Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

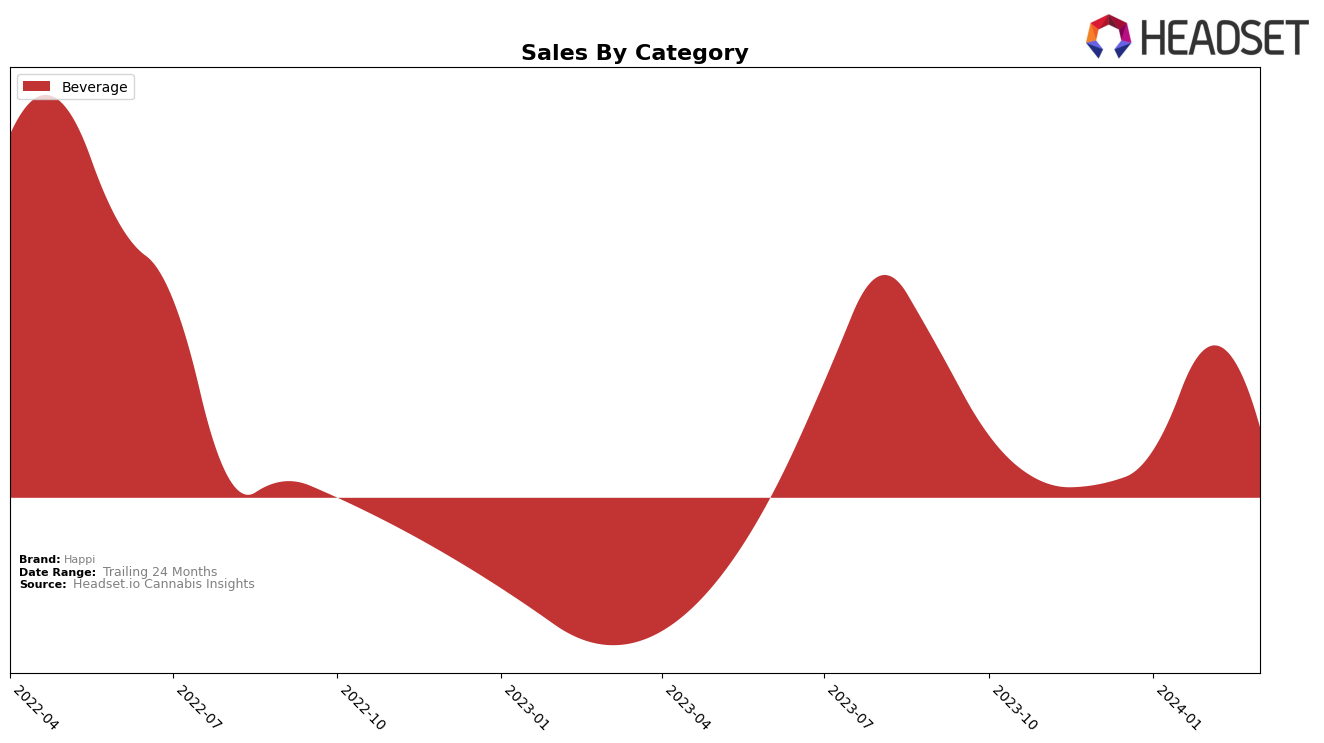

In Michigan, the cannabis brand Happi has shown a notable presence in the Beverage category, with an interesting trend in its rankings over the recent months. Starting from December 2023, where Happi was ranked 22nd, it saw a significant jump in January 2024 to the 18th position, followed by an impressive climb to 13th in February 2024. However, in March 2024, there was a slight dip, bringing Happi back to the 18th spot. This fluctuation in rankings indicates a dynamic performance within the competitive Beverage category. The peak in February, where Happi reached its highest rank of 13th, suggests a strong market acceptance during this period. Although there was a decrease in rank in March, the overall upward trend from December to February highlights Happi's growing influence in Michigan's cannabis beverage market.

The sales figures for Happi in Michigan further illuminate the brand's journey through these months. Starting with sales of $960 in December 2023, there was a substantial leap to $3,243 in January 2024, followed by an even more remarkable increase to $10,229 in February 2024. However, March 2024 saw a decrease in sales to $4,815. This sales trajectory mirrors the rankings trend, with the peak sales in February correlating with Happi's highest ranking. The decrease in both rank and sales in March 2024 could suggest various factors at play, including market saturation, increased competition, or seasonal consumer behavior changes. Despite the drop, the overall performance of Happi in the Beverage category in Michigan showcases its potential and challenges in navigating the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of the beverage category in Michigan, Happi has shown a notable trajectory in terms of rank and sales over the recent months. Starting at a rank of 22 in December 2023, Happi improved its position to 18th by January 2024, climbed to 13th in February, and slightly dipped to 18th in March 2024. This fluctuation in rank is mirrored by its sales performance, which saw a significant increase from 960 units in December 2023 to a peak of 10,229 units in February 2024, before settling at 4,815 units in March. Competitors like MyHi, despite a higher starting rank in December, experienced a decline to 20th by March, showcasing a contrasting trend to Happi's growth. Meanwhile, new entrants such as Ice Kream Hash Co. and Crown B Alchemy have quickly ascended the ranks, indicating a rapidly evolving competitive field. Primitiv also displayed resilience, maintaining a presence in the top 20 throughout the period. Happi's performance, especially its sales peak in February, suggests a growing consumer interest, positioning it as a brand to watch amidst stiff competition and dynamic market shifts.

Notable Products

In March 2024, Happi's top-performing product was Raspberry Honeysuckle Seltzer (5mg), maintaining its leading position from the previous month with impressive sales of 1298 units. Following closely, Pomegranate Hibiscus Infused Seltzer (10mg) ranked second, despite leading in February, showcasing the competitive nature of Happi's beverage category. Lime Wild Mint Infused Seltzer (10mg) secured the third spot, consistently improving its rank from fourth in December 2023 to third in March 2024. Lemon Elderflower Seltzer (5mg) was the fourth best-selling product, indicating a stable preference among consumers for Happi's seltzer range. These rankings reveal a strong consumer inclination towards Happi's seltzer beverages, with notable shifts in preferences indicating dynamic market trends.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.