Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

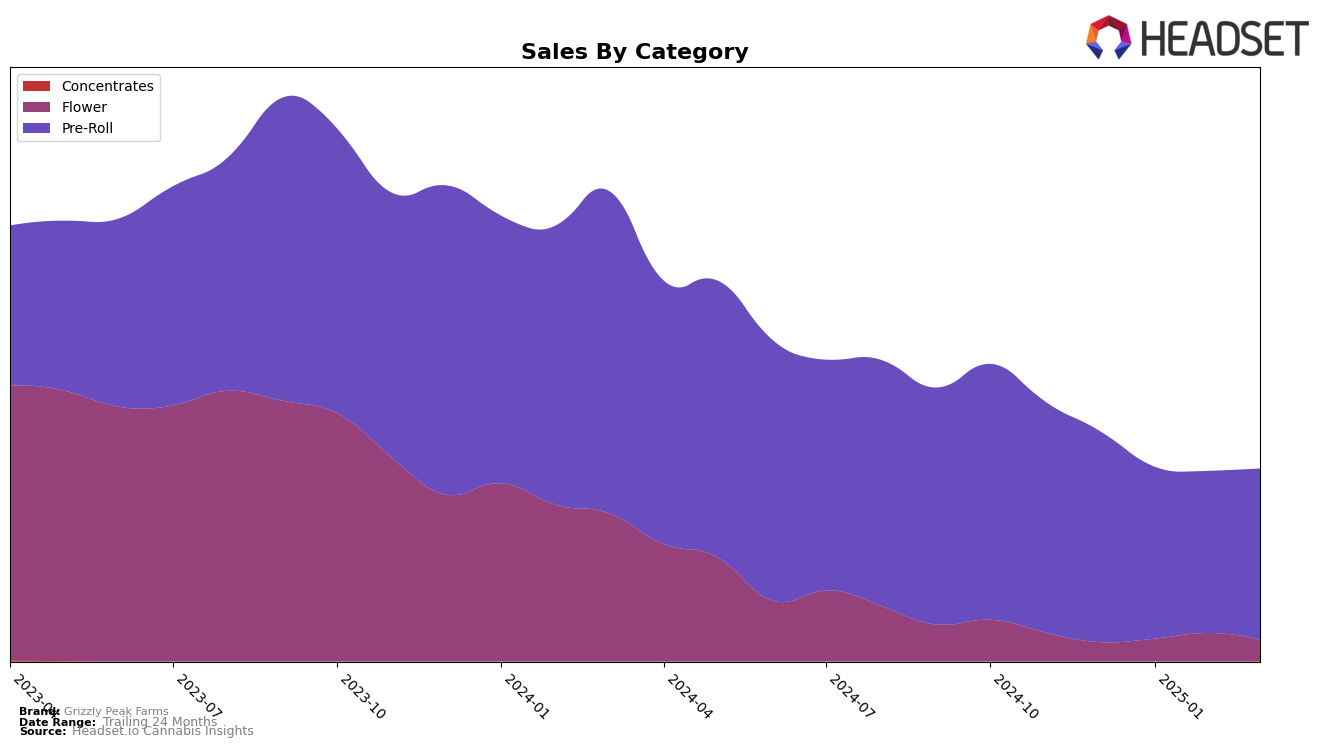

Grizzly Peak Farms has shown a consistent presence in the California pre-roll category, maintaining a steady ranking within the top 20 brands. Over the months from December 2024 to March 2025, the brand's rank slightly declined from 17th to 20th. This movement indicates a need for strategic adjustments to maintain its competitive edge. Despite the dip in rankings, the brand's sales figures reveal a trend of fluctuating performance, with a notable decrease in January followed by a recovery in March. These shifts suggest that while Grizzly Peak Farms remains a significant player in the market, there is room for improvement to regain and potentially surpass its earlier standings.

In terms of geographical performance, Grizzly Peak Farms' presence is currently limited to California, with no indications of ranking within the top 30 in other states or provinces. This absence could be seen as a limitation in their market reach and an opportunity for expansion. The brand's consistent ranking within California highlights its strong foothold in a competitive market, yet the lack of presence in other regions could impact long-term growth potential. Understanding the dynamics of other state markets could provide insights into new opportunities for Grizzly Peak Farms to explore and expand its influence beyond its current territory.

Competitive Landscape

In the competitive landscape of California's Pre-Roll category, Grizzly Peak Farms has experienced fluctuating rankings, reflecting a dynamic market environment. From December 2024 to March 2025, Grizzly Peak Farms consistently ranked within the top 20, starting at 17th and ending at 20th. This period saw them competing closely with brands like PUFF, which also hovered around similar rankings but occasionally fell out of the top 20, indicating a competitive parity. Notably, Paletas showed a strong performance, climbing from 23rd to 19th, surpassing Grizzly Peak Farms in March 2025. Meanwhile, Gelato demonstrated a significant rise from 25th to 18th, suggesting a potential threat to Grizzly Peak Farms' market position. The sales trends indicate that while Grizzly Peak Farms maintained a steady sales volume, competitors like Selfies and Paletas experienced notable sales increases, which could influence future rankings and market strategies for Grizzly Peak Farms.

Notable Products

In March 2025, Big Steve Diamond Infused Pre-Roll (1g) from Grizzly Peak Farms maintained its top position in the rankings, continuing its success from February with a notable sales figure of 21,802. Greatful Dave Pre-Roll (1g) held steady in second place, consistent with its performance in February. Sativa Bone Diamond Infused Pre-Roll (1g) and Indica Bone Diamond Infused Pre-Roll (1g) also retained their third and fourth positions, respectively, without any change in their rankings from previous months. The Grizzly Bone Pre-Roll (1g) remained in fifth place, showing stability in its ranking over the past few months. Overall, the top products for March 2025 demonstrated consistent performance with no shifts in rankings from February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.