Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

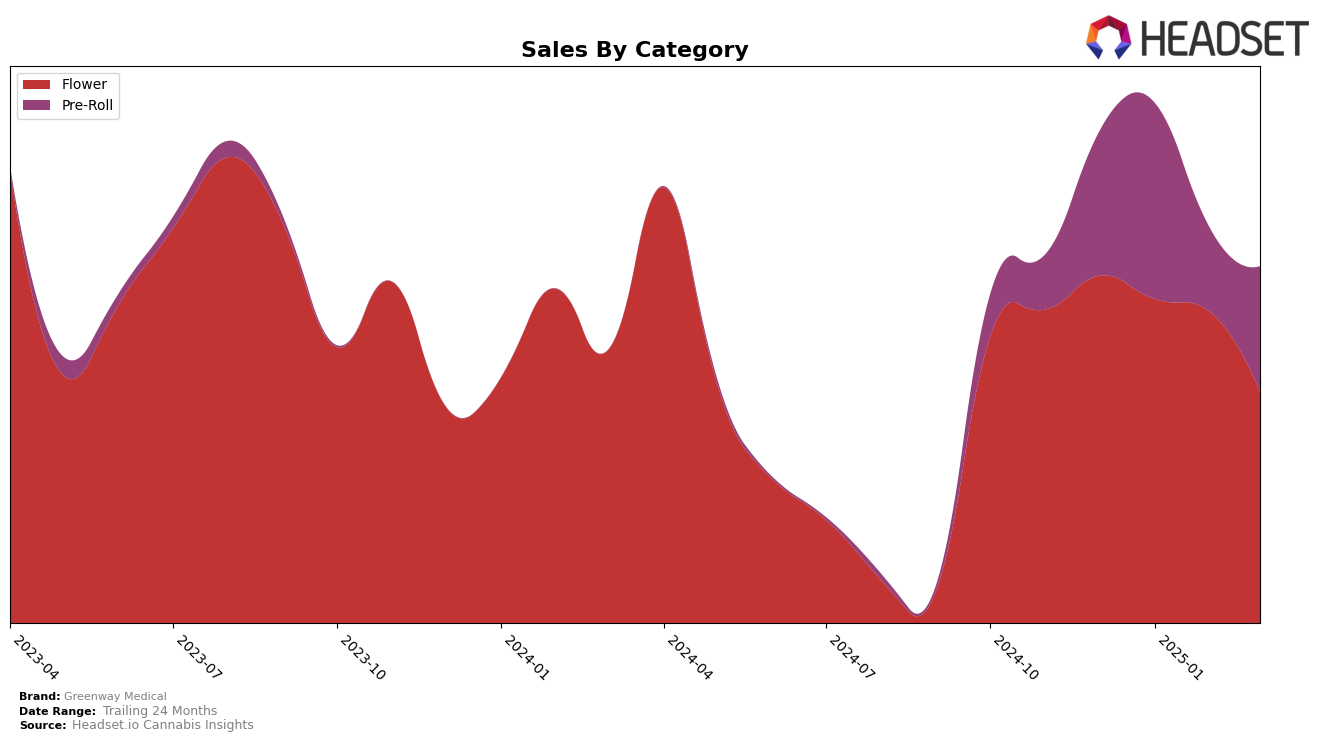

Greenway Medical's performance across different product categories and states reveals some intriguing trends. In the state of Nevada, the brand's Flower category experienced a decline in rankings from December 2024 to March 2025, moving from 23rd to 33rd place. This downward trajectory is accompanied by a decrease in sales, highlighting potential challenges in maintaining market share in this category. Conversely, the Pre-Roll category showed a more volatile yet generally positive pattern, with a notable jump to 10th place in January 2025 before fluctuating in subsequent months. This indicates that while Greenway Medical may face challenges in the Flower category, there are opportunities for growth and recovery in Pre-Rolls.

It is worth noting that by March 2025, Greenway Medical's Flower category fell out of the top 30 rankings in Nevada, which could be a cause for concern if the trend continues. However, the Pre-Roll category's ability to rebound to 15th place in March 2025 after a dip in February suggests resilience and potential for strategic focus. These movements across categories and rankings underscore the importance of adaptive strategies in response to market dynamics. For those interested in a deeper dive into Greenway Medical's performance, the brand's detailed profile can be accessed here.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Greenway Medical has experienced a notable decline in both rank and sales from December 2024 to March 2025. Starting at the 23rd position in December 2024, Greenway Medical slipped to the 33rd position by March 2025, indicating a downward trend. This decline in rank is mirrored by a decrease in sales, which have dropped significantly over the same period. In contrast, competitors like SeCHe have shown resilience, maintaining a stable rank around the 29th position and experiencing an increase in sales. Meanwhile, BLVD has improved its rank from 41st to 30th, accompanied by a notable increase in sales, suggesting a positive trajectory. Additionally, Remedy has climbed the ranks from 51st to 34th, with sales figures reflecting this upward movement. These shifts highlight the competitive pressures Greenway Medical faces, emphasizing the need for strategic adjustments to regain market share in Nevada's flower category.

Notable Products

In March 2025, Greenway Medical's top-performing product was Electrolime Pre-Roll (1g) in the Pre-Roll category, maintaining its consistent rank as number one with sales reaching 3983 units. Following closely, Cap Junky Pre-Roll (1g) secured the second position, rising from its previous fourth place in January 2025. Electrolime (3.5g) in the Flower category ranked third, showing a steady improvement from its fourth position in February 2025. Chem De La Chem Pre-Roll (1g) dropped slightly to fourth place from second in January 2025, indicating a shift in consumer preference towards other products. Jungle Pie (3.5g) remained stable in fifth place, despite a decline in sales compared to February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.