Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

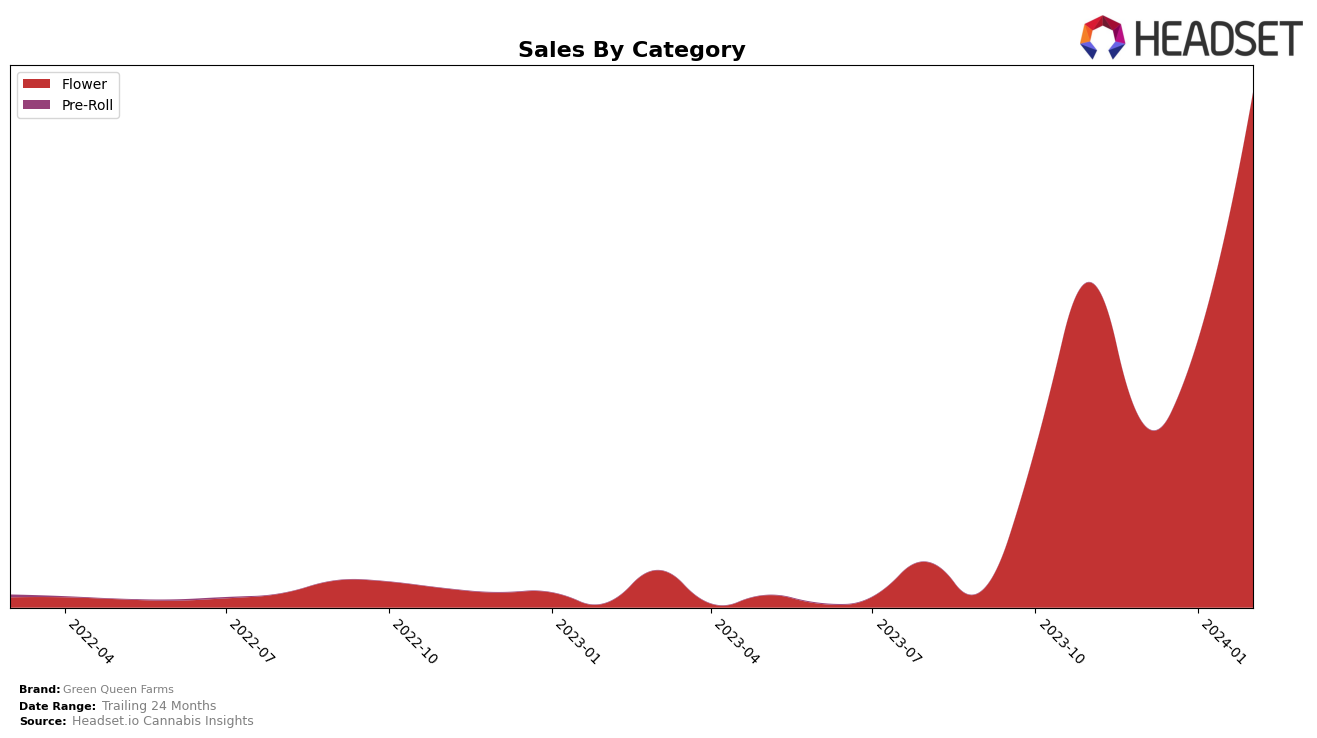

In the competitive cannabis market of Oregon, Green Queen Farms has shown a notable performance in the Flower category, although with some fluctuations. Starting outside the top 20 in November 2023 with a rank of 29, the brand experienced a significant drop in December, falling to the 58th position. This decline is particularly concerning as it indicates the brand was not among the top 20 cannabis brands in Oregon for that month, potentially impacting its visibility and sales. However, Green Queen Farms managed to reverse this trend in the following months, improving to 34th in January 2024 and making an impressive leap to 13th by February 2024. This upward trajectory is a positive sign, showcasing the brand's resilience and ability to regain its footing in the competitive landscape. The sales in February 2024, amounting to $369,176, underscore this recovery, highlighting a significant rebound in the brand's market performance.

While the detailed analysis of Green Queen Farms' performance across other states or provinces and categories is beyond the scope of this summary, the data from Oregon presents a compelling story of challenges and recovery. The fluctuating rankings, especially the drastic drop in December 2023, underscore the volatile nature of the cannabis market and the importance of maintaining consistent quality and brand visibility. The subsequent recovery to the 13th position by February 2024, however, suggests that Green Queen Farms has effectively addressed these challenges, at least in the short term. This performance could indicate strategic adjustments in marketing, distribution, or product quality that have resonated well with the market. Moving forward, it will be crucial for Green Queen Farms to sustain this momentum and continue to adapt to the evolving preferences and competitive dynamics of the cannabis industry in Oregon and beyond.

Competitive Landscape

In the competitive landscape of the Oregon cannabis flower market, Green Queen Farms has shown a notable trajectory in terms of rank and sales over the recent months. Initially not ranking within the top 20 in November 2023, it made a significant leap to 13th place by February 2024, indicating a strong upward trend in both market presence and consumer preference. This is particularly impressive when compared to competitors such as Oregon Roots and Urban Canna, which have shown fluctuations but remained within a closer range of their initial rankings. Notably, Kaprikorn, despite a dip in December, climbed back up, ranking just one place above Green Queen Farms by February. Meanwhile, Otis Garden showcased the most significant rank improvement, jumping from not being in the top 20 to 11th place, surpassing Green Queen Farms by a narrow margin. This competitive analysis suggests that while Green Queen Farms is on a robust growth path, the dynamic nature of the Oregon flower market, with competitors experiencing varying degrees of rank and sales changes, poses both challenges and opportunities for the brand moving forward.

Notable Products

In February 2024, Green Queen Farms saw Super Lemon Mac (Bulk) from the Flower category taking the top spot with a significant sales figure of 1743 units. Following closely behind was Platinum Kush Breath (3.5g) in second place, marking its debut in the rankings. Kush Crasher (Bulk) dropped one position from the previous month to secure the third rank, showing a consistent preference for bulk Flower products among consumers. Kush Crusher (7g) also made its first appearance in the rankings at fourth place, indicating a broadening interest in varied packaging sizes. Lastly, Platinum Kush Breath (Bulk), which was the leading product in January 2024, fell to the fifth position, illustrating a dynamic shift in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.