Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

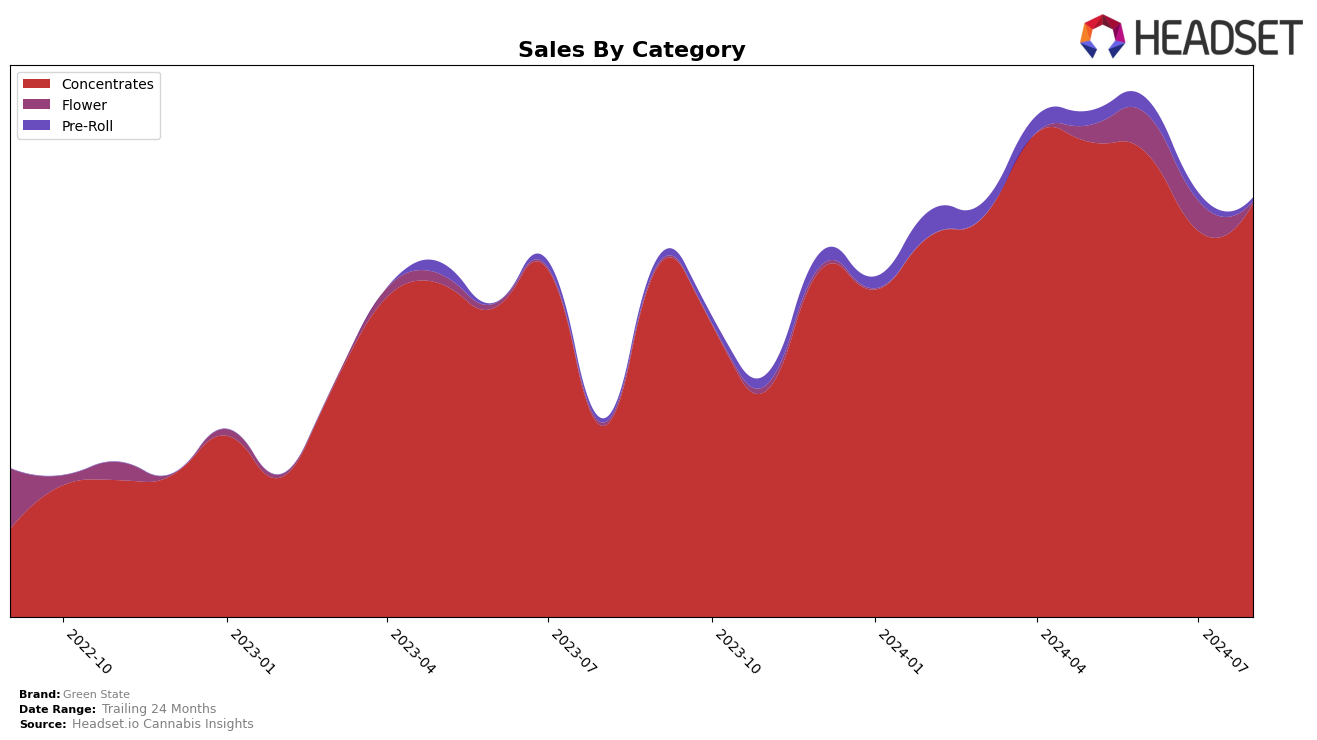

Green State has shown a consistent presence in the Concentrates category within the state of Washington. Over the past few months, their rankings have fluctuated slightly, holding positions within the top 30 brands. Specifically, Green State ranked 27th in May 2024, improved to 24th in June, but then dropped back to 27th in July before climbing to 25th in August. This indicates a relatively stable performance with some minor volatility. A noteworthy trend is the dip in sales from May to July, followed by a slight recovery in August, suggesting possible seasonal influences or market dynamics at play.

It's important to note that Green State has maintained a presence within the top 30 brands in Washington's Concentrates category throughout the summer months, which is a positive indicator of brand resilience. However, the brand's inability to break into higher rankings consistently could be seen as a challenge. The fact that they remained within the top 30 each month, even if just barely at times, is a testament to their steady market position, but it also highlights areas for potential growth and improvement. While the sales figures and ranking movements provide valuable insights, more detailed analysis would be required to fully understand the underlying factors driving these trends.

Competitive Landscape

In the Washington concentrates market, Green State has experienced notable fluctuations in its ranking over the past few months, impacting its sales performance. In May 2024, Green State was ranked 27th, improved to 24th in June, but then dropped to 27th in July before recovering slightly to 25th in August. This volatility contrasts with competitors like Agro Couture, which showed a steady upward trend from 30th in May to 24th in August, and Green Envy, which maintained a relatively stable position, peaking at 22nd in July. Meanwhile, Supernova (WA) also demonstrated gradual improvement, moving from 33rd in May to 27th in August. VENOM (WA), however, showed a declining trend, falling from 21st in May to 26th in August. These shifts indicate that while Green State has faced challenges in maintaining a consistent rank, its competitors have either capitalized on market opportunities or struggled similarly, suggesting a dynamic and competitive landscape in the Washington concentrates market.

Notable Products

In August 2024, the top-performing product for Green State was Glookies Hash Rosin (1g) in the Concentrates category, achieving the number one rank with notable sales of 888 units. Grape Gas Hash Rosin (1g) maintained its strong performance, holding the second position consistently from June to August, with sales figures reaching 861 units in August. Smorez Hash Rosin (1g) improved its standing, moving up to third place from fourth in July. Bislato Hash Rosin (1g) saw a slight decline, ending in fourth place after being third in July. Dark Lemons Hash Rosin (1g) remained steady at fifth position, despite fluctuations in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.