Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

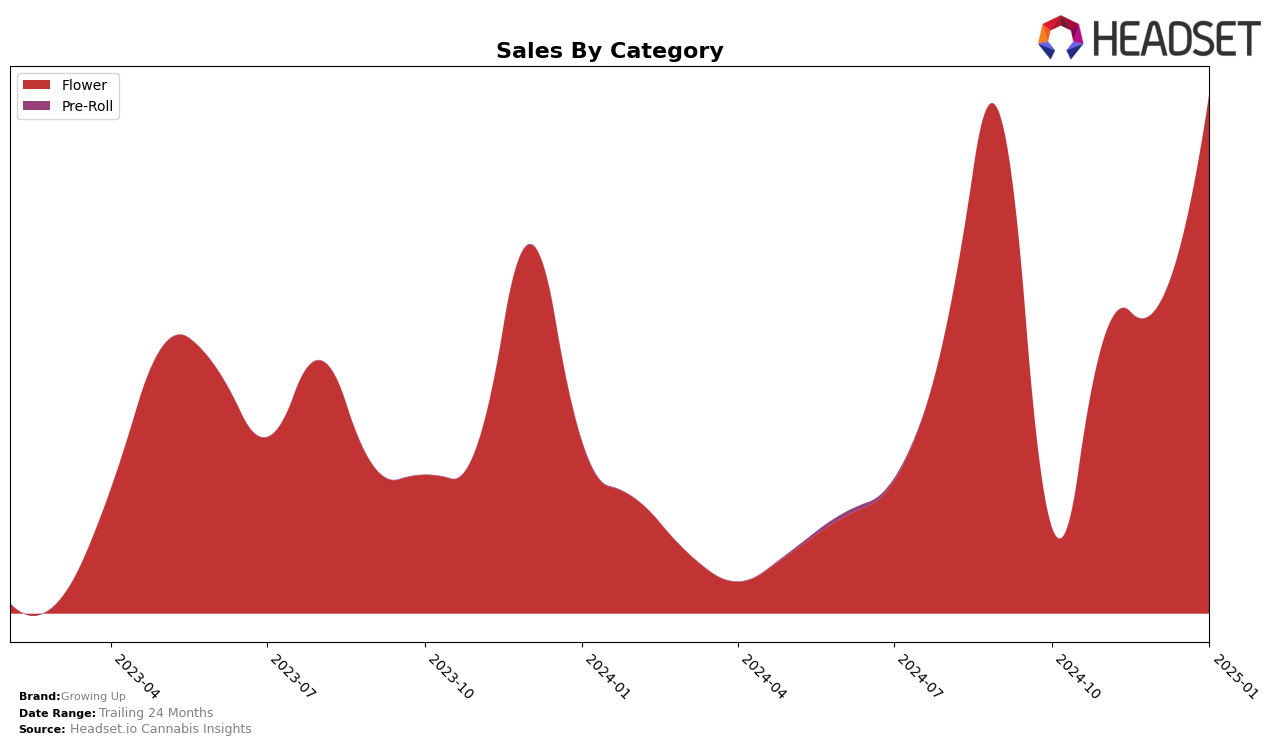

Growing Up has shown notable performance shifts across different states and categories, particularly in the Flower category in Oregon. While the brand was not ranked within the top 30 in October 2024, it made a significant leap to 48th in November, climbing further to 43rd in December, and finally reaching the 24th position by January 2025. This upward trajectory indicates a strong recovery and increasing market presence within the state, suggesting effective strategies in product offerings or marketing could be at play. The absence of a ranking in October may initially appear concerning, but the subsequent months demonstrate a positive turnaround.

Despite the lack of detailed sales data across other states or provinces, the available figures for Oregon suggest a robust growth pattern in sales from November to January. Sales in the Flower category increased from $151,905 in November to $259,664 by January, reflecting a substantial rise in consumer demand or market penetration. This growth trajectory in Oregon could hint at similar potential in other regions, although further data would be necessary to confirm such trends. The insights from Oregon's performance might serve as a benchmark for evaluating Growing Up's strategies and their applicability in other markets.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Growing Up has demonstrated a notable upward trajectory in recent months, despite not ranking in the top 20 brands in October 2024. By December 2024, Growing Up climbed to the 43rd position and further improved to 24th by January 2025, reflecting a significant boost in sales performance. This upward trend contrasts with some competitors, such as PDX Organics, which experienced fluctuations, peaking at 10th in November 2024 but dropping to 23rd by January 2025. Similarly, Cannabis Nation INC saw a dramatic rise to 5th in December 2024, only to fall to 22nd in January 2025. Meanwhile, Roots Grass Cannabis showed volatility, reaching 24th in November 2024 but slipping to 26th by January 2025. Growing Up's consistent improvement in rank and sales suggests a strengthening market position, which could be attributed to strategic marketing efforts or product differentiation within the Oregon flower market.

Notable Products

In January 2025, the top-performing product for Growing Up was Apple Banana Zoap (1g) in the Flower category, which ascended to the number one rank from the second position in December 2024, with sales reaching 1567 units. Primetime (Bulk) maintained a strong performance, securing the second rank, marking its re-entry into the rankings after being absent in November and December 2024. Highlighter (1g) dropped to the third position after leading in December 2024. All Starz (Bulk) emerged in the fourth spot, improving from its fifth position in December 2024. Croissant (Bulk) experienced a slight decline, moving from third to fifth place, with sales slightly decreasing to 856 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.