Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

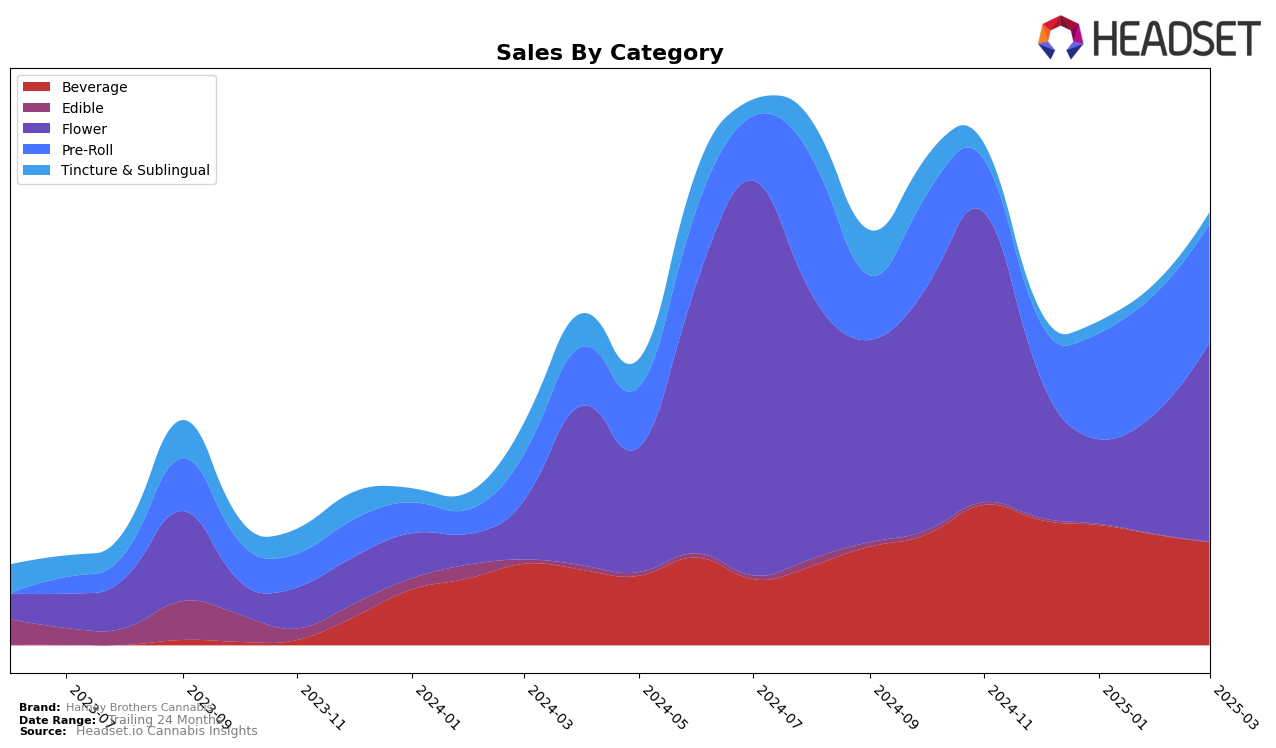

Harney Brothers Cannabis is making a notable impact in the New York cannabis market, particularly in the Beverage category where they have consistently maintained a solid third-place ranking from December 2024 through March 2025. This stability is impressive, although there is a slight downward trend in sales from $61,174 in December to $50,236 in March. In contrast, their performance in the Flower category has been more volatile, with rankings fluctuating from 75th in December to 67th by March, indicating a positive trend despite not breaking into the top 30. This movement suggests that while they are not yet a top contender in Flower, there is potential for growth.

In the Pre-Roll category, Harney Brothers Cannabis has shown improvement, climbing from 87th in December to 64th in March, a positive upward trajectory that points to increasing consumer interest and market penetration. This improvement is underscored by a significant rise in sales from $26,983 in December to over double that amount in subsequent months. However, it is important to note that they have not yet reached the top 30 in the Pre-Roll category, indicating room for further growth and market strategy refinement. The brand's performance across these categories highlights both their strengths and opportunities for expansion within the New York market.

Competitive Landscape

In the competitive landscape of the New York flower category, Harney Brothers Cannabis has shown a notable upward trajectory in recent months. After starting at rank 75 in December 2024, it experienced a dip to rank 93 in January 2025, but then rebounded to rank 67 by March 2025. This improvement is significant when compared to competitors like Toast, which saw a decline from rank 59 to 72 over the same period, and Lobo, which fluctuated but ended at rank 70. Meanwhile, Packs (fka Packwoods) experienced volatility, dropping from rank 38 in January to 65 in March. Another competitor, 1937, entered the top 20 in February at rank 81 and improved to 64 by March. Despite the competitive pressures, Harney Brothers Cannabis's sales have shown resilience, with a significant increase from January to March, indicating a positive reception in the market and potential for further growth.

Notable Products

In March 2025, the top-performing product for Harney Brothers Cannabis was the Sour Diesel Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from February 2025 with sales of 2840 units. The Hella Jelly (3.5g) from the Flower category took the second spot, climbing up from being unranked in previous months. Lemon Mints Pre-Roll (1g) slipped from second to third place, showing a slight decrease in sales momentum. The CBD/THC 2:1 Maple Coffee Nitro (10mg CBD, 5mg THC, 12oz) in the Beverage category ranked fourth, down from third in February, indicating a decrease in consumer preference. Finally, the CBD/THC 2:1 Tangy Lime Sparkling Water (10mg CBD, 5mg THC, 355ml, 12oz) entered the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.