Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

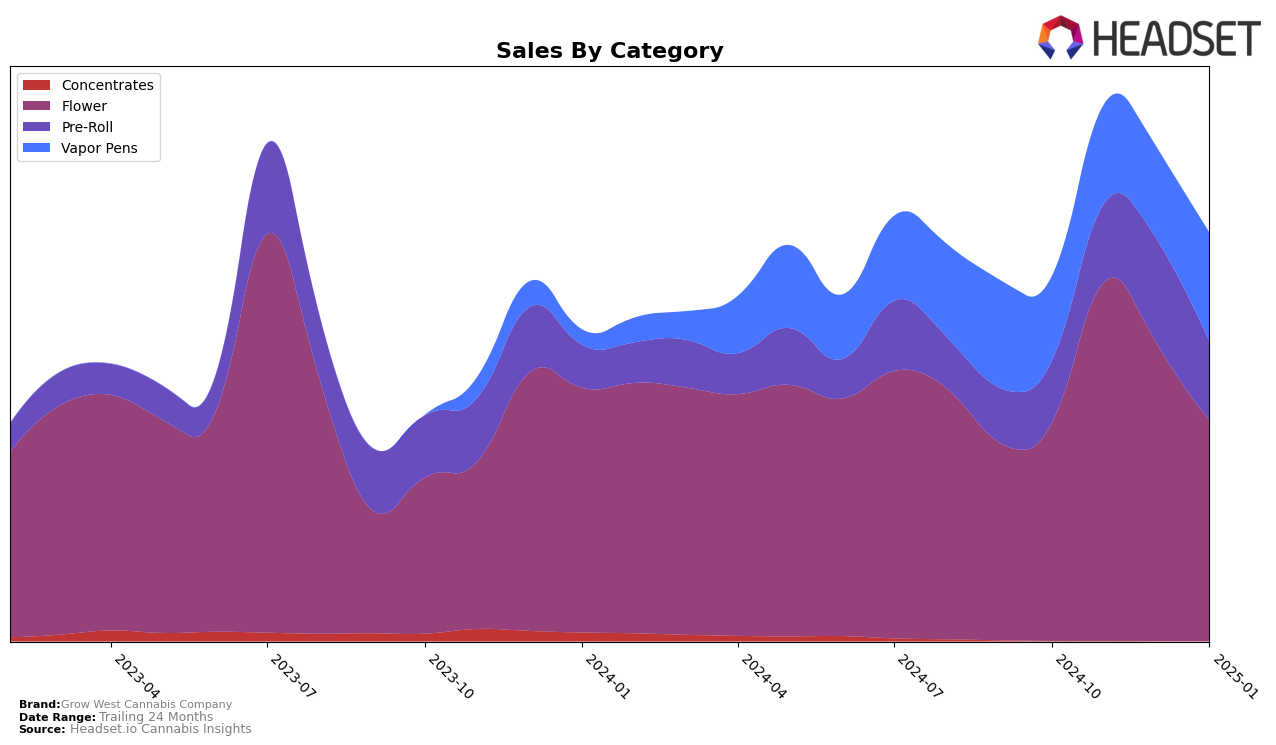

Grow West Cannabis Company has shown notable performance in the Maryland market across several product categories. In the Flower category, the brand experienced fluctuations in its ranking, peaking at 7th place in November 2024 before dropping to 13th by January 2025. This movement suggests a competitive market where maintaining a top position is challenging. In contrast, the Pre-Roll category has been a strong area for Grow West, achieving a commendable 5th place in December 2024, indicating a potential focus or successful strategy in this segment. The Vapor Pens category also showed a steady improvement, with the brand climbing from 11th to 9th place over the four months, hinting at growing consumer preference or improved product offerings.

Despite these achievements, it is important to note that Grow West Cannabis Company did not appear in the top 30 rankings in any other state or province, which could be seen as a limitation in its market reach or strategic focus. The brand's absence in other markets might suggest a concentration of efforts in Maryland, where it has established a significant presence. This focused approach might be beneficial in capturing a larger market share within the state, but it also poses risks if market dynamics shift unfavorably. The sales figures reflect a dynamic market environment, with notable sales in November 2024 for the Flower category, suggesting potential seasonal trends or successful promotional activities during that period.

Competitive Landscape

In the Maryland flower category, Grow West Cannabis Company experienced notable fluctuations in its ranking from October 2024 to January 2025. Initially ranked 11th in October, the brand climbed to 7th in November, indicating a significant surge in sales performance. However, by December, it dropped to 9th, and further to 13th in January. This volatility suggests that while Grow West Cannabis Company had a strong showing in November, it faced stiff competition from brands like Modern Flower, which peaked at 8th in December, and Garcia Hand Picked, which consistently maintained a top 15 position. Meanwhile, CULTA showed an upward trend, improving its rank from 17th in October to 12th in January, potentially posing a growing threat to Grow West Cannabis Company's market share. These dynamics highlight the competitive landscape in Maryland's flower market, where maintaining a leading position requires continuous strategic efforts.

Notable Products

In January 2025, the top-performing product for Grow West Cannabis Company was Cherry Chocolate Widow (3.5g) in the Flower category, maintaining its top rank from October 2024 with notable sales of 6206 units. Baja Blast Distillate Cartridge (1g) emerged as a strong contender in the Vapor Pens category, securing the second position with significant sales. Gandhari Kush (3.5g) also made a notable entry in the Flower category, ranking third. Reserve - Goat Piss (3.5g), which had previously held the top spot in November and December 2024, fell to fourth place in January 2025. Finally, Georgie's - Mile High Volcano Pre-Roll 2-Pack (1g) rounded out the top five, indicating a diverse consumer interest across different product categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.