Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

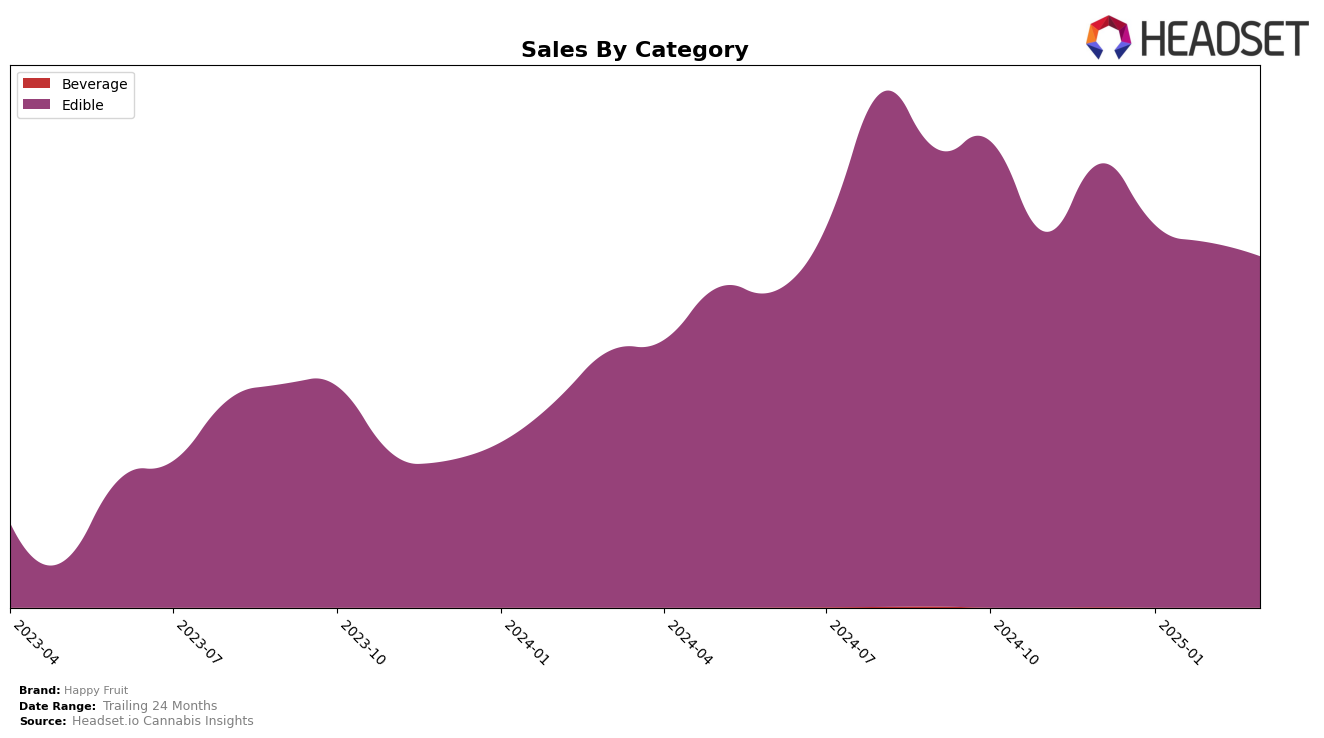

Happy Fruit has shown varied performance across different states and categories, particularly in the Edible category. In California, the brand maintained a steady presence in the top 30 rankings, fluctuating slightly between the 19th and 21st positions from December 2024 to March 2025. This stability suggests a consistent demand for their products in this competitive market. However, the steady decline in sales figures over these months might indicate challenges in either maintaining their market share or external factors affecting the overall market dynamics. Meanwhile, in Colorado, Happy Fruit did not make it into the top 30 rankings in the Edible category after December 2024, which could be a sign of either increasing competition or a need for strategic adjustments in that state.

Despite the challenges in Colorado, Happy Fruit's presence in California remains a key focus area, as evidenced by their consistent ranking. The brand's ability to stay within the top 30 in California indicates a strong brand recognition and consumer loyalty, even as they face a gradual decline in sales. This could suggest that while the brand is popular, there may be room for growth in terms of expanding their product offerings or enhancing marketing efforts to boost sales figures. The lack of presence in the top 30 in Colorado after December suggests that the brand might need to reassess its strategy to regain a competitive position in that market. Overall, Happy Fruit's performance showcases the importance of adapting to regional market conditions and consumer preferences to sustain growth.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Happy Fruit has experienced notable fluctuations in its ranking and sales over the past few months. While Happy Fruit maintained a steady presence within the top 20 brands, ranking 20th in December 2024 and January 2025, it saw a slight improvement to 19th in February 2025 before dropping to 21st in March 2025. This drop indicates that Happy Fruit fell out of the top 20, suggesting increased competition. Brands like Petra and Zen Cannabis have shown resilience, with Petra consistently ranking higher and Zen Cannabis closely trailing Happy Fruit in February before surpassing it in March. Despite these challenges, Happy Fruit's sales figures, although declining from December to March, remain competitive, indicating a need for strategic marketing efforts to regain its standing and capitalize on the growing market.

Notable Products

In March 2025, Happy Fruit's top-performing product was the THC/CBG/CBC 1:1:1 Raspberry Remedy Gummies 10-Pack, which climbed to the first rank with sales of 2,539 units. The THC/THCV 2:1 Strawberry Lifted Limeade Rosin Gummies, previously the top product in February, dropped to the second position. The THC:CBN 2:1 Moon Berry Indica Gummies maintained a steady third rank, though its sales showed a slight decrease compared to February. Berry Cool Solventless Rosin Gummies, which started as the top product in December 2024, continued its decline to the fourth position. The CBD:CBG:THC 1:1:1 Peaceful Pineapple Gummies held the fifth spot consistently from February to March, showing stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.