Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

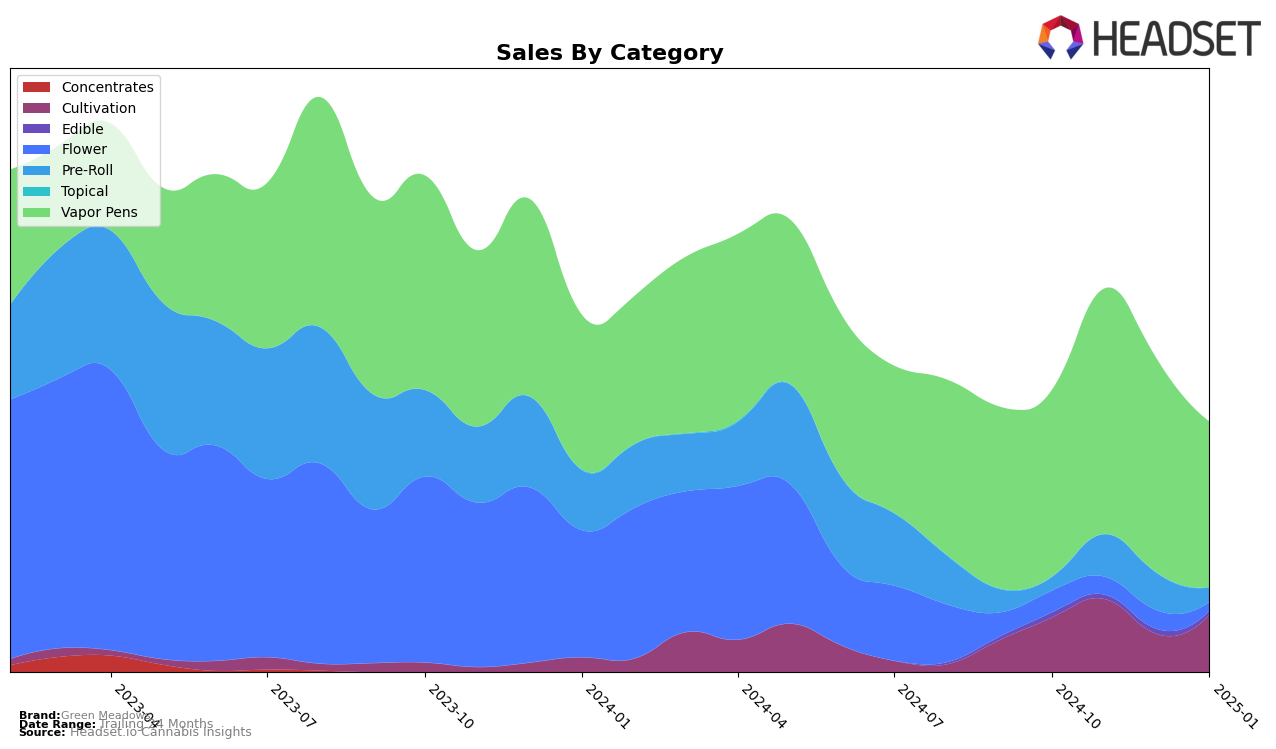

Green Meadows has shown a mixed performance across different product categories in Massachusetts. In the Vapor Pens category, the brand has maintained a relatively strong presence, with rankings fluctuating between 20th and 27th from October 2024 to January 2025. This suggests a consistent demand for their vapor pen products, although a slight decline in January 2025 could indicate emerging competition or seasonal factors affecting sales. In contrast, Green Meadows did not appear in the top 30 brands for Pre-Rolls during the same period, highlighting a potential area for improvement or a strategic shift in focus. The absence from the top rankings could be seen as a challenge for the brand to enhance its market share in this category.

Focusing on sales trends, Green Meadows experienced a notable peak in Vapor Pen sales in November 2024, followed by a decrease in the subsequent months. This peak could be attributed to promotional activities or increased consumer interest during the holiday season. Despite the decline, the brand's ability to maintain a presence in the top 30 suggests resilience and a solid customer base in this category. However, the lack of ranking in the Pre-Roll category throughout the period indicates a missed opportunity for growth in Massachusetts. This gap might prompt the brand to reevaluate its product offerings or marketing strategies to capture a larger share of the Pre-Roll market.

Competitive Landscape

In the Massachusetts vapor pens category, Green Meadows experienced notable fluctuations in its ranking and sales over the observed period. Starting from October 2024, Green Meadows was ranked 25th, improving to 20th in November, before slipping to 22nd in December and further down to 27th by January 2025. This volatility suggests a competitive landscape where Green Meadows faces significant challenges from brands like DRiP (MA), which maintained a more stable ranking, peaking at 24th in October and staying within the top 30 throughout the period. Meanwhile, Cresco Labs showed a consistent upward trend, moving from 32nd to 25th, potentially indicating a growing market presence that could impact Green Meadows' positioning. Despite a strong sales performance in November, Green Meadows' sales dropped by January, highlighting the need for strategic adjustments to regain and maintain a competitive edge in this dynamic market.

Notable Products

In January 2025, the top-performing product from Green Meadows was The Tank - Blue Dream Distillate Disposable (1g), which climbed to the second rank from its consistent fourth place in previous months, achieving sales of 1320 units. AJ Sour Diesel Pre-Roll (1g) made a notable debut at the third rank, marking its first appearance on the list. The Tank - Gingerbread Cookie Distillate Disposable (1g) secured the fourth position, while The Tank - Pineapple Express Distillate Disposable (1g) maintained a steady presence, ranking fifth after previously being fifth in November 2024. Larry Lovestein #1 Pre-Roll (1g), which had dominated the top spot in prior months, was absent from the rankings in January. This shift indicates a rising trend in the popularity of vapor pens over pre-rolls for Green Meadows.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.