Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

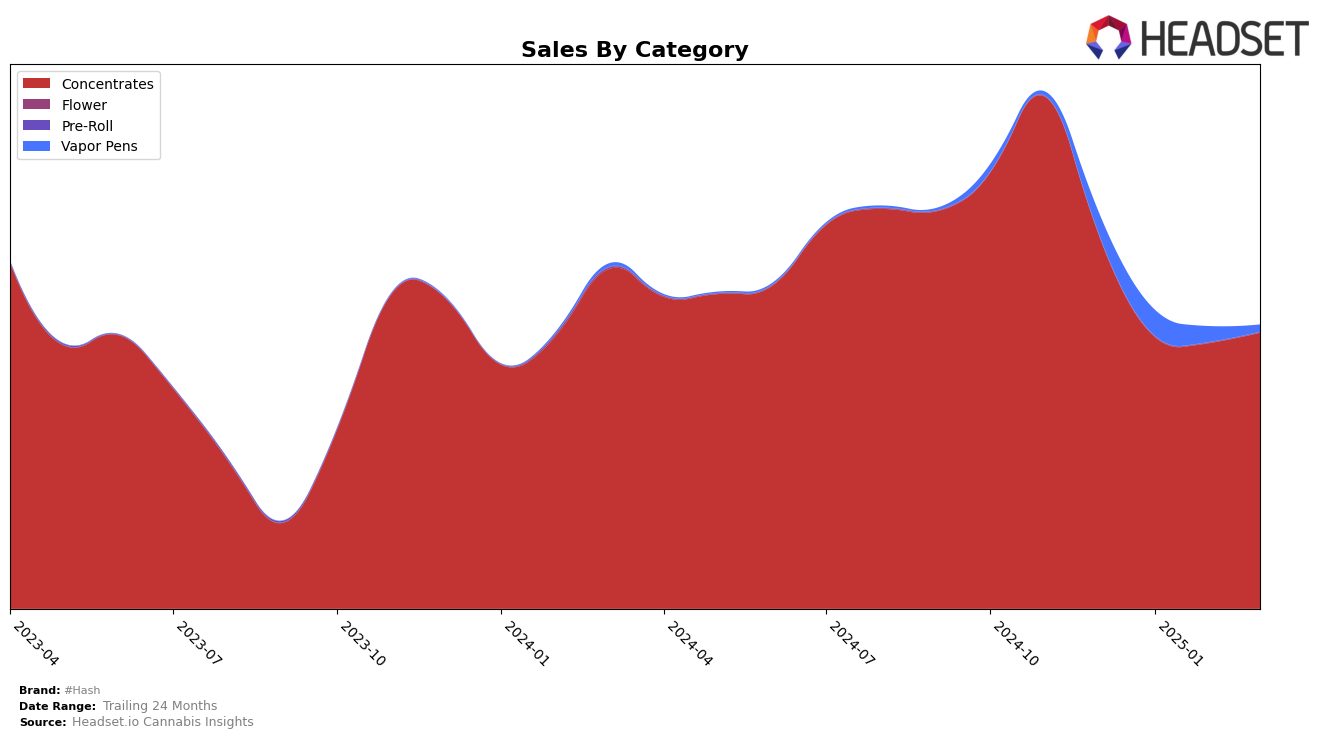

The performance of #Hash in the concentrates category has shown notable fluctuations across various states. In Michigan, the brand experienced a downward trajectory, moving from a strong 2nd place in December 2024 to 30th by March 2025, indicating a significant decline in market presence. Conversely, in Illinois, #Hash demonstrated a remarkable improvement, climbing from 31st in December 2024 to 17th by March 2025, suggesting a growing consumer interest or market strategy shift. New York remains a consistent stronghold for #Hash, maintaining a steady 2nd position throughout the months, which could imply a solid brand loyalty or effective market penetration strategy. In Maryland, however, the brand fell out of the top 30 by March 2025, indicating potential challenges in maintaining its market share.

In the vapor pens category, #Hash's performance was less consistent. In Maryland, the brand did not rank in the top 30 by March 2025, despite earlier appearances in the rankings, which may reflect increased competition or shifting consumer preferences. In Ohio, #Hash showed a fluctuating presence, initially ranking 60th in December 2024, improving to 48th in January 2025, but then dropping again in subsequent months. This volatility suggests a competitive landscape where maintaining a foothold is challenging. The brand's presence in states like Colorado also underscores this competitive nature, as it remained outside the top 30 in the concentrates category, highlighting the difficulties in gaining traction in certain markets.

Competitive Landscape

In the competitive landscape of the New York concentrates market, #Hash has maintained a steady rank at number two from December 2024 through March 2025, showcasing a robust performance amidst fierce competition. Notably, while Mfny (Marijuana Farms New York) consistently holds the top position, their sales have shown a slight decline from December 2024 to February 2025, before a slight recovery in March. This trend contrasts with #Hash's impressive upward trajectory in sales, particularly from February to March 2025. Meanwhile, Jetpacks and Hudson Cannabis have been vying for the third and fourth positions, with Hudson Cannabis overtaking Jetpacks in March 2025. This shift indicates a dynamic market environment where #Hash's consistent rank and increasing sales volume highlight its growing consumer appeal and potential to challenge the market leader in the future.

Notable Products

In March 2025, the top-performing product for #Hash was Snow Dream #1 Crumble (1g) in the Concentrates category, reclaiming its number one rank from December 2024 after slipping to second place in February 2025. It achieved a notable sales figure of 2842 units. Chemical Soap Budder (1g) debuted strongly, securing the second rank in March 2025, while LA Mendo #1 Sugar (1g) dropped to third place after leading in February. Soap Punch Budder (1g) and Berry Cake Crumble (1g) occupied the fourth and fifth positions, respectively, marking their first appearances in the rankings. The dynamic shifts in rankings highlight the competitive nature of #Hash's product offerings within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.