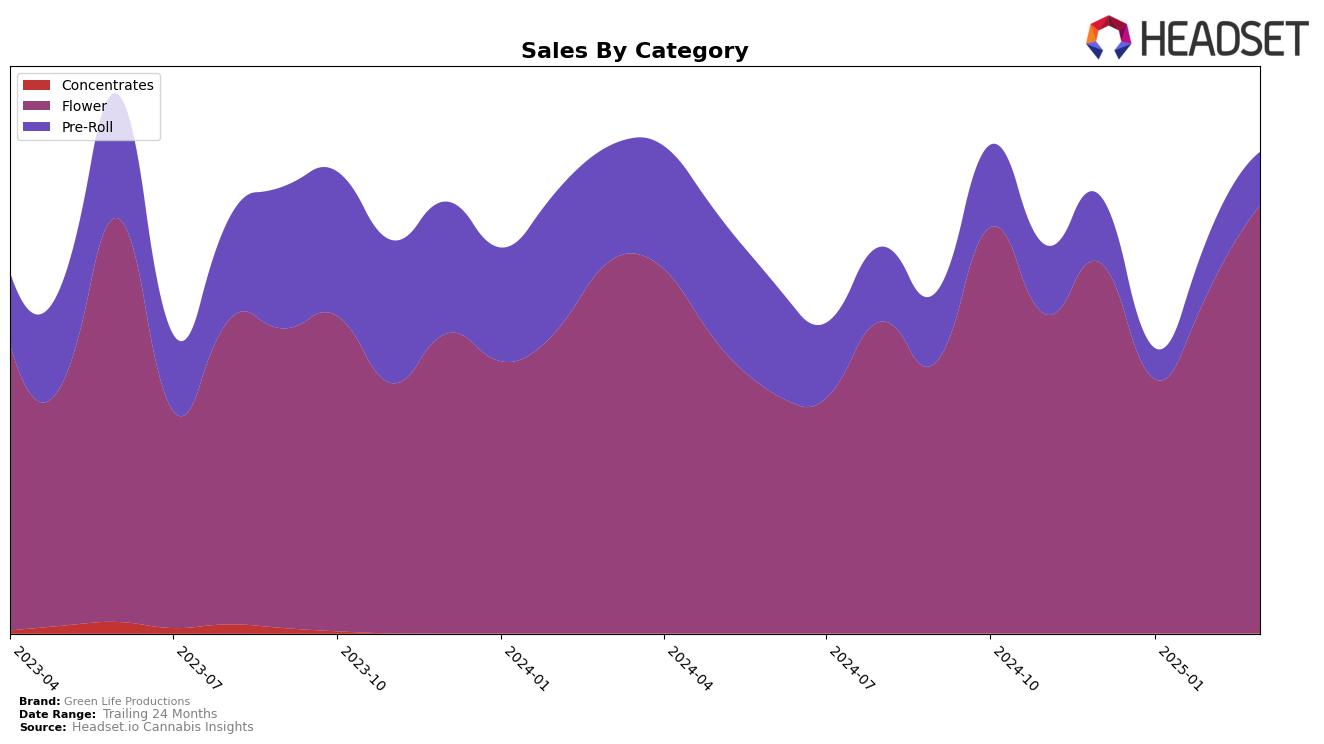

Green Life Productions has shown a notable performance in the Nevada market, particularly in the Flower category. Starting from December 2024, the brand held a strong position at rank 9, though it experienced a dip to rank 16 in January 2025. However, it quickly rebounded, reaching rank 12 in February and climbing back up to an impressive rank 8 by March 2025. This upward trajectory indicates a solid recovery and growing consumer preference for their Flower products in Nevada. The brand's ability to recover and improve its standing in the Flower category is a positive indicator of its market resilience and strategic positioning.

In contrast, Green Life Productions' performance in the Pre-Roll category in Nevada presents a more fluctuating trend. The brand started at rank 20 in December 2024, dropped to rank 30 in January 2025, and then showed some recovery by advancing to rank 21 in February. However, by March 2025, it slightly declined to rank 23. Notably, being at the edge of the top 30 in January could be seen as a concern, suggesting potential challenges in maintaining a competitive edge in this category. This inconsistency in ranking highlights areas where Green Life Productions might need to focus on strengthening their market strategy to enhance their position in the Pre-Roll segment.

Competitive Landscape

In the competitive Nevada flower market, Green Life Productions has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting at 9th place in December, the brand saw a dip to 16th in January, before recovering to 12th in February and 8th by March. This recovery in rank is indicative of a positive trend in sales, which increased from $323,345 in January to $544,915 in March. In comparison, Nature's Chemistry maintained a more consistent presence, ranking between 6th and 10th, with a significant sales boost in March. Meanwhile, Find. experienced a decline in February but remained competitive, and Hustler's Ambition showed strong growth, surpassing Green Life Productions in both rank and sales. Ghost Town Cannabis also demonstrated a competitive edge, climbing to 8th place in February. These dynamics suggest that while Green Life Productions is on an upward trajectory, it faces stiff competition from brands that are either maintaining or improving their market positions.

Notable Products

In March 2025, Grape Pie (3.5g) maintained its top position from January, with impressive sales of 2,648 units. Blue Shocktartz (3.5g) dropped to the second position after leading in February, with sales decreasing to 1,915 units. Miracle Alien Cookies (3.5g) climbed to third place from fifth in February, showing a strong sales increase to 1,536 units. Black Triangle (3.5g) secured the fourth position, consistent with its prior ranking in December 2024. Sunshine Daydream (3.5g) slipped from third in February to fifth in March, with sales at 1,302 units, highlighting a slight decline in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.