Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

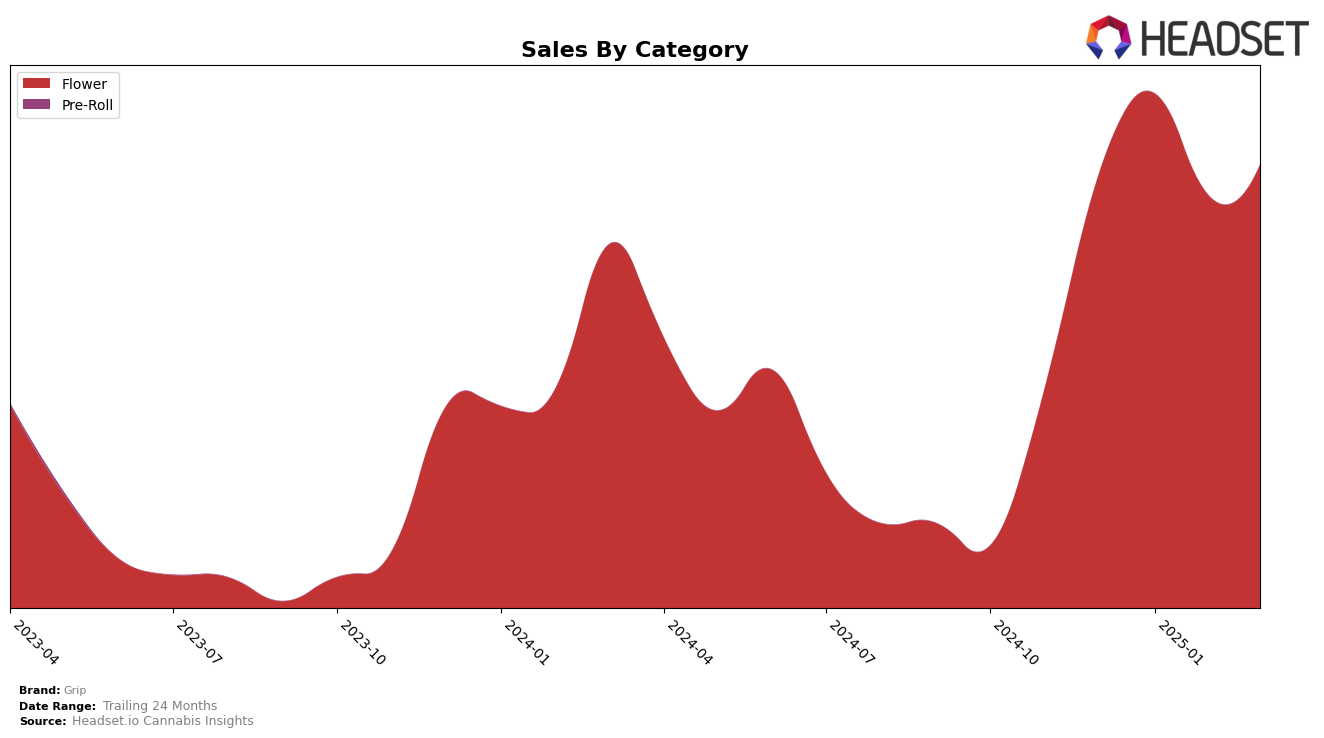

Grip's performance in the Michigan market has shown some interesting fluctuations in the Flower category over the first quarter of 2025. Starting strong with a rank of 12 in December 2024, Grip climbed to 9th place in January 2025, indicating a positive reception and possibly effective marketing strategies or product launches. However, the brand saw a dip in February, falling to 14th place, and continued to slide slightly to 15th in March 2025. Despite these fluctuations, the brand maintained a presence in the top 15, suggesting a stable consumer base in Michigan. The sales figures reflect these movements, with a notable increase from December to January, followed by a decrease in February, and a slight recovery in March.

The absence of Grip from the top 30 in other states or provinces suggests that the brand's influence is currently concentrated in Michigan, where it has managed to maintain visibility in the competitive Flower category. This could be interpreted as either a strategic focus on strengthening its presence in a specific market or a challenge in expanding its reach beyond Michigan. The data indicates that while Grip is performing commendably in Michigan, there is potential for growth and improvement in other regions, which could be an area of interest for stakeholders looking to understand the brand's market strategy and future potential. This concentrated performance may shape Grip's decisions as they consider scaling operations or diversifying their product lines.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Grip has shown a dynamic performance from December 2024 to March 2025. Starting at a rank of 12 in December, Grip improved to 9 in January, indicating a positive reception and increased sales momentum. However, by February and March, Grip's rank slipped to 14 and 15, respectively, suggesting intensified competition. Notably, Common Citizen maintained a strong presence, consistently ranking in the top 5 for December and January, before dropping to 12 and 14 in the following months, which could have impacted Grip's relative positioning. Meanwhile, Simply Herb showed a steady upward trend, surpassing Grip in March with a rank of 13. Additionally, High Supply experienced fluctuations, falling out of the top 20 in February but rebounding to 16 in March, presenting a potential challenge to Grip's market share. These shifts highlight the competitive pressures Grip faces and underscore the importance of strategic marketing and product differentiation to maintain and improve its standing in the Michigan flower market.

Notable Products

In March 2025, the top-performing products from Grip were Blue Runtz and Ice Cream Cake, both in the Flower category, sharing the first rank with notable sales of 8047 units each. Sherb Cream Pie followed closely in second place, while Greasy Runtz secured the third position. Super Boof, which was ranked first in February 2025, dropped to fourth place in March, despite a sales increase to 7006 units. The consistent top rankings of Blue Runtz and Ice Cream Cake highlight their strong market presence, maintaining their lead from previous months. Overall, Grip's product lineup showed dynamic shifts, with Super Boof experiencing the most notable change in ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.